Bitcoin Cash and the Big Blocks

Hello again guys, I made this post for everyone out there who are just like me who want to better understand Bitcoin Cash and why they are offering Bigger Blocksize solutions instead of just using the upcoming Segwit and Lightning Network (Sidechain solutions).

Here are some links that have helped me get a better understanding of Bitcoin Cash I hope these help you guys too:

A compelling article about Bigger Blocksizes from a business-owner using bitcoin:

https://keepingstock.net/an-open-letter-to-bitcoin-miners-c260467e1f0

A video by Roger Ver, one of the biggest pioneer investors in Bitcoin:

The Bitcoin Cash website showing their proposals, solutions and the exchanges supporting them.

https://www.bitcoincash.org/

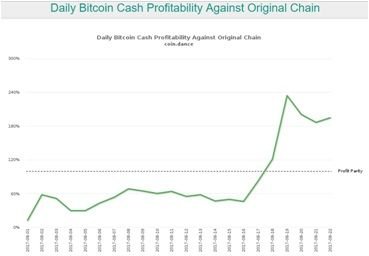

Charts about Bitcoin Cash blocks and mining profitability vs legacy chain mining

https://cash.coin.dance/blocks

Personally, I believe Bitcoin Cash has a real possibilty of overtaking the Bitcoin legacy chain for many technical reasons.

But I feel these are the most important reasons to watch out for:

- CHEAPER transaction fees and FASTER confirmation times due to bigger Blocksize limits.

- Majority of Bitcoin users already have Bitcoin Cash (unless they already sold them) and are ready to use it when adoption increases driving volume and price.

- Bitcoin mining hardware can switch to Bitcoin-cash at any time slowing down the Bitcoin legacy chain creating a feedback mechanism for even more users to switch to Bitcoin-cash.

This has been my personal opinion. I could be right or I could be wrong. Only time will tell.

I hope this post helped you out guys!

I would agree with your points.

The amount of unconfirmed transaction on the legacy Bitcoin chain is now north of 90k, and the fees have skyrocketed once again.

Not to mention the fact that the legacy Bitcoin chain has lots 3TH/s of mining power over the last 3 days.

Exactly.. the congestion has forced people to go to other altcoins like Ethereum and Ripple..

It's not a coincidence that around February 2017 when the average blocksize started getting closer to its 1 MB limit the Bitcoin dominance sharply fell from 86% to an all-time low of around 39%. The price was still rising but the rest of the money went to the other altcoins.

If Bitcoin still retained even just 80% of our current marketcap of $152B (Aug.23,2017) Bitcoin's price today could have been $7323.87 per Bitcoin

https://coinmarketcap.com/charts/#dominance-percentage

https://blockchain.info/charts/avg-block-size?timespan=2years

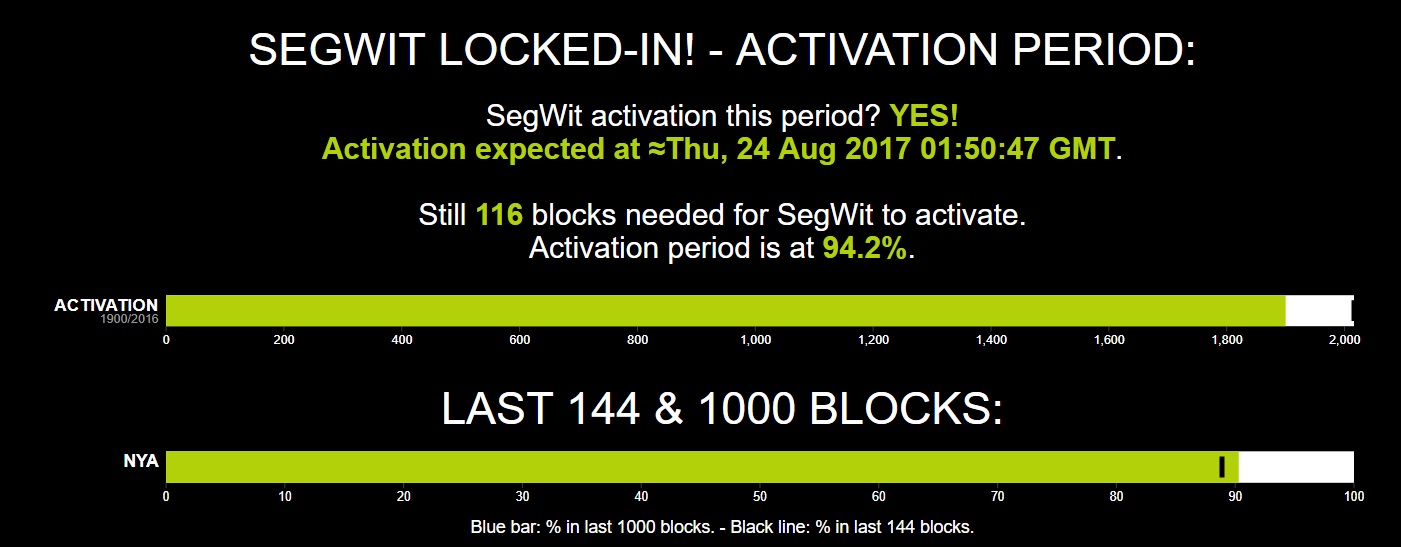

As of this writing only 116 Blocks remain to be mined before Segwit activates, which means it will activate tomorrow (Aug. 24)

https://xbt.eu/

Segwit will give a temporary solution of increasing the capacity but keeping the 1 MB limit by separating the Transactions from the Digital Signatures, proof or witnesses that the transactions are real (i.e. Segregated Witness)

Meanwhile, Bitcoin Cash ALREADY has the capacity to accept around 8x the amount of transactions the legacy chain can handle right now.

"The price was still rising but the rest of the money went to the other altcoins."

This is a very good point. If Bitcoin was properly scaled years ago, the alts would have never risen so fast, but there is also lots of innovations happening there, so it's not completely unexpected.

Great post. BCH has a long way to go before it overtakes bitcoin.

You sure about that? Bitcoin is down to about 2 blocks an hour.

We are racing to get the Lightning Network up and running. If anything Bitcoin Cash sped up Bitcoin's support for the Lightning Network.

VERY NICELY DONE.

UpVoted!

Congratulations @daniel3! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP