Getting REKT on BitMEX - Losing on a Highly Leveraged BTC Trade

To Get REKT = To Get Burnt or Liquidated

This past week, I have had a bad case of trading-fever which I get every so blue-moon as a function of being in the crypto space. Usually my strategy is and has been to buy and hold or HODL my altcoins. However, as this bull-run started to kick in the past week, I started to crave some more action and got greedy. The problem is, I sought to satisfy this insatiable desire through trading highly leveraged bitcoin derivatives on BitMEX over the last 2 days.

BitMEX is unique because it offers leverage trading up to 100x. Most exchanges which offer margin trading may go up to 5x max. To give you the short version of what this means is BitMEX offers Bitcoin traders the ability to trade up to 100x the bitcoin they have in a given position (Long or Short). BitMEX is unique from most margin trading exchanges because the risk on your collateral or margin in a given position is limited to -100% ROE while your upside in a trade is not capped.

*** If you are inexperienced with trading bitcoin or derivatives and/or don't understand the terminology or the mechanics but are more curious of how this works, no worries (It is not Rocket Science) - Read this Medium Guide to trading Bitcoin derivatives on BitMEX as it explains the concepts of Leverage, Margin Trading & BitMEX's unique platform mechanics thoroughly. ***

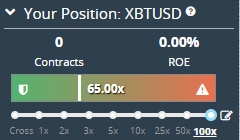

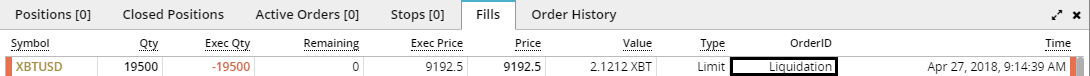

Being the Noobie I was, I ended up taking a rather large position of $19,500 BTCUSD Contracts (Almost 2 Bitcoins Worth!) using around 65x Leverage on ~$300 collateral. My position was a Long when the price of BTC was hovering around $9300 (If I remember correctly) and I was betting that BTC's price would go up. Needless to say the price ended up going down about $100 and my position was liquidated and I lost ~$300 so I got REKT as you can see in the screenshots below 😭😭!!

Using the total amount of money I had in my account and using that amount of leverage was sheer stupidity. There is no question. I was an inexperienced trader, essentially gambling with Bitcoin Derivatives. Although there were things I could have done smarter and there are disciplined methods of trading which I didn't use - I see how easy it is to lose focus and get into the gambling mindset on an exchange that offers such high leverage and upside potential on a single trade. Case in point - Don't mess around with Bitcoin Derivatives and only Risk What You are Willing to Lose. That $300 loss was painful for me, but thankfully it was just a fraction of my overall altcoin portfolio. I am not going to use BitMEX again or daytrade or trade BTC derivatives. I would much rather continue sticking to value investing - that is the buy & hold strategy - undervalued altcoins for the long-term as the risk & stress involved are much less and the reward is higher most 9 out of 10 times.

I am glad I had this experience and learned my lesson - 90% of day-traders lose money - and trading high-leverage bitcoin derivatives in a highly volatile, unregulated & manipulated market is probably a dumb idea.

Get Rekt on Bitmex sounds like they Crypto enthusiast equivalent to a hangover. I haven't had the guts to try any leveraged trading yet.

But I'm a great market indicator, whatever I buy immediately dumps.

HAHA. Leverage Trading bitcoin is the equivalent of gambling bro, don't try it. LOL, I longed BTC and then a few hours later, it just dumpeddddd.😂

Your Post Has Been Featured on @Resteemable!

Feature any Steemit post using resteemit.com!

How It Works:

1. Take Any Steemit URL

2. Erase

https://3. Type

reGet Featured Instantly & Featured Posts are voted every 2.4hrs

Join the Curation Team Here | Vote Resteemable for Witness

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by Daddyku from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Interesting, and I don't think you should abandon it. It's essentially just a buy with an automatic stop-loss, where you choose the stop-loss point with your leverage. If you use normal stop-losses elsewhere this could be more profitable because you don't have to pay a transaction fee the times you lose. (Not sure what their fee structure is, maybe you pay more to do it this way?)

@tcpolymath Thanks for the comment!

My leverage was way too high so I didn't have much cushion room for setting a stop-loss. I would have also still taken a hit and lost a good amount had I set a stop-loss somewhere. I really didn't give myself much room to maneuver with the 65x leverage tho 😖

I see people losing a lot because they lack the knowledge and don't know exactly how to read indicators when they trade on Primexbt/Bitmex/Bybit. And it requires a lot of time to become a profitable trader.