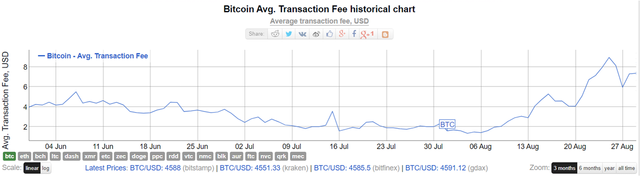

Bitcoin: Death by a thousand fees...

Hello again fellow Steemians! With the Bitcoin price at an All-time-high people are buying for Fear-of-Missing-out but I want people to see that the economic fundamentals that made Bitcoin successful are in trouble.

Due to the rising transaction fees Bitcoin today is becoming less of a currency and becoming more of an asset. People are no longer using Bitcoin but saving it and praying that it gets more valuable.

Even the Russian government's financial sector wants to ban people from buying Bitcoin and will only allow "QUALIFIED INVESTORS" (usually means already RICH investors) to buy and sell Bitcoin in Russia. I'm pretty sure this was not Satoshi Nakamoto's intended goal.

Source: https://www.coindesk.com/russian-regulator-bitcoin-limited-qualified-investors/

If Bitcoin continues to be the way it is now with high transaction fees then more and more Bitcoin users will slowly but surely move on to other cryptocurrencies to provide faster and cheaper solutions. This will eventually leave the network with just speculators and traders. Unless new money flows into the network to feed the gains and profits of these people the price will stagnate and soon drop.

Am I sure Bitcoin is in trouble?

It is and I fear a lot of people are going to be affected by it. But I think this will be a long and slow journey before it finally crashes. The reason for this is because businesses and institutions are already invested in it and will continue using it despite the rising transaction fees especially with people jumping on the bandwagon of wanting to see Bitcoin's price go higher. China and Russia especially are going to continue fueling the speculation train. Russia just recently announced plans on raising funds to invest heavily in Mining equipment to compete with China's dominance.

But historically and economically speaking, growth based on speculation instead of utility is 100% guaranteed to fail sooner or later. The overall number of transactions (confirmed and waiting in the mempool) are getting smaller and yet the price has just hit an All-time high this week... Less people are using it due to rising transaction fees but bigger investments are pumping in. These are signs of a Bubble right now.

Source: https://bitinfocharts.com/comparison/bitcoin-transactionfees.html#3m

The price will keep rising but soon it will be a slow and long drop to bottom. The only question is WHEN.

Is there hope?

Segwit was supposed to be the "HOPE" everyone was promised but it did not live up to its promises and just left Bitcoin with the same problem with even more technical questions than answers.

The root cause of the problem is the transaction fees. Unless it decreases enough to encourage people to use Bitcoin again then the problem remains.

People are leaving Bitcoin and in the short to mid term people are choosing other Alt-coins like Ethereum, Monero, Dash and others.

But in the LONG-TERM I believe Bitcoin Cash will inherit the Bitcoin legacy's network and cryptocurrency market dominance.

Why Bitcoin Cash will be chosen:

Bitcoin User Adoption

Users, Businesses and Institutions that have Bitcoin can choose to invest again in another Alt-coin to replace Bitcoin but this will just mean spending more time and money in understanding a new cryptocurrency as well as trying to get their own friends and customers to adopt to the new changes which will cause delays and uncertainty.

With Bitcoin Cash, on the other hand, they don't need to spend as much time and money to adopt to changes because Bitcoin Cash is mostly the same as Bitcoin in terms of code with the added incentive of having cheaper transaction fees.

Each Bitcoin Public Address has an equivalent Bitcoin Cash Public Address which makes integration much simpler than choosing another cryptocurrency.

However, the issue with Bitcoin Cash right now is that it still needs stable Mining hashpower support for it to provide faster transactions.

Mining Infrastructure

Bitcoin mining pools have invested a LOT of money, time and effort in buying, installing and maintaining their mining rigs and hardware. Their specialized hardware is customized to maximize profit and be as efficient as possible but will ONLY perform for Bitcoin transactions, it cannot mine any other cryptocurrency -- But that was until Bitcoin Cash came along.

The Bitcoin mining pools will be faced with a choice when Bitcoin eventually becomes unprofitable. They will either retire and throw away their expensive equipment OR utilize their hardware for BITCOIN CASH. And when that happens Bitcoin Cash will acquire the hashpower support it needs to provide consistent and reliable network transactions.

End Game for the Bitcoin Legacy chain

The last chance for it to succeed is the anticipated "Lightning Network" which promises faster transactions.

But unfortunately this will require 3rd-party participants for transactions which makes it even less likely that the root cause of the problem (TRANSACTION FEES) will get smaller...

Hopefully, the transition from Bitcoin legacy to Bitcoin Cash will be a gradual process resulting in less financial casualties in the end.

Bitcoin Cash Crash: Chicken or the Egg

Which came first the chicken? Or the egg?

Did people use Bitcoin because the price was rising? Or did the price rise because people were using Bitcoin?

Despite the falling price of Bitcoin Cash it's economic fundamentals (CHEAPER transaction fees) are in place for it to succeed and continue where the Bitcoin legacy is today.

And as the Bitcoin legacy chain becomes less profitable more miners will support Bitcoin Cash making it faster as well.

When people start using it the price will rise as well.

Really great analysis.

It is a logical path that it can take.

Need to follow the trends in BCC!

Thanks for sharing :)