This is what I learnt about SegWit2x, BTC split and Bitcoin Cash

Why Bitcoin Cash?

I've been trying to get my head around the current bitcoin tsunami. As a complete newbie, it all looks a bit too complicated. Reading up a few articles made things a little clearer, I'm still confused though. I'll try to write about what I think the reasons behind BTC split. Please correct me if I misinterpreted things.

It all began with proposals to solve bitcoin's scalability issue. The BTC blockchain needs to accommodate a greater number of transactions should it aspire wider acceptance. Today the Bitcoin network is restricted to a sustained rate of 7 transactions per second (tps) due to the bitcoin protocol restricting block sizes to 1MB. For comparison, VISA handles on average around 2,000 and has a peak capacity of handling 56,000 tps; Ethereum network handles ~20 tps. In order to address the scaling problem, miners are voicing for blocksize increase, while developers propose SegWit, a mechanism to take signature data from main blockchain effectively increasing capacity up to four folds. A middle ground is SegWit2x which implements SegWit as well as increases block size to 2 MB.

The mechanism of changes in bitcoin protocol looks as cryptic as the cryptocurrency itself. Here's list of terms that should help understand current BTC discussion better.

Terminology

Softfork and Hardfork

A project fork happens when developers take a copy of source code from one software package and start independent development on it, creating a distinct and separate piece of software. Softforks are forwards-compatible, that is to say, old nodes will accept blocks created by new nodes. With a softfork, only miners will have to upgrade, or else they will end up on the losing fork. Users and merchants can keep running older nodes, which will accept the newer blocks.

Hardforks, on the other hand, are not forwards-compatible, i. e., old nodes may not accept blocks created by new nodes. With a hardfork, everyone (miners, users, and merchants) will need to upgrade to the new code.

Segregated Witness (SegWit)

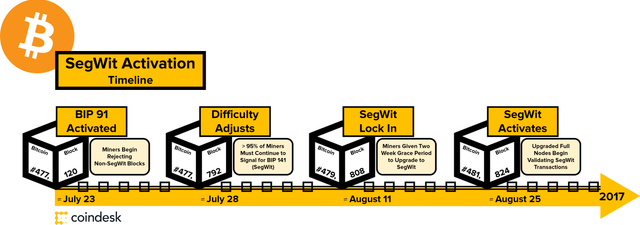

Proposed by volunteers of Bitcoin Core in 2015, SegWit is aimed to increase network capacity and solve transaction malleability via a soft fork. BIP 141, its proposal, requires a super-majority (95%) of miners to signal for the upgrade over two weeks.

Segwit2x (aka New York Agreement)

Backed by miners and startups, this proposal seeks to enact SegWit via a soft fork, while committing to a block-size increase to 2 MB by hard fork three months later in November.

Bitcoin Improvement Proposal (BIP 141)

Introduced in November 2016, BIP 141 is the original plan for activating SegWit.

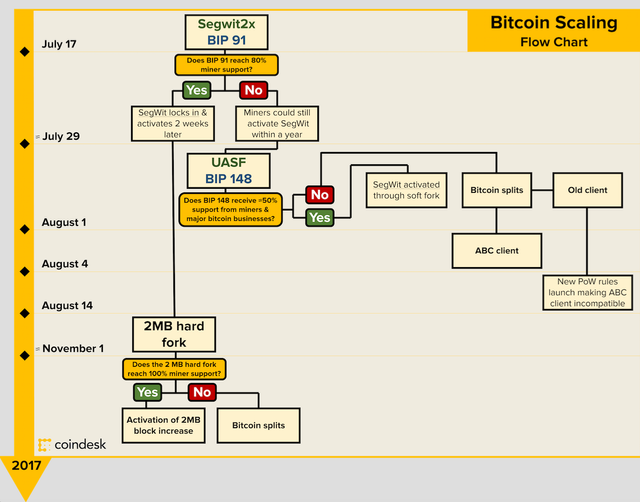

BIP 91

Created by BitmainWarranty engineer James Hilliard, BIP 91 looks to lock-in SegWit2x's SegWit update before August 1, making the proposal compatible with BIP 148. BIP 91 requires 80% of bitcoin’s miners to signal support for a lock-in and a shorter signaling period than BIP141.

BIP 148

Uses an older mechanism for making changes to bitcoin, called a user-activated soft fork (UASF). It requires about 50% of mining pools to support the change. Without that support, BIP 148 could activate and split the network into two competing blockchains.

Segwit2X is a political compromise to end a years long stagnation in Bitcoin scaling development due to disagreements on how it should be done. Basically Segwit2X implements Segwit now plus an automatic hard fork to raise the block size limit to 2 MB in approximately 3 months time. Even though BTC1, the reference Segwit2X implementation, has the 2X part built in, a miner that does not intent to fork can simply switch back to an implementation that will not enforce the fork like for example Bitcoin Core. In other words there is absolutely nothing in Segwit2X forcing a miner or user to accept bigger blocks in the future.

SegWit is just a few hours away from being activated on bitcoin. Some of those who supported Segwit2x proposal appear to be losing confidence in an eventual block size increase (to be implemented in November), so they are creating their own version of bitcoin - Bitcoin Cash.

Bitcoin Cash

- Launch date: 2017-08-01 12:20 p.m. UTC

- BTC holders will get same amount of BCC when they import BTC private key to Bitcoin Cash wallets

- Address begins with 3, bitcoin's begins with 1

- Wallets: Bitcoin ABC, Bitcoin Classic, Bitcoin Unlimited and more. Transactions issued from these wallets will not be accepted by "real" bitcoin nodes.

- Exchanges: Almost all major exchanges look positive about including Bitcoin Cash; some already started trading futures (agreement to buy or sell assets in future) at ~$450 per Bitcoin Cash.

Is there any correlation between the price of bitcoin and bitcoin cash? Like a ratio? I have been watching bitcoin cash vs bitcoin trade for the past few days and there seems to be nothing clear. Thanks for your post.

at start BCH was 15% of BCT because 15% mining hashpower shifted towards BCH but now people's interest in it is decreasing and so is the price

Thanks for the reply, I guess time will tell

Hey there @cryptovest,

I noticed you paid $4SBD to Carlo belgado to resteem your post... would love to know your opinion as I believe this is a scam to try and take advantage of others and get as many SBDs as he can with little return.

Check out this post and let me know what you think, would love to hear if it made a difference for you?

Oh I see. I didn't notice the number of users he himself follows and didn't think about follow-for-follow phenomenon. I love to try out things people create using Steemit as a platform. Thanks for pointing out this. @hannahlicious

Nice post

Good post! Upvoted and Resteemed.

BCC has dropped to $236. Mainly because I decided to grab $100 worth at $310 lol!

What is the best option, in your opinion, for BTC owners ? Should we grab our BCC and trade it for BTC or just let things go and wait in case of a BCC rise ?

BCC or BCH or whatever you call it, it doesn't seem to have a future. If it's controlled by only a few, it's not decentralized. @richq11 @carltheexplorer

I bet you miners start mining it as there aren't many miners mining it.

Good post! Upvoted and Resteemed.

Really good post! Thank you!