Ripple Mining (aka XRP mining)

As a cryptocurrency info useful resource, we get a number of questions. We make each effort to offer useful solutions in plain English and, after all, person questions give us a number of info too. They tell us what newcomers to the area discover vital, tough, or complicated.

One query which has been arising so much these days is…

How Do I Mine Ripple (also called XRP)?

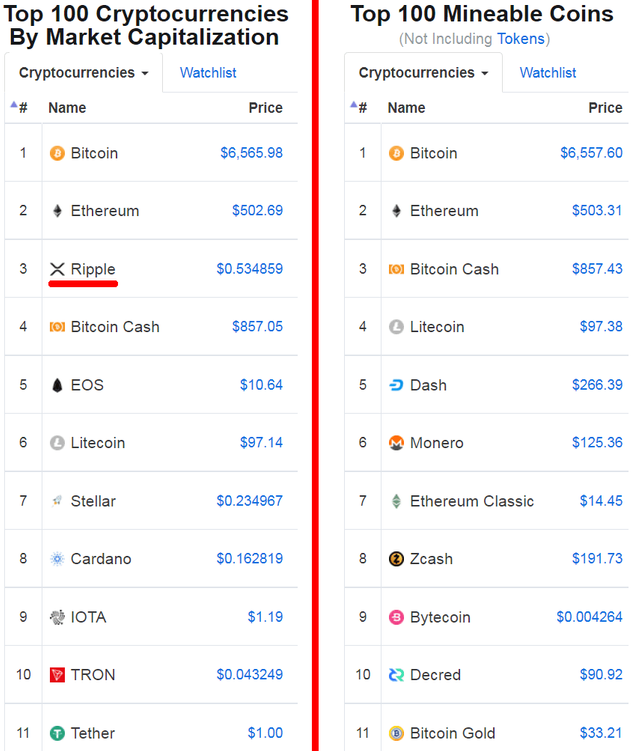

Nicely, to reply it merely, you possibly can’t. In reality, lots of the cash we’re used to seeing within the coin worth rankings aren’t mineable. Evaluate these two lists from CoinMarketCap, exhibiting all coins vs. mineable coins:

Why Can’t Ripple be Mined?

Mining is principally important within the case of fully decentralized cryptocurrencies, like Bitcoin. By remaining open to anybody with the required abilities and assets to mine, Bitcoin theoretically prevents any single entity from controlling the blockchain.

Not like Bitcoin, XRP is issued by Ripple, with most distributed servers associated to Ripple, thus rendering unbiased mining non-essential. In a lot the identical method as AMZN shares are issued by the Amazon firm, XRP was issued immediately by the Ripple firm somewhat than being mined into existence. The one solution to purchase Ripple is due to this fact to purchase or earn it.

Listed here are Some Ripple Fundamentals

Image: XRP

Present Provide: 39,245,304,677 (39 billion) XRP

Provide Cap: 100,000,000,000 (100 billion) XRP

Ripple Execs:

- Ripple transactions are extraordinarily quick, confirming inside seconds,

- Ripple can attain 50,000 transactions per second in throughput,

- The Ripple community requires no important electrical consumption.

Ripple Cons:

- The system can probably be shut down or altered by the state.

- Transactions happen on the firm’s discretion and could also be reversed or frozen.

What's the objective of Ripple?

Ripple is extra focused at enhancing the present banking system, somewhat than changing it. Ripple’s success due to this fact in the end depends upon acceptance by main banks and central banks. Nonetheless, according to Ripple themselves and NYT fintech journalist, Nathaniel Popper, they nonetheless have a protracted street forward of them, because the highly-conservative banking trade is unlikely to make the soar any time quickly

An extra level of concern is that Ripple remains unsupported by main American exchanges, in addition to Kraken. A Coinbase itemizing would most likely do so much for Ripple.

When you have any additional questions on getting maintain of Ripple, see our full information to the method, How to Buy Ripple in 3 Simple Steps. Hope this cleared a couple of issues about Ripple and about why it will possibly’t be mined.

The Historical past of Ripple

RipplePay was created by Ryan Fugger in 2004, 5 years earlier than Bitcoin’s launch, with the intention of changing banks. It allowed for peer-to-peer lending and funds however customers may default on obligations. RipplePay was an fascinating mannequin however didn’t catch on.

Impressed by Ripplepay, Jed McCaleb based the eDonkey file sharing community. McCaleb was additionally the creator of Mt. Gox. In 2011, the eDonkey staff started work on a cryptocurrency through which mining work was changed by social consensus (much like the method of recent cryptos like EOS). In 2012, McCaleb purchased out RipplePay and renamed the undertaking to OpenCoin.

OpenCoin applied the Ripple Transaction Protocol (RTXP) as a way to ship cash immediately and quickly between customers. Customs tokens, consultant of real-world property, had been made doable inside RTXP, elevating the query of XRP’s function. Financially-compliant Ripple Gateways, such because the Bitstamp alternate, handle the interchange between the RTXP community and different property. These Gateways shifted belief away from community friends to licensed monetary establishments.

OpenCoin performed a significant XRP giveaway in early 2013, awarding 1000 XRP to any BitcoinTalk discussion board person who requested it. This yr marked the purpose at which the present XRP asset was applied. OpenCoin additionally succeeded in elevating a number of enterprise capital funding in 2013. McCaleb left the corporate round this time and went on to create Stellar, which has similarities to Ripple. OpenCoin then modified its identify to Ripple Labs, shortening this to only Ripple in 2015.

Someday round 2013, Ripple pivoted away from being a transaction protocol for customers to being a specialised settlement community for banks. Ripple then added quite a few options to help compliance, akin to the flexibility to freeze person property. The primary financial institution to become involved was Germany’s Fidor Financial institution, adopted by America’s CBW financial institution. A number of different banks and fee companies have since gotten concerned within the Ripple undertaking.

Writer Replace:

This text has confirmed somewhat controversial and obtained some strongly essential suggestions. I’d like to deal with a few of the factors raised within the feedback part, that are additionally summarized on the XRP FUD Bingo web site.

Some clarification relating to the distinction between XRP and Bitcoin-like cash: Ripple makes use of HashTree somewhat than a typical blockchain. In response to Global Coin Report, HashTree is a “functional programming data structure that provides consensus to the ledger by comparing and validating the summarized data.” Whereas HashTree may be thought of a blockchain, it’s not thought of decentralized.

As for the existence of validators proving Ripple is distributed; whereas that's certainly appropriate, I wish to level out that as of the writing of this text there are solely 2 non-Ripple validators. One can create a customized checklist of non-affiliated validators, nonetheless, a Ripple shopper must obtain 5 keys from Ripple.com to function.

As for state censorship of the Ripple community, it’s asserted that that is unattainable as a result of Ripple is taken into account decentralized by many. whereas non-ripple validators support decentralization, they're recognized and thus topic to state strain.

With regards to the opportunity of freezing property, there may be a precedent for that. A few of Jed McCaleb’s XRP was frozen by Bitstamp on the behest of the Ripple firm.

In abstract, the target perspective on Ripple on this article largely accord with these of revered trade specialists, who’ve researched this topic in appreciable depth. As such, I don’t imagine these factors may be glibly dismissed as mere bias or FUD.

</div><script async src="http://platform.twitter.com/widgets.js" charset="utf-8"></script>

Exclusive offer GET 5 STEEM Airdrop

Join our Site and get 5 steem airdrop on your steem account. The Campaign has start for attract new user to use our service and mass adoption.

Get 5 STEEM NOW CLICK HERE