What percentage should you invest in each cryptocurrency? A guaranteed winning strategy (index updated 8/13/2017)

Investing in crypto is becoming a safer bet each year as Bitcoin and altcoins get older, improved and better established. We are still in the very early days of crypto and the opportunity to strike it rich is still within reach of most people provided they have access to the internet, modern banking and a little disposable income. However, which coins should you invest in and how much?

There’s so many of them, so much information, high tech jargon and amazing promises that sound like lies uttered by politicians. Every new coin is hyped, packaged and sold like the next CocaCola... They could all come crashing down but it’s very unlikely at this point that all coins crash to zero. Some of them will very likely make it big in the future but which one(s)?

The reality is, no one knows, whoever tells you they do, they are flat out lying, fooling you and themselves. This market looks very much like the early car industry in the U.S. in which thousands of brands appeared everywhere but most eventually went bankrupt and only a few succeeded in the long run.

So, how do I know which coins will succeed?

The simple answer is you DON’T. Trying to pick winners is very dangerous game that most people lose, those who don’t are demonstrably just plain lucky and end up losing everything the next time they bet big. The strategy that I’m introducing to you guarantees the winners come to you, rather than you pick them up.

How much money should I put in each?

This is a huge conundrum for most investors. With so many coins available and limited disposable income to invest it’s hard to distribute the funds in a sensible way.

Introducing the Millionth of Supply Passive Indexing strategy:

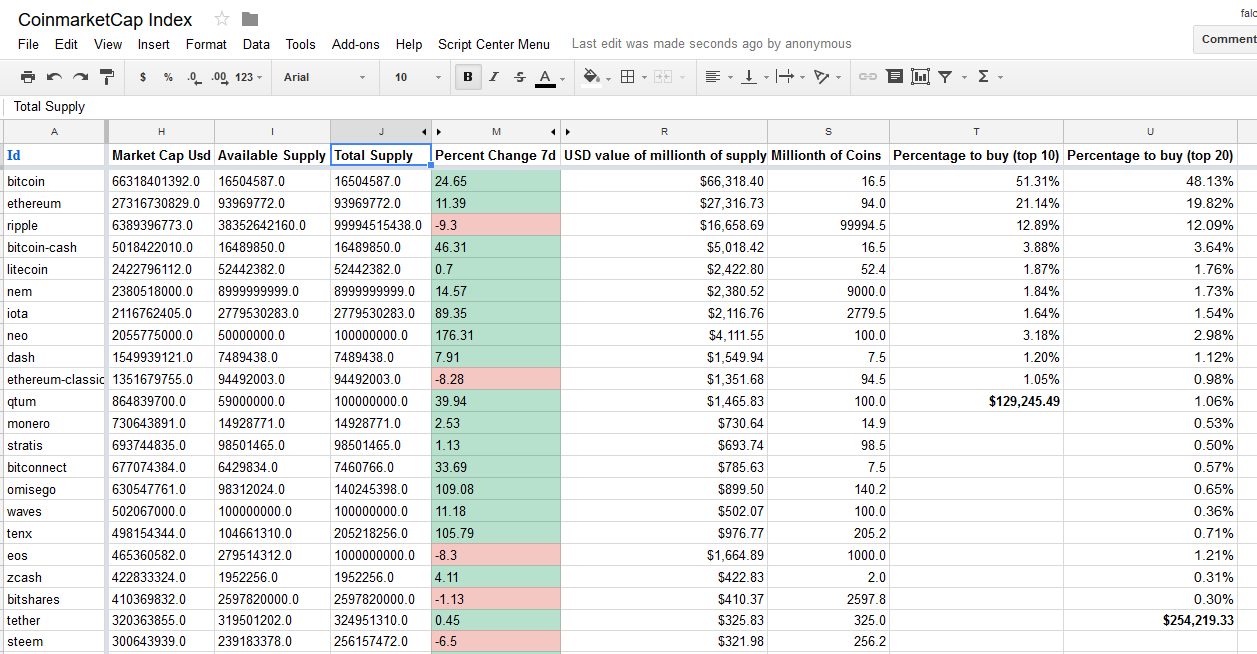

The following spreadsheet feeds from Coinmarketcap’s API and lists (or indexes) the top coins by market cap and daily trading volume. The coins at the top give you a pretty good idea of the current coins being favored by the market as of the day of publication of this post.

Download spreadsheet image showing USD value of millionth of supply and percentages to invest to own the top coins by market cap as of 8/13/2017. Follow @CryptoEagle for updates.

The goal of this strategy is to own a millionth of the supply of each of the top coins by market cap. This way you guarantee that if any of them succeeds in the future you will be part of the elite, the top 0.1 percenters and millionaires of the future. If any of the coins (or some of them) succeed(s) and become(s) a widely used reserve currency you will be guaranteed to own a millionth of its supply.

In columns T and U of the spreadsheet you'll find the percentage of funds you should invest based on market cap and the USD value of the millionth of supply of the coin. This is calculated by dividing the USD value of the millionth of supply by the total amount you should invest to own the top 10 or 20 coins.

It doesn’t matter if you invest $100 dollars every month or $100,000 at once, your goal should be to own the millionth of the supply of the top coins as soon as possible without spending any income that's not disposable to you. So, if for example, all you had is $100 dollars to invest monthly, you would invest this amount in each top coin according to the percentages shown, no more, no less. At the bottom of the columns is the total amount in USD you should invest to do this for the top 10 and 20 coins.

How rich will you be if you follow this strategy?

There are currently an estimated 10.5 trillion dollars in existence. If you owned a millionth of the supply of US dollars right now you would own about ten million five hundred thousand dollars. Just to give you an idea, in the United States alone, at end of 2016, there were 10.8 million millionaires, according to a study from Spectrem Group's Market Insights Report 2017.

There are approximately 18 million millionaires in the world according to the 6th annual Credit Suisse Global Wealth Index. This doesn’t even account for the disruption of other industries such as remittances, Gold as a store of value and many other new uses of crypto currencies that we can’t even dream of today. As an example, if Bitcoin overtook just 5% of the market cap of Gold, a single bitcoin would be worth approximately $24,000 USD.

But, “introduce any crazy coin name here” is so great, the technology is amazing, so exciting. It’s the future, my guts tells me!

Yeah right, the market doesn’t care about your hunches, white paper promises, or all those great technologies that people sell as the best thing since Coca Cola. Nope, only market cap, volume and related network effect can tell you what coin will end up being favored by the market.

You must re-balance every once in a while

About every 3-6 months you should take a look at this index and re-balance it. Follow me for updates to this post. If any coins dropped in market cap sell them and re-invest the money on the top coins until you own the millionth of their supply. If there are new coins in the list you should invest in them until you reach the goal as well, no more (over invest), no less (under invest). If you don’t do this you are risking missing the upcoming coins and keep investing in the long term losers.

Advantages of this strategy:

- You will be almost 99% guaranteed to become a multimillionaire by owning the top coins the market finally ends up favoring. You will certainly sleep like a baby!

- You can start investing with very limited funds and continue investing periodically. Even if you don't get to own the millionth supply of every top coin you'll be certain you did as best as you could with your limited resources.

- You won't over or under-invest in any particular coin and thus keep risks at a minimum.

- You’ll skip all the typical drama of investing in cryto. The Fear of Missing Out (FOMO), the Fear, Uncertainty and Doubt (FUD), the daily crashes, the pumps and dumps etc. will not rattle your nerves and send shivers down your spine every time they happen.

Disadvantages:

- This is a boring, long term, no feelings involved, passive strategy, you will not have the adrenaline rushes and enjoy or suffer all the crypto drama. Picking winners is reduced to a simple to follow probabilities game.

- There may be coins that gain 1000 percent in a few weeks that won’t show up in the index until their market cap grows to the top and which you will miss but, on the bright side, you’ll also miss the big losers, the suicide inducing and family wrecking crashes.

- There’s still the slight possibility (the 1% chance) that the entire crypto world is a huge bubble that will never work, the Internet could come crashing down after an EMP attack or a meteorite could strike earth... In which case we are all screwed anyways and should worry more about food and bullets to fight the zombies...

Tell me what you think of this strategy in the comments below. This is not professional investment advise. I'm not your financial advisor. Only invest money you can afford to lose!

Contact me for updates to the spreadsheet and for instructions on how to own it and update it yourself.

Happy crypto investing!

Well written and always interesting to see strategies of other investors.

The biggest risk with that strategy (like you mentioned yourself) I feel is that new coins like: iota, neo and omisego sky rocket into the top market cap. You would start to buy big after they had massive gains. The risk that those are coming down again is quite high. And if they are coming down you would tend to sell them for other coins who are now in the top market cap charts. I see that especially with certain trend which appear. Eg beginning of the it was private cryptos. But now you don't see much about pivx and zcash anymore. At the moment it is china/asia coins. Who knows where they are in 3-6 month. And if you look up who was in the top 10 market cap in 2016 a lot of them arent there any more.

Also regularly leveling leads to sell the winners.

But that are certain risks which you just habe to manage as onvesting always comes with risks. And I totally agree that you need to have an investment perspective on all the top market cap projects.

Hello famunger, thanks for your kind remarks. Missing the wonder coins is the price you pay for sleeping well, keeping your marriage and not dying young from a heart attack trying to pick winners ;). Also, rebalancing too often is a bad idea. I have to emphasize that in my post and will do it thanks to your comments. My best regards friend, happy investing!

Hello cryptoeagle

Thank you for your comment. I absolutely agree that rebalancing too often is a problem which too many are falling for.

I like the very strong mechanic in your approach helping to leave emotions out.

Nice post!

High quality article, I like it. Keep on sharing your thoughts, I always like to read about other peoples approaches!

Thanks cryptotem! I'm checking out your strategy as well, reestemed and will follow you for updates. I like your The 70% Core / 30% Play Money Approach. regards

You title the blog post a guaranteed winning strategy and end by saying don't invest more than you can afford to lose.

But I thought it was guaranteed? 😝

There's always the 1% chance Toria that all crypto goes to zero, unlikely but possible. You should never invest more than you can afford to lose in any situation, ever. Only death and taxes are guaranteed in this life. I'm glad you commented on the strategy, hope it's useful to you and reduces your risks to a minimum. Suggestions for improvement are always welcome! regards

In the future not even those will be guaranteed

See http://losthorizons.com for how to mitigate taxes, that is, if you don't work for government. Form 4852 is the key.

Thanks for this post as well, I like the strategy!

I like this strategy and it makes a lot of sense. However, I can see a parallel here to the way my 401k works.

When you are young and eager, and have years of investment in front of you, you can put your 401k funds into highly aggressive volatile investments for a chance at increased gains. But as you get older you want to look at the more stable, predictable, steady income streams.

It seems almost like the top 20 in marketcap are your steady gainers. Whereas the new coins are the highly volatile stocks that can boom or bust.

I would like to get to a point where I can allocate proportionately say 70% top market cap to 30% new coin with boom potential. This will give both the "can sleep at night" profitability of the top market cap, along with the thrill of the daily fluctuations of the newest currencies.

But maybe that is just my desire to get a little thrill of seeing something I bought go to the moon.

Nice article! Thanks @cryptoeagle.

I was discussing this topic (diversifying our crpyto portfolios for max gain) with a colleague at lunch today.

Definitely upvoted.

Interesting strategy and I'll be following you to keep updated on these spreadsheets you generate. I was wondering how you made the sheet, but read your reply that you have a script to do that. I've been keeping my own spreadsheet (with data laboriously entered by hand :-) and have used that to sort & rank those I'm watching. Your idea of ranking by "millionth of supply" makes sense. Good strategy and great article!

Hello longshot, I use a script called =ImportJSON() that you can import into Google Spreadsheets. Here's the github page: https://gist.github.com/chrislkeller/5719258

It requires a bit of programming knowledge but if you find it overwhelming don't worry, I'll publish updates to the spreadsheet regularly here. Actually, if you re-balance too often you are doing it wrong. You shouldn't be looking at the indexes too often, this is something very important I learned from reading Ben Graham and Warren Buffet's books.

BTW, great name :)

Jeez! Sometimes I HATE this "Reply" function! I just spent close to an hour writing you back but hit "Reply" again (instead of "POST") sending my work into the void off the blockchain! At LEAST it wasn't crypto!

As to my avatar, "Longshot": I figured it'd be a "longshot" if I ever made enough money doing this blogging stuff to pay for my eventual retirement! 😉

I've never used Google Spreadsheet before, preferring to use LibreCalc installed on my Linux machine. I don't expect it'd be too different, and possibly importable, but I don't know.

Anyway, I have a couple of questions for you if you feel like answering: I see where you derive your values in columns R & S from columns H, I & J, but I wonder how you arrived at the calculations for T & U, "Percentages to Buy" (both Top 10 & Top 20)? And what determines your percentages for those allocations?

I KNOW I may be asking the magician to reveal where the rabbit is hid here (heh-heh) ~ And if you'd prefer to reveal all these secrets in successive posts I can't fault you for that. I will be following in hopes you post your tracking results of this system as I suspect they'll be quite profitable.

Again, thanks for answering and keep up the good work!

PS: NEVER reply after typing a reply by hitting "Reply"! (Argh!)

Hello cryptoeagle thanks for this information concerning a strategy to use on investing it's very much needed.

Great article, thanks for sharing your thought, I'm still on my early steps but I have already decided that I will do something similar, every month I will divide the amount of money that I wanna invest on different cryptos using a similar strategy .

I would like to get updates of your sheet and numbers though.

Hello akramf11, I'll be publishing updates to the spreadsheet regularly here. Don't re-balance too often, that's not a good idea. Congrats on going with a passive indexing strategy rather than the typical craziness outhere of trying to pick coins. regards

you are so right! BUY BULLETS AND LONG TERM STABLE FOOD!!!