Gresham's Law, Cryptocurrencies and Bitcoin today

Hello everybody! Today I wanted to share with you Gresham's Law and my view on how it affects the world today.

The law was named after Sir Thomas Gresham (1519–1579), who was an English financier.

Gresham's Law says that

Bad Money drives out Good Money if they exchange for the same price

Another way to phrase it is: Bad Money drives out Good Money if people are forced to accept the Bad Money. But if people are NOT forced to accept it then GOOD MONEY DRIVES OUT THE BAD MONEY!

This is an ECONOMIC LAW OF MONEY that is followed subconsciously and without fail by all human civilizations.

Legal Tender Laws

Legal tender laws force people to accept coins or banknotes and use it for payments.

When laws force people to use BAD MONEY then people tend to hoard GOOD MONEY.

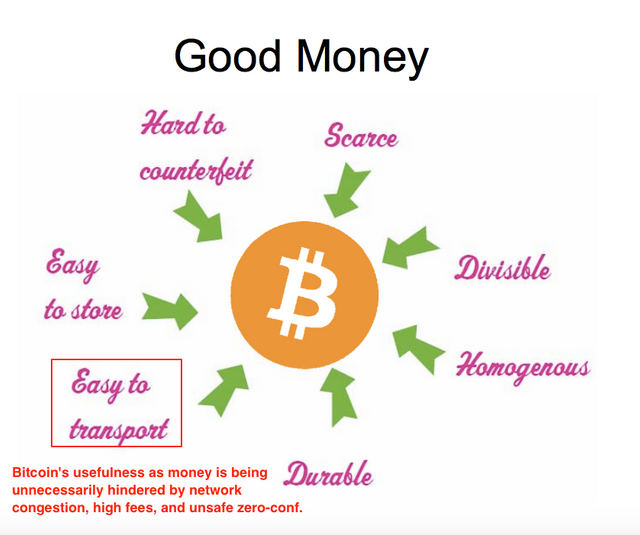

Good Money

What is "Good Money" anyway?

Here's a checklist:

- Hard to Counterfeit

- Scarce (Limited in Supply)

- Divisible

- Homogeneous (Each denomination is uniform in value)

- Easy to Transport

- Easy to Store

In the distant past Gold and Silver were the universally accepted Good Money. And I even wrote how the world accepted Gold as Good Money here: https://steemit.com/money/@daniel3/the-story-of-how-pieces-of-paper-became-money

Bitcoin and the Cryptocurrency Revolution

Ever since the release of Bitcoin into the world from Jan 4, 2009 people kept criticizing it and saying how it would fail.

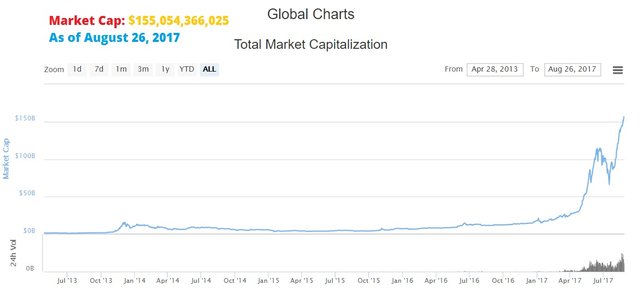

But after over 8 years and a price of over $4000 people are still scratching their heads wondering how it hasn't crashed yet -- and even more shocking to them is the fact that over more than 800 more Cryptocurrencies have emerged successfully by themselves!

Analysts and Doom-prophets keep repeating that Bitcoin and the other Cryptocurrencies are bubbles soon to burst based on what they know of traditional finance and stocks.

But what they fail to see, or more likely have chosen NOT to see, is Gresham's Law at work:

Bad Money drives out Good Money if they exchange for the same price

- Good Money are the cryptocurrencies that complete our checklist.

- Bad Money (based on our checklist) are the FIAT CURRENCIES around the world: US Dollars, Euros, Sterlings, Pesos... etc.

The price rise of Bitcoin is not behaving like typical stocks. People around the world are simply rejecting the coins and banknotes force-fed on them by the central banks of the world and are REPLACING them with GOOD MONEY cryptocurrencies.

What was once laughed and ridiculed by the rich banking elite are now being eyed with fear and concern because they can see a real possibility of a monetary revolution that would render all their wealth worthless to the world.

The conversion from BAD MONEY to GOOD MONEY is not perfect with other cryptocurrencies turning out to be scams or just failing to complete the checklist of being GOOD MONEY. But with a market capitalization of over $150 Billion the cryptocurrencies are now too big to ignore anymore.

The financial markets around the world are TRILLIONS OF DOLLARS today. What do you think would happen to the cryptocurrency prices if investors from those financial markets added to the Market Capitalization and raised it to at least $1 TRILLION DOLLARS?

The original Bitcoin and the Segwit pivot

What drove the adoption and price of Bitcoin up from nothing was purely basic laws of economics lining up.

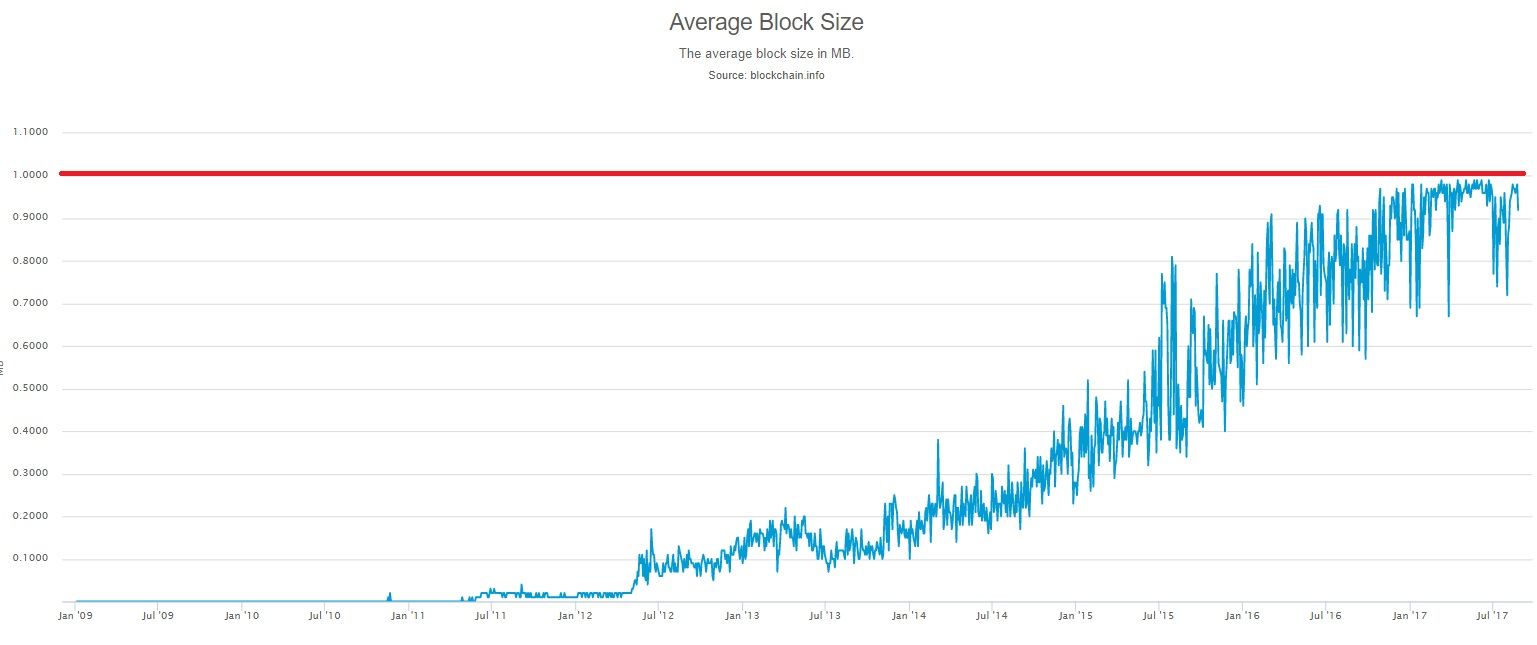

Before Segwit Bitcoin was accelerating to mainstream adoption as GOOD MONEY as evident in its skyrocketing price and number of transactions.

But that was until the 1 MB ceiling was hit and everything changed.

Transactions are getting slower and getting more expensive.

To address this after years of debate and politics miners and users were forced to accept Segwit and after activation the effect was effectively zero. Transactions remained expensive and the number of unconfirmed transactions keep getting bigger.

Until something changes Bitcoin today is no longer GOOD MONEY

Bitcoin Cash and the Alt-coins

Gresham's Law will soon reveal itself once more but this time against Bitcoin as it currently stands

Bad Money drives out Good Money if they are forced by law

But Good Money drives out Bad Money if there is no force by law

When there is no coercion by law Good Money will always circulate and the people will reject the Bad Money.

Segwit failed to deliver it's promises and we are left with a stunted Bitcoin network.

And right now, because Bitcoin is no longer Easy to Transport/Transact people will sooner or later reject it and find other cryptocurrencies. It is basic economics and Gresham's Law will prevail.

Bitcoin Cash would be the next logical choice for current Bitcoin users since the only difference is that it has expanded it's Blocksize limit to 8MB allowing for more transactions and cheaper fees to be processed. And if they had Bitcoins before the Hard Fork then they would have an equivalent amount of Bitcoin Cash to use and transact with.

The Market Capitalization of Bitcoin would slowly transfer to Bitcoin Cash and effectively continue the original intent of Bitcoin of being a peer-to-peer digital cash being used with cheaper fees and faster transactions and available for everyone around the world to use.

And the same can be said with Alt-coins as well of being able to offer faster transactions and cheaper fees than Bitcoin today. As long as they follow the checklist of being Good Money then in the long-term future they could might as well replace Bitcoin in dominance.

@daniel3 This is the kind of content that I appreciate here on Steemit! Jeff Berwick on @dollarvigilante shared his taughts that Bitcoin cash will be "the only one left standing at the end". Thanx for this post. I learned something here... ;-)

Followed and upvoted

Steem on!

Thanks @kapetanic! Appreciate it!

Yup... "Bitcoin" has been usurped by Bitcoin Core Developers and Blockstream. Their propaganda against Bitcoin Cash worked really well in the beginning but after Segwit finally activated and flopped miserably on its promises the users and businesses are finally seeing through their lies the hard way through $5 to $10 average transaction fees... The Bitcoin community is paying the price (literally) for their "1MB forever" delusion!

Well now we have SegWit and LN.

Problem solved for Bitcoin Core.

You made the mistake of implying scaling issues are permanent and can never be solved.

I wish you BCash people would be a bit more truthful

LN is bad money.

Thanks but I do not understand the reverse flippening. Why would Bitcoin become bad money?

BTC is faced with the problem of having the transactions take too long to process. If you are a buying a house, waiting an hour for the transaction to complete might not be a big deal. However, I doubt many are willing to stand around that long when purchasing a cup of coffee.

The amount of transactions per second that a Visa, as an example, can process, is light years ahead of BTC. BCH and LTC offer an alternative to this although they arent without their challenges. Technological and scaling issues still remain on this front.