AMAZING!!! Read this to understand the DAICO (improved version of an ICO)

What is a DAICO?

It's a change on the ICO gathering pledges demonstrate that consolidates certain parts of DAO's.

The thought was recommended by Vitalik Buterin in January 2018 and is gone for influencing ICO's more to secure by including financial specialists in the underlying undertaking advancement process.

It will additionally empower token holders to vote in favor of the discount of the contributed stores on the off chance that they are not content with the advance being made by engineers.

For ventures that execute the DAICO idea, it will compel a level of responsibility on engineers and give token holders extra significant serenity that they are ensured to either observe no less than a base feasible item or recover their cash.

How does a DAICO function?

It begins off as a Smart Contract in commitment mode.

The DAICO contract will have an instrument where patrons can send assets to the task in return for arrange particular tokens. At the point when the crowdsale period closes, the agreement will preclude anybody from contributing any further, i.e., typical token deal.

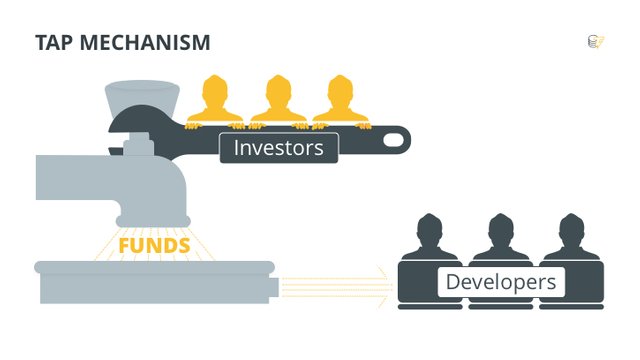

There is one variable that happen after the commitment time frame has finished called the tap variable. This tap in the agreement can be customized to foreordain the sum (every second) that engineers can pull back from the token deal stores.

At first, the breaking point will be set to zero, however benefactors would then be able to vote on a determination to build the tap.

What components from a DAO are fused?

There are three primary components taken from DAO's.

In the first place, at no time is finished trust set totally on a concentrated group. Choices on stores from the get-go are chosen by a just voting framework.

Second, financing isn't discharged in a singular amount, yet an instrument is actualized to spread it after some time.

Lastly, there is a chance to discount the contributed cash. This choice depends on the 'knowledge of the group,' i.e., the donors can vote in favor of a discount of the rest of the funds, if the group neglects to execute the undertaking.

How is it unique in relation to an ICO?

The principle distinction is access to reserves.

With an ICO, once the token deal completes, engineers have finish access to all the contributed reserves. Engineers need to figure ahead of time what amount is important to deliver a base suitable item and once they achieve this sum, called 'the delicate top', they can begin to chip away at the item and spend the cash on whatever they consider essential. On the off chance that they don't achieve this underlying delicate top, they need to discount the cash. Yet, in the event that they do, there's no further genuine commitment.

With a DAICO, givers can vote on resolutions (amid the improvement stage) to either build the tap or to restore the rest of the contributed reserves (self-destructing the agreement).

What are the advantages contrasted with ICO's?

It puts more control in the hands of financial specialists.

Patrons have substantially more to state and impact in the advancement phase of the venture. On the off chance that they are not content with how the task is advancing, they can set the agreement to pull back and get a discount.

This totally mitigates the danger of trick ICOs where designers hold a token deal and after that flee with the cash when the ICO is done, without creating any item.

As the measure of assets that gets discharged from the Smart Contract is restricted and entirely controlled, it will diminish the event of 51% assaults. Regardless of whether a 51% assault happens, where an aggressor needs to send assets to a picked outsider, the results will be contained to the sum that was approved to be discharged by the supporters (or the creating group) at any one point (the tap).

With an ICO, once the group raises a huge number of dollars, it endures crumbling in its inspiration to execute the venture; or, in any event, the movement diminishes essentially. With DAICO show the group's inspiration to breath life into the thought, i.e. to convey the item, is managed over a lifetime period.

What are a portion of the potential difficulties with DAICO's?

Similarly as with any new idea, there will be a few difficulties that need resolving.

On the off chance that designers hold a vast piece of the conveyed tokens, they possibly just need to impact a little level of supporters of influence their vote and get more subsidizes discharged from the Smart Contract.

Benefactors' training is likewise pivotal. They have to comprehend why the cost of a particular token is rising or tumbling to settle on the correct choice when voting on expanding the tap sum, or restoring the assets. The best choice is one in light of the realities identifying with the task itself, not on feelings associated with the cost of a specific token.

At long last, supporters can likewise totally separate by putting all their trust in the DAICO idea itself and in this manner feel it's a bit much for them to really share in votes and resolutions, lessening the lion's share edge and debilitating the security of the component.

What are a portion of the primary qualities of a DAICO?

It's difficult to state as the idea has never been actualized yet.

In any case, to answer the inquiry, it is useful to take a gander at a venture that intends to lead the world's first DAICO.

The Abyss, for example, a cutting edge computerized appropriation stage in light of a crypto compensate biological system, plans to do this with the accompanying DAICO highlights:

A determination to vote on tap increments must be started by venture designers.

There's a rate restrict by which the tap can be expanded at once (to counteract mishandle).

The recurrence of potential tap increments is restricted (close to state once at regular intervals).

Just speculator tokens can be utilized to vote, not those held by venture engineers.

Givers will be educated well ahead of time of an arranged survey.

At the point when givers choose to end the venture, the Smart Contract will change to withdrawal and discount their cash, while in the meantime wrecking tokens held by engineers.