Crypto Loans

Five to ten years ago, the financial services market was almost completely controlled by banks and microfinance organizations. With the development of Bitcoin and other blockchain and crypto technology and the penetration of the Internet, the situation has changed. Now there is a huge variety of crypto start-ups and online services that provide financial help.

The rapid growth of cryptocurrency capitalization in recent years and the attraction of worldwide attention to it provoked the emergence and development of Internet services, the key idea of which was financial operations with digital assets.

Lending in Bitcoin appeared 5 years ago. I was one of the early adopters in this space and started loaning my Bitcoin with many P2P crypto leading sites. The services quickly gained popularity, but, as usual, several difficulties arose. Identifying customers was more difficult than obtaining a loan in a regular bank. And the number of scammers who did not want to repay loans was only increasing. A new business model was needed.

Enter Crypto-collateral Lending

Using Bitcoin (BTC) Ethereum (ETH) and other crypto currencies as collateral for obtaining a loan has become a growing practice amongst members of the crypto community. From time immemorial, there have existed several forms of financial market tools being utilized as collateral for obtaining credit. I have started investing in crypto collateral lending platforms and the results are very good in my opinion much better then P2P leading platforms. My favourite platform is YouHolder

More about YouHodler

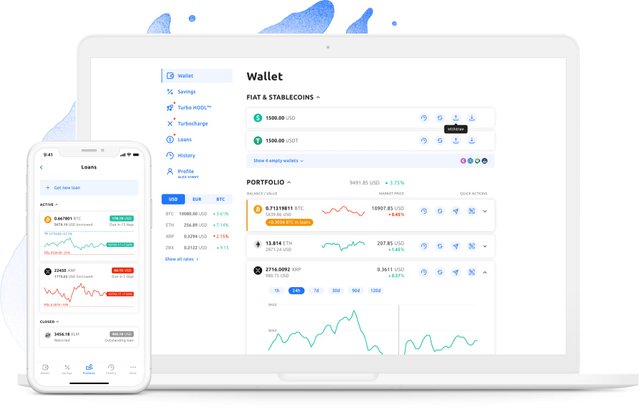

YouHodler is a Swiss company that specializes in providing a cryptocurrency line of credit and a cryptocurrency exchange platform. Founded in 2018, the company’s mission is to minimize passive ownership, allowing investors to earn interest on their assets or borrow money.

One of the most core products offered by YouHodler are cryptocurrency loans, available in tokens such as BTC, ETH, XRP, Dash, LTC and so on. Depending on the token, users can choose one of the available plans, which differ by loan period. For example, users can choose plans that range from 55% to 95% in cost ratio, from 5% to 40% in price reduction, and a loan period from 30 days to 180 days.

The company does not perform any credit checks, as user credit scores are meaningless to the loan application process. Borrowed money is fully secured by cryptocurrency and is based on the loan-to-value ratio. Because of this, even if users cannot repay their loan, their credit score will not be affected.

Additionally, YouHodler has a Turbocharge service, which allows users to get a chain of loans. The platform uses borrowed fiat to purchase additional cryptocurrency without commission and then uses it as collateral for other loans in the chain. Ilya Volkov, CEO of YouHodler, says the option is popular among traders

Here are some videos to showcase the YouHodler platform:

Crypto Loan: How to Get an Instant Crypto Loan on YouHodler:

Earn Crypto: How to Use Crypto Savings Accounts on YouHodler:

Sign up with YouHolder and get $25 as welcome bonus reward when you take a loan worth $500 or more using this promo link. https://www.youhodler.com/?rid=3EEUH5PB5R3IT66Y