Bitcoin Transactions have dropped like they have not been for two Years! What's happening?

For nearly a month, the number of daily transactions has been between 150,000 and 200,000. So approximately at the level we had in early 2016. Is it Segewit, Batching, Lightning - or did people just stop using Bitcoin?

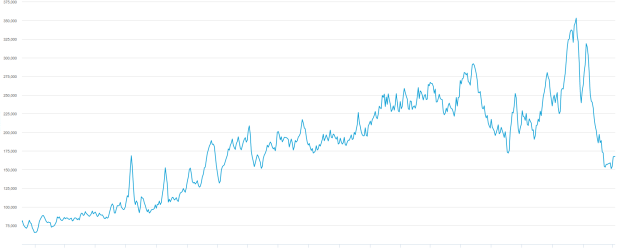

There was a time when I saw the number of daily transactions as the most important indicator of Bitcoin. If I remain faithful to this perspective, the current trend is not exactly pleasing: The number of daily transactions has fallen from more than 300,000 in December - peaked at 375,000 - to less than 200,000. Thus, the activity on the Bitcoin blockchain ranks at a level that was so low at the beginning of 2016.

The number of daily transactions for about 2.5 years. Source: Blockchain.info

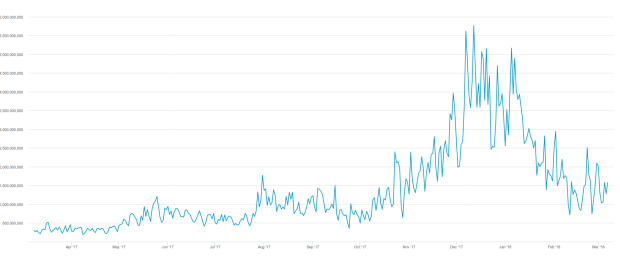

Sure, you could of course say, and rightly so, that not the number of transactions is the important indicator, but the value of the Bitcoins sent in dollars. Then the chart looks very different.

The volume of daily transactions in dollars. Source: Blockchain.info

However, it is a little questionable what the hen and what the egg is. Is the increase in price a consequence of people sending more value to Bitcoin - or are people sending more value because Bitcoin has become more valuable? Who knows how Bitcoin transactions work, understands that it is not possible to send more money when the price rises. You could certainly discuss this further. Here, however, we focus on the variable of the number of daily transactions, for the sake of simplicity. So, what is it? Let's look at the possible explanations.

Is it due to SegWit? No definitely not. Although around 30 percent of all transactions now involve SegWit transactions, which increases the average block size to about 1.1 to 1.2 megabytes, SegWit does not reduce the number of transactions, so it has nothing to do with the issue itself.

More realistic is the assumption that the Lightning network is effective. Because Lightning brings offchain transactions, which means they are not included in the count of daily transactions. With Lightning, it would be possible for the statistics to persist in 150,000 transactions, while in truth several millions of transfers take place. It would be a good explanation, but it is unlikely. Because the Lightning network stagnates for several weeks at a little less than 2,000 channels. In some parts, it is even declining. It is unlikely that this activity will be significant on the whole.

Let's have a look at the topic of batches. Batching means that exchanges and other platforms do not send transactions individually, but bundle them into packages. In the course of the extreme fee peaks in December and January, more and more exchanges have begun to do that. For batching, the size of the blocks, unlike the number of transactions, is much higher than it was at the beginning of 2016. The correct value, which is why some people say, is no longer the number of transactions, but the total number of outputs, since each output is in one batching transaction is equivalent to a single transaction.

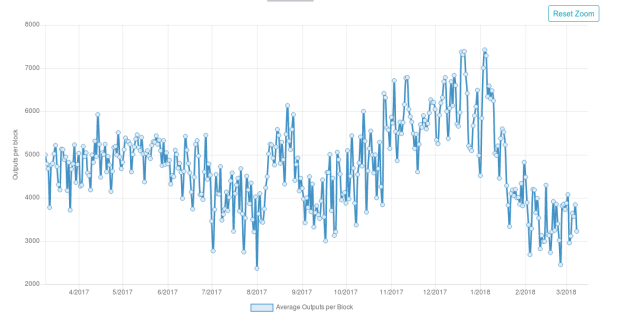

The number of outputs per block for one year. Source: outputs.today

However, this value is not much sunnier. Also in terms of outputs Bitcoin is currently at a low point. When you make transactions, in the simplest case you take an input and transform it into two outputs - one for the receiver, and one for the change. So, if you make five payments individually, you'll get 10 outputs. If you batch the five payments, you only get 6 outputs.

This darkens the actual effect of batching. However, one may like to assume that it turns out to be significantly larger than can be seen in the charts. In theory, the approximately 500,000 outputs available today could equal several million outputs without batching. It is possible that the true number of Bitcoin transactions is currently at an all-time high, but not in the charts.

Batching is certainly part of the answer - but probably not all. Because it is undeniable that the high fees and the hard-to-calculate time for confirmation, which have shaped the user experience of Bitcoin in December and January, but also repeatedly broke out in the months before and after, led to a decline in actual use to have. For example, Steam has stopped accepting Bitcoin, and many people have stopped using Bitcoin as a common currency to order pizza or print products, for example, after some very negative experiences. At the same time, Monero seems to be taking Bitcoins first place, in the Darkweb which is not surprising as Monero transactions are faster, cheaper and more anonymous.

This decrease in Bitcoin usage is far less negative than you might expect for many in the Bitcoin scene. Why use a power money like Bitcoin to buy games on Steam or have pizza delivered? If the blocks stay small, it will keep Bitcoin decentralized, and if this has the effect of displacing business models earlier than late, which in the long run have no place on the blockchain, then that is welcome.

However, how much of a decline in actual transactions really is can be as hard to quantify as the effect of batching. So, as is often the case, in the end we end up with the answer that it is a little bit of this, and a little bit of that, but we can not even begin to say which parts. We can only say that there may be an actual decline in economic activity, but it is probably much smaller than one might think at first glance.

Image Sources:

- Post header created by myself

- Blockchain.info

- outputs.today

Have a nice day!

LOVE&LIGHT

Off topic, but why are you powering down mate? It is probably the best time to accumulate more steem.

Soon I will have not much time more for steemit because I am moving from Mauritius back to Germany and there I will have a lot of things and new projects to work on that is why I am powering down but just to 1K and it makes not much difference if you have 2K or 1K :)

Ya, that makes sense

Strange times! I hope Bitcoin rebounds, cause I've been talking about it nonstop for over a year!

The fad of bitcoin is over, ppl may try using other crypto to do transaction

I just sold some BTC and transfer to my card, the fee was like 0.22cents ---> 10min option. I was surprised:)

Damn that is cheap. I haven't sold any BTC for a long time not even in the all time high back in Dec. I am still waiting for the right price to cash out ;)

Thats cool! I sell when I need cash, f it:)

My wife works and I have some good savings so I am lucky and don't need to sell for cash yet. The only time I spend BTC is when I buy new altcoins but yes bro I understand you specially with the renovation of your house.

LOVE&LIGHT

Lucky bastard hahah good for you brotha! I wish you sell at 100.000$ per BTC!

Thanks bro yes this is a number which sounds like music in my ears lol

All the proof some may need that this thing could drop to zero.

Yep...The BCC settlement may cause some serious sell-offs for restitution payouts. It will be interesting to see how much BTC will be affected by the BCC woes.

Peace.

For me this is an indicator of stronger hands now being in control of the Bitcoin supply. Less transactions means less people are liquidating (in general), which is bullish for when the institutions come on line pending regulation.

I think the decrease in the amount of transactions due to the low price of bitcoin , There are many people who own bitcoins because they bought them at an expensive price,And they do not want to sell it because it will produce them great losses ,,, I think therefore less quantity of transactions، good luck my dear friend @danyelk 👍😉

All the best for you 👋😃

I haven't made a bitcoin transaction in quite some time. Litecoin does everything bitcoin does with lower fees.

This is some great, thorough analysis. Many people argue the Bitcoin valuation follows Metcalfe’s law, what are your thoughts on this?

Thank you!

Yes it could be but I am not sure and don't like to brake my head over this just want to see BTC at a price where I can finally sell. I think there are many factors who play a roll when it comes to the valuation of BTC.

I wonder if tax season has anything to do with it

That is a good point and maybe it plays a part.