Why Bitcoin is Perfect for Most First-Time Investors

This article comes with a corresponding video. The video includes a separate introduction and includes all information in the article along with supplementary commentary and pictures. Feel free to watch or read depending on your preference.

Introduction

Bitcoin has had an interesting impact on the younger generation as it is often their first experience with investing. A recent study found that over 30% of millennials would prefer having $1,000 worth of Bitcoin rather than stocks or bonds, although it seems the survey may not have been fair. However, the point still stands: A significant portion of the younger generation is more entranced with Bitcoin than traditional financial investments. Is this net positive or should we be concerned about the effects this might have on their longer-term future?

Why Bitcoin Investing is Unhealthy

On the downside, many young investors in Bitcoin have unrealistic expectations when it comes to returns. Many see 10% in a month to be an “unexciting” sum of money, partially because their gross investment amount tends to be small and partially because Bitcoin has had numerous times where it has increased over 50% in a month. As a result, first-time investors in Bitcoin often have idealistic and outright outrageous expectations on their returns. This is even worse for those who invest in riskier altcoins (cryptocurrencies other than Bitcoin), some of which are akin to penny stocks (as if Bitcoin wasn’t risky enough).

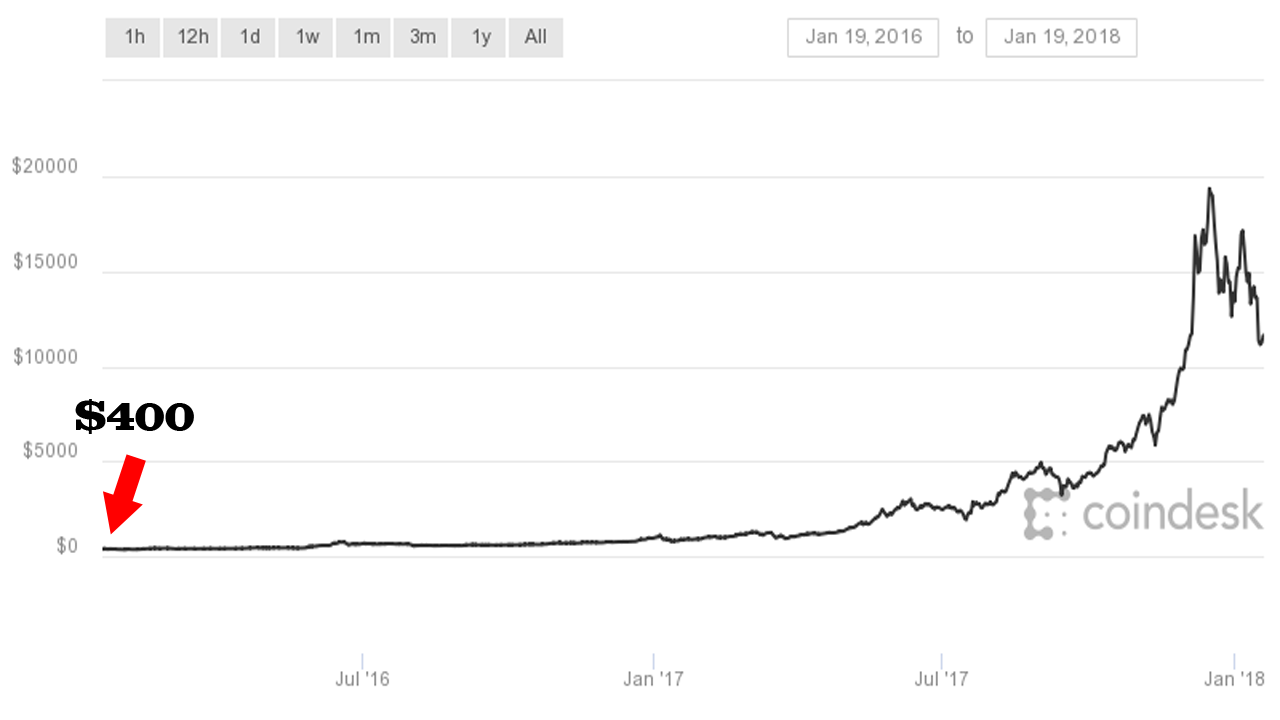

Extended bull-run for Bitcoin. Source: Coindesk.

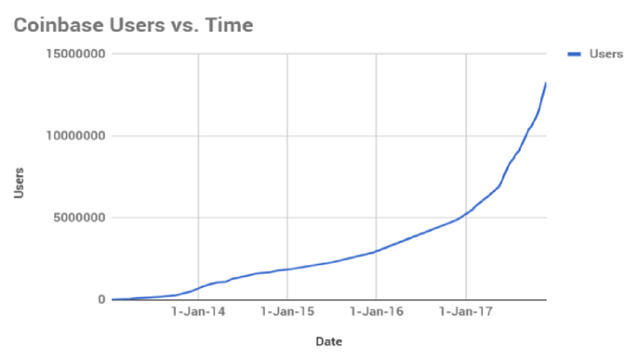

Furthermore, many first-time investors who begin with cryptocurrencies have limited perception of risk. Given the market has been in an extended bull trend for over a year, and given that over 50% of existing market participants haven’t been around for longer than a year (based on Coinbase user growth), most haven’t had to experience any substantial losses until just recently. Many of them have profits that outweigh their initial investments in a ratio of 10-to-1, meaning that even if the market saw a decline of over 80%, they still would have outperformed the stock market (which has been booming, for the record).

Source: coinbase.com/about and various news outlets aggregating data.

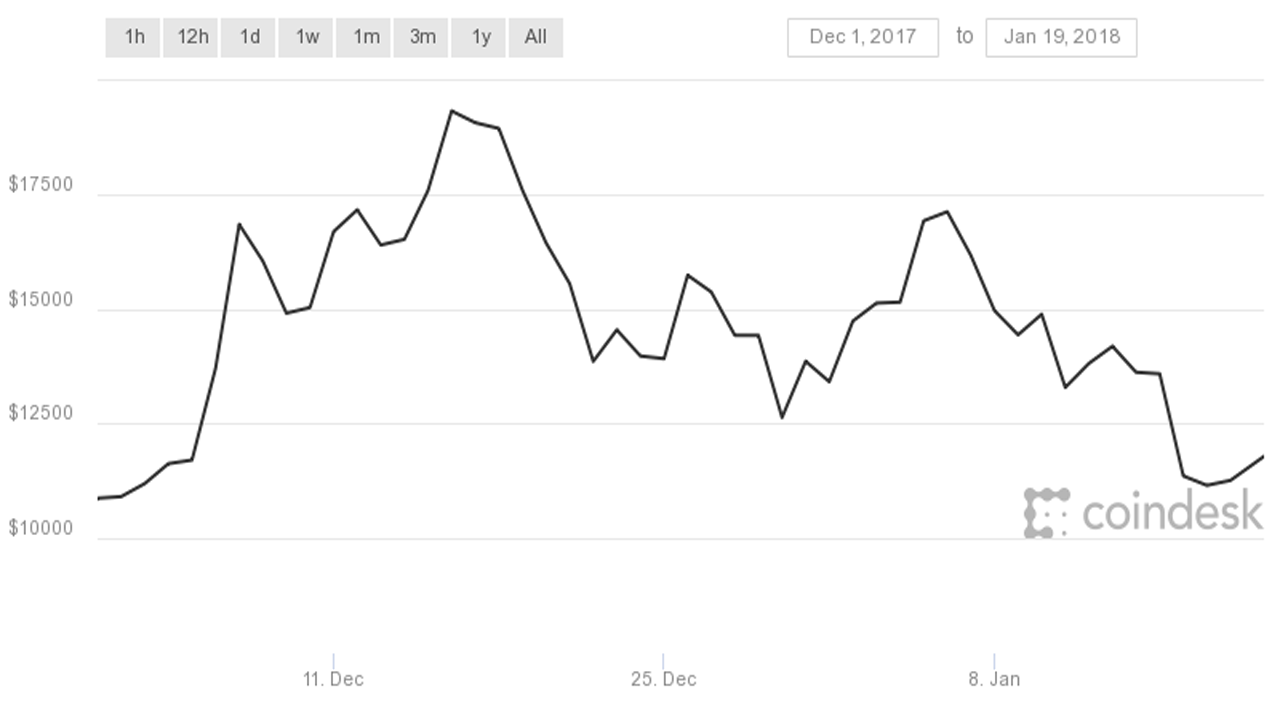

It is easy to “stomach” risk when you are playing with profits – this is a common gambler’s fallacy and one I find even myself susceptible to (a dollar of profit is no different from an initial investment dollar, yet mentally we perceive them as different). The only group of people who have seen their initial investment dwindle (which didn’t arise from overtrading) is those who bought since December, where Bitcoin spiked to $20,000.

Bitcoin price since December. Source: Coindesk.

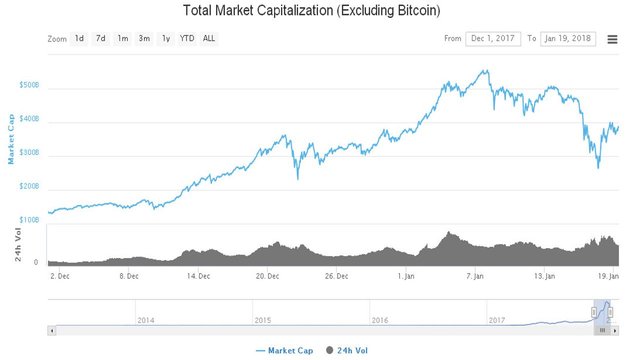

However, even among that demographic, there is an even smaller group who is experiencing major losses as altcoins have boomed during this decline for Bitcoin. This means any individual who bought Bitcoin at its peak ($20,000), but still had money in altcoins is likely still in the black.

Altcoins boomed while Bitcoin dropped off. Source: coinmarketcap.com

In fact, we have even seen a shift in what I would call “market narrative,” where an increasing number of individuals are proclaiming Bitcoin dead as its “technologically superior” altcoin brethren take over. This suggests that many investors have substantial altcoin positions, meaning the demographic with major losses is really quite small.

The fact that so few have losses in this market is the key argument for why cryptocurrency investing is a net negative for first-time investors. Their expectations for returns aren’t realistic and their perception of risk is warped by gambler’s fallacies. It isn’t a far cry to say that cryptocurrencies are in a bubble, as we see cryptocurrencies like Tron with an obtuse (arguably plagiarized, unless translation error) white paper, no product and unoriginal code receive valuations in excess of $10 billion due to marketing hype. This speculative behavior isn’t investing, detractors will say, and it will only lead to eventual pain and suffering. Just look at the recent price action!

Why It Isn’t So Black & White

While I agree with this last, grim statement, there are more positive elements to cryptocurrency investing that we should be focusing on. First and foremost, most financial advisors can attest to the fact that the biggest reason that people aren’t able to comfortably retire is because they don’t save any money. Dave Ramsey is likely the biggest testament to that idea, hounding it over and over as a straw man argument against anyone who tells him that his annual 12% mutual fund figure is nonsense (which it is).

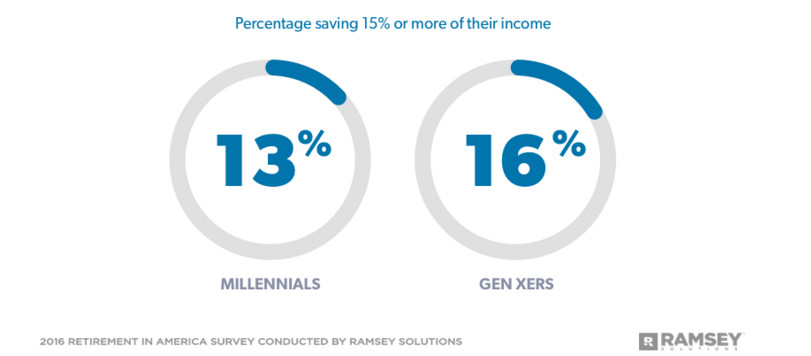

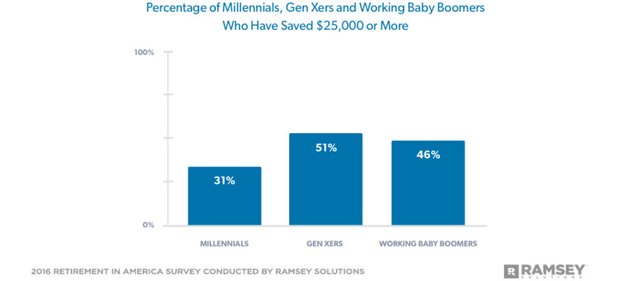

Source: daveramsey.com

However, the statement on retiring is remarkably true: A surprising amount of Americans just don’t save any damn money, and that story doesn’t change as you go to a global perspective. Those of us in the financial world are far too focused on investment optimization: Maximize returns, minimize risks, achieve diversification benefits, allocate to the right asset classes, hedge against interest rate fluctuations, etc.

But the reality is that as long as you are saving and paying down debt, you’re a step above the rest. The “mission statement” of many financial advisors is to just pass this simple idea on to more people, even if it means they get paid less! This is where Bitcoin and other cryptocurrencies come to “save the day”…

The more experienced among us like to point out that the illusion of high returns and ‘low’ risk is ultimately going to result in a catastrophic and life damaging event for many young investors (perhaps this crash, for example). However, it is the very illusion of high returns and “acceptable” risk that is encouraging them to become investors in the first place!

… Hold on just a darn second, you say in writhing objection. That’s just stupid – of course that’s why they’re “investing!” But when (not if) the bubble pops, they’ll become so disillusioned with investing that they’ll never want to participate again! Just look at all the people who invested in Bitconnect (cryptocurrency Ponzi scheme that recently collapsed): We must protect them from this inevitable situation. They will blame everyone and everything but themselves: Whales manipulated the market, the governments don’t want to see it succeed, the banks tanked the prices, the exchanges conspired against us, yada yada yada. No one ever takes responsibility for anything they didn’t exercise discipline to achieve!

Source: Shutterstock.

You’re right. When the bubble eventually pops, fingers will be pointed everywhere. Many investors won’t accept that they themselves were responsible for the gross mispricing of nearly all cryptocurrencies, especially given many are fueled by political ideologies. Just as they bandwagon’d into cryptocurrencies, they will bandwagon against whatever the masses determine as the primary cause for the bubble popping. They will scream “FUD” and blame the “weak hands” for being so easily manipulated.

Why Bitcoin Investing is Net Positive

But don’t let this likely reality deter you from an even greater and more valuable truth: Many people are deferring spending and are investing instead because of cryptocurrencies. If you’ve been involved with Bitcoin for longer than a week, you’ve likely heard about the story of the $100+ million pizzas. It’s a rather stupid story, given Bitcoin would never have the value it has today without people using it back when it was fractions of a cent, but the impression it leaves on people is the relevant part here: Why spend money on anything when you can save it in Bitcoin and have more in the future?

Now funny enough, this concept is true of all investing. You could replace Bitcoin in that sentence with any investment: Stocks, bonds, real estate, personal businesses, etc. But as they say, “everybody has their price.” In this case, price is returns and stocks just aren’t interesting enough to people that only have $1,000 (often less) to invest. How many teenagers have you heard say: OH BOY! $100 in a year if I’m lucky? Guess I should hold off from buying that (insert anything relevant here)!

Bitcoin on the other hand? The absurd returns are enough to make anyone, even teenagers, take a step back and seriously consider whenever they are about to make a new purchase. People are starting to take a small portion of their paychecks and devote it to cryptocurrencies. How much do you want to bet that portion of their paycheck likely would have been spent instead if there were no cryptocurrencies?

There-in lies the important revelation for those of us who know these returns won’t last forever: Even after the bubble pops, many people (even those who bought at the peak) will be wealthier than they otherwise would have been. Obviously it will be a mixed bag – some people are investing in cryptocurrencies entirely in lieu of stocks or paying down debt. Some are even going the extra mile and are taking ON debt to invest more. Those individuals will likely come out less wealthy than they otherwise would have been (some bankrupt), but the net effect should be positive.

I also suspect that a number of individuals who are exceptionally successful in cryptocurrency investing will likely move over to more traditional investments as they see their portfolio worth increase from 5 figures into 6 or 7 figures. There comes a point where even a teenager will see 7 – 10% in a year (I guess arguably lower given current stock market return projections) as attractive with a large enough sum of money. Funny enough, it’s not like the stock market is exactly cheap right now either.

Furthermore, those who have a first time investing experience in Bitcoin and cryptocurrencies should have a strong tolerance for volatility. Losses in excess of 30% are common, which in stocks would be considered catastrophic. Many folk who have invested for cryptocurrencies for longer than a few months aren’t even phased by movements like we’ve seen the past few days and are less prone to make emotional decisions (although admittedly, I ponder how these individuals will act when Bitcoin DOESN’T recover in the course of a month). This should prepare them for future recessions and bear markets, whenever they might occur.

Conclusion

All in all, while investing solely in cryptocurrencies is certainly NOT a prudent financial decision (at least in a fundamental sense), it is welcoming a whole new class of investors to the world. When the bubble pops, it will leave a poor taste in most of their mouths. However, many will likely be wealthier even after the bubble pops and EVEN IF they bought at the peak. Why? Because many of these people investing solely in cryptocurrencies were never allured by traditional investing in the first place and would have spent the money instead, which is often negative 100% ROI given the resale value of most items (and more importantly, the laziness of most people to sell anything they no longer need).

For those who get a taste of what investing can do for them, they might consider jumping into the traditional world of investments, especially given the number of “influencers” in this space that encourage such a choice. As with all matters, cryptocurrency investing isn’t as black and white as most would paint it. In many cases, it will behave as a crucial stepping stone into the world of accumulating wealth and achieving financial independence. Some lucky people will achieve it before the bubble pops and secure it (congratulations if so), but even factoring those individuals out, I still suspect cryptocurrency investing is net positive for our younger generation.

Liked this article? Upvoting, following and sharing help increase its visibility and is a great way to show your support. What are your thoughts? Let me know in the comments below and thank you for reading / watching.

In terms of technology, I have no doubt in my mind that we are at the early stages of something huge, that does not mean that the crypto market is not a bubble though. I think the problem at times is that people cant see the difference between the value of a coin and the potential fundamental value of the technology. Dot com is the most obvious comparison, everyone correctly assumed that the internet was going to be a big thing going forward but that never meant that all the companies would survive and most didn't.

The vast majority of alts have tiny communities and/or no actual product, you can only attribute value to something on the basis of there being a business case in the future for so long. That's excluding the ones that are outright scams, bitconnect was an extreme example, and a pretty obvious scam at that, but many are no more than a whitepaper and a clone of something else. Others are taking the approach of "build it and they will come"....they probably won't. You need to build something actually useful then sell it to the world at large not just the users on reddit and steemit. Some people seem to get emotionally invested in a project just because the rode and wave of hype and made money. Don't get me wrong, I do that too but just because I

investspeculate on a coin in the short term, does not mean I believe that the project is likely to have value long term. I know I'm gambling and the amount of money that I have on the line reflects that fact, (I am far from 100% in crypto) I like to think at least that that will give me an edge when the day of reckoning finally comes. Still I could be wrong there too and set my expectations accordingly, unrealized gains are what they are.Seriously, if anyone reading this is borrowing money to speculate. Reconsider, that is lunacy.

I don't see it happening in the short term but there will be a shakeout in the crypto space and it will be epic. Some coins will be left standing and will be stronger for it in the long run, but most will die. It is from the ashes of that, that we will see the real projects, the survivors and the new ones that are actually useful, the ones with real value.

Thanks for the video and all those who have contributed their personal experiences :) I have learnt so much these last few weeks. Awaiting the next peak!

Very insightful article.

Economic agents work on a system of incentives, and given the lackluster rate of return offered in the stock market over the past couple of decades-- which looks even more mediocre when you factor in the real rate of inflation throughout most of the developed world -- the incentive to save and invest simply isn't there for most people.

Myself included.

I'm not entirely sold on the theory that Bitcoin is in a bubble, though. Market analysts, professors, and a whole array of so-called "experts" have been calling it a bubble since at least 2011. And they've been proven wrong, time and time again.

These individuals often showcase a very shallow knowledge of how Bitcoin works, or its history. They keep repeating the same cliches about the Tulip Mania or the South Sea Bubble, without ever addressing more plausible doomsday scenarios brought upon the market by things like Tether.

Tether really is the other thing that keeps me up at night, but you don't read or hear anything on the issue from the mainstream media.

You have to go on YouTube (which is how I found out about this channel, incidentally) to learn about these things, which attests to the slipshod nature of the analysis provided on more mainstream media outlets and publications.

If Bitcoin can outlive Tether, then there's a very high degree of likelihood that it'll be around for many, many decades more to come. This simply because it derives a lot of value from its ability to allow nearly instantaneous (with the Lightning Network and similar scaling solutions), frictionless payments across borders.

Like gold, its scarcity means it's immune to degenerate money printing courtesy of vertically-integrated structures like Central Banks, which means that -- all other things being equal -- it must inevitably appreciate against inflationary fiat currencies.

All of the aforementioned characteristics make it desirable to hold as an investment, and markets normally associate the long term desirability of an asset class with value.

How much value exactly is anyone's guess, but I think it would be premature to say it can't grow, say, another 1000% from here, and hold on to that value long term.

I drew this earlier today. I thought I should leave it here.

OMG, would you please link a bigger version? I want to print it out and paste it into my trading journal. :D So good.

Sadly my fledgling studio has no scanner yet. But if you wanted to support the cause and check out some more of my other hand drawn crypto related images, you can go to my online store:

(https://www.redbubble.com/people/ideaman4380?ref=account-nav-dropdown&asc=u)

Aaaaaand, you could technically just copy the image and throw it into word and crop it/size it to the page.

Oooh, Steemit doesn't shrink uploaded images! :D I thought it was just a tiny thumbnail (i.e. not printable.)

Again, wonderful drawing! Thank you so much for sharing.

Great post and video. I think the major takeaway for me was how this was one of the first investments that a younger generation has made. This gives crypto a really great association and makes it something exciting to be part of.

Traditional investing feels so out of touch with the world today and the younger generations viewpoint on it so that is one of the reasons I'm so bullish on crypto. If this is all we've known, we're gonna stick with it.

Hi cryptovestor,

This is a great and well thought out video. I never had money before. Crypto's gave me a chance to restart my financial situation. I had so called friend ripped me to the tune of $60k. That was my life savings. I was putting $50 a week since June and I'm 800% on my investment. I'm glad I found a vehicle to get those gains.

When Facebook dropped to $18 in 2007, I wish I had money. I would have invested in that back then because I believed in that. Now I do my own research to see which projects to back.

Really happy to be in this space and I've made a lot of friends and now I'm a lot happier I can see that we are still early adopters.

Would be nice to see your portfolio and holdings , im sure many of us want to know your positions ? have you sold most cryptocurrencies you have ? do you still participate on ICos ?

About madoff , the problem iam thinking about , is all those people who were involved inside this ponzi scam holdings, are still running around the nature , while it was the most historical scam of the economy that we have seen , the big daddy madoff did all alone right , noone from the US regulation was involded according to the US justice... fact is $65billion missing amount ,what are they now doing ?people from the 17th floor and all his " friends " maybe these unknown whales ? maybe this group of people called nakamoto ? or maybe in the stock market still ? we dont rly know , but my opinion is that they are coming back maybe already back with a more sophisticated way to get money, to not forget is that even he ruined life of many people , I hate him for that , he created the Nowadays digital market , Nasdaq is madoff.

What are your thoughts on the recent minting of millions of $ of Tether? Do you believe that the reason we didn't see $7-8k BTC was due to Tether pumping counterfeit money into the space? voiding all the TA that pointed to $7-8k?. What are your thoughts on the current state of the market and how bad do you think the Tether bubble will be. It would be fantastic if you could share your update thoughts on Tether given the recent severe pumping.

I think there is a major problem with bitcoin because a good percentage of its value is due to possible future first time buyers into cryptocurrencies.

The fact that supposedly/certainly many people in the next few months or year will enter the cryptocurrency markets via bitcoin, gives it a pretty good boost in price.

However these future first time buyers will also already have seen many news stories in mass media against bitcoin or about bitcoin crashes (30%,40%). And this is probably going to keep many of them out, even if it's not a reasonable or valid criteria.

Moreover, 2017 was the year of entrance for hundreds of thousands of low buying power speculators and people that were chasing for casino-like gains. Therefore, I believe future investors will be more cautions, more informed and have better alternatives to bitcoin like never before.

I do agree that if the crypto market crashes horribly, there will be a trend of these new investors never wanting to invest ever again. But on the flip side I liked your point that those of us who will stay investing and continue on the path of financial responsibility even after a catastrophic market crash are "seasoned" against letting emotion ruin our choices. That said, however, it's important to bring up the #1 rule in investing: never invest more money that you aren't willing to lose. Obviously nobody wants to lose money, but if the money you put into the market were to vanish in a day and it destroys your life beyond repair, then that's a sign that you shouldn't have invested that much. This amount will be different for everyone because we all come from different backgrounds of wealth. But I repeat, if you can't live with the fact that your investment can disappear forever, then you should never put that amount of money in the market.

On another note, if the next great crypto crash occurs, let's say a 75% drop or more and the market stays that low for months to years, it will be a true test to how new investors in particular can handle it. Crypto investors seem to be unphased by the supervolatility of this market and I feel that even if a recession occurs, many of us will brush it off, even putting more back into the market to load up on cheap coins. Here's to the future!