What was SegWit2x all about? (Should it really have been called off?)

I wrote this article a few weeks ago and had it stored on my computer waiting for the best time to publish it, but given that SegWit2x is not happening, right now is the best time I guess. Don't get me wrong, I'm very happy that the fork didn't come to fruition and the community was heard. It just goes to show the power of Bitcoin as a truly decentralized option and that nobody can come and tweak it to serve their own interests.

So, there was a lot of controversy surrounding the SegWit2x hard fork coming in mid-November. A lot of people raised their voices opposing this chain split. but why? if you are new to this space you might feel confused about this whole situation. You might be wondering, was this a good thing? Should I have given my support?

I created this article precisely for that reason. To inform the people who might not know what was happening but want to be involved in the community and have their say.

So let me start by explaining where this debate came from and why SegWit2x was (or not) necessary.

The problem with Bitcoin.

- Bitcoin is currently limited in the number of transactions it can process.

Bitcoin has a scaling issue, in that each block can carry a maximum of amount of data. If a block is 1MB, therefore 1,000,000 bytes and a transaction will use 495 bytes of data. Consequently, each block can handle around 2,020 transactions. A new block is mined every 10 minutes, thus 600 seconds which means that Bitcoin can process 3.37 transactions per second. If you compare this to PayPal which can handle 193 transactions per second and Visa which can handle 1,667 transactions per second you can see that Bitcoin must compete on these numbers.

- As all users pay a fee to miners to make transactions, this limitation on space has increased average fee costs.

Once a transaction is made on the Bitcoin network and has been validated by the nodes it sits in something called the memory pool also known as the "mempool". Think of this as a holding area for transactions where they wait here for a miner to pick them up and add them to a block to be mined. If when miners are adding transactions to a block, and it reaches its 1mb limit, then any other pending transactions need to wait in the memory pool until the next block.

The issue this causes is that when the blocks are filling up, the miners will increase their fees for including transactions within the block, and therefore it becomes a supply and demand bidding war for having your transaction included. What this means is that for small transactions (the old cup of coffee argument), either the transactions do not get picked up because the fee offered is too low or the fee becomes too high to justify the transaction.

What was SegWit2x?

On May 23rd, 2017, the Digital Currency Group published the New York Agreement (NYA). The New York Agreement was signed by a large number of Bitcoin companies and by miners representing over 80% of Bitcoin’s hashpower. The signatories of the agreement accepted a compromise called SegWit2x. This plan would call for the near-immediate activation of SegWit, and would follow that with a hard fork in November to double the block size. Basically, the whole purpose of the New York agreement was to avoid a chain split.

The real issue.

The block size increase from 1mb to 2mb was a problem for a lot of people.

People have expressed concern that raising the block size limit will mean fewer full nodes due to the increased data storage costs involved, which could dissuade users to operate full nodes and centralize the system around entities capable of handling bigger blocks.

Nevertheless, the real problem with SegWit2x was over who gets control over Bitcoin and its future development. Let me explain, the difference between this hard fork and previous hard forks (Bitcoin Cash and Bitcoin Gold) is that the people behind it wanted the resulting new chain to be called "Bitcoin". Obviously, there can't be two coins called "Bitcoin" at the same time! that's why there was so much controversy over this hard fork.

We all know that Bitcoin is the most valuable cryptocurrency of all. It might not be the best from a technical standpoint, but its the most well known and this gives it a huge amount of value.

Basically, people were calling this move a hostile corporate takeover of Bitcoin.

Necessary?

In the first place, I don't think increasing the block size from 1mb to 2mb is even necessary.

The current Bitcoin already has blocks larger than 1mb and you can easily find them, as high as 1.3 mb. SegWit is only about 10% to 15% adopted so far, when it reaches 100% we will be well over 2mb blocks. So why do we need to increase a block size that is already increased trough SegWit? This article explains a bit more on this point.

The people behind SegWit2x claim that the reason they are forking Bitcoin is to comply with the New York agreement, but wait, the New York Agreement was broken when Bitcoin Cash was created. Bigger blocks already exist. So what was the real motive for an unnecessary fork?

The word on the street is that they wanted to kick out the Bitcoin Core Development Team out of the project. They wanted to stop Core to continue writing the Bitcoin code because their vision is not aligned with their interests.

Let's remember that the Bitcoin Core devs are the guys who have been writing code for the Bitcoin network for the longest time. They worked with Satoshi Nakamoto. Nobody understands the code better than them. They care about keeping Bitcoin decentralized and secure.

On the other hand, we have the people behind SegWit2x (mostly miners) which don't care about network decentralization, in fact, they want to centralize the network to increase their profits.

To sum up, the way the Core devs want to scale Bitcoin will go in the way of miners profits.

The result.

Basically, after the fork there was going to be 2 coins called "Bitcoin". and was up to the community to decide what blockchain will be the real Bitcoin.

Some exchanges like Coinbase and Gemini have stated that the blockchain with the most accumulated hashing power (most people mining) will be the original Bitcoin.

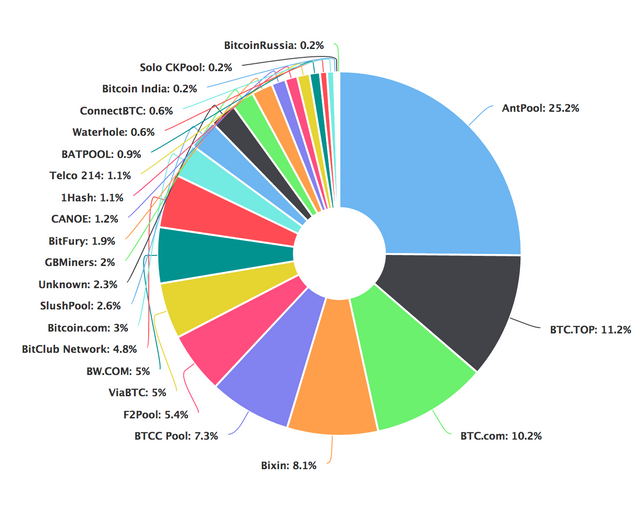

Almost everyone knows that Bitcoin mining is reduced to a few companies that control the majority of the hashing power. Most of this companies are also signatories of the New York Agreement.

When the chain split happened there was a high probability that these miners moved their hashing power to mine the new chain with bigger blocks, thus making this new chain the real Bitcoin for some people. Let's also remember that Coinbase is a huge middleman for introducing people into the crypto space. It just added a 100.000 thousand users in a single day.

So if the majority of hashing power moves to the SegWit2x chain and Coinbase keeps its word, all of these new people being introduced to the crypto space will be supporting the new chain (imposed by miners) without even knowing it. Where is the decentralization in that?

Thanks for taking the time to read this article guys ✌ I hope this information was useful to you. Please leave a comment below leaving your 2 cents on the subject (especially if you disagree), I'd love to read your thoughts!

Resteemed your article. This article was resteemed because you are part of the New Steemians project. You can learn more about it here: https://steemit.com/introduceyourself/@gaman/new-steemians-project-launch

Thanks for the explanation!