What has more predictive power for Bitcoin's price? Supply, Google trends, or Tether

After writing my article on Tether's manipulation and influence on Bitcoin I began to wonder if there were other factors that have predictive power on Bitcoin's price. There were a few choices and one I still need to add (as soon as Twitter gives me access to their API). But the ones I was able to get most easily were google trends, Bitcoin's supply, and the supply of Tether on the market. I gathered data going back to 2015 and up to the first of the year.

With these things I ran a regression and tried to determine which ones had the best predictive power.

First though I decided to graph some of the data points with price to get an idea of what we might expect from the analysis.

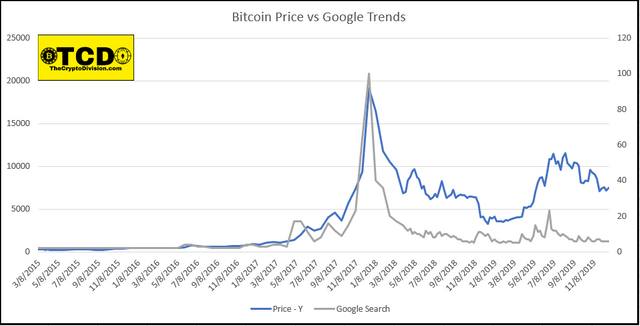

Bitcoin price vs Google Trends:

Here we can see that google trends might have a slight predictive power in comparison to Bitcoin's price. It certainly has a fairly high correlation with a 0.6 or a positive correlation of 60% with Bitcoin's price.

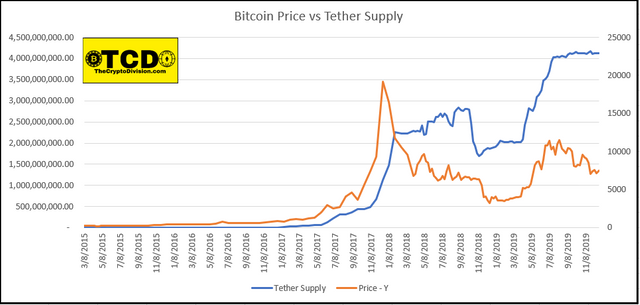

Tether's supply and Bitcoin's price:

Here we can see that Tether's supply increases seem to be a lagging indicator or maybe they rise to support Bitcoin's price? as the rises seem to happen after or during a price fall, up until the boom. Then after the boom Tether's authorizations seem to more or less mimic Bitcoin's movements. Tether has a greater correlation with Bitcoin's price at 81%. But the final question is graphing Bitcoin's supply against the price.

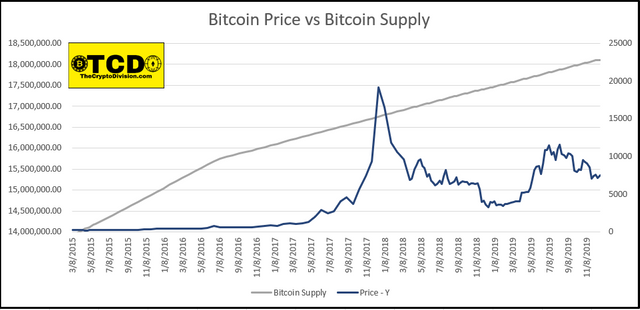

Bitcoin's price vs the supply:

Yep, not too terribly interesting. But economic theory says that supply should play a role in price so we should be including it within our regression to see if there's any predictive power. Bitcoin's supply has a 16% correlation with it's price. So, we kinda expected this, as there are some theories that say the halving won't impact the price at all. With such a low correlation and no real visual correlation it's probably safe to say there's no predictive power with Bitcoin's supply. But lets run a regression and see for sure

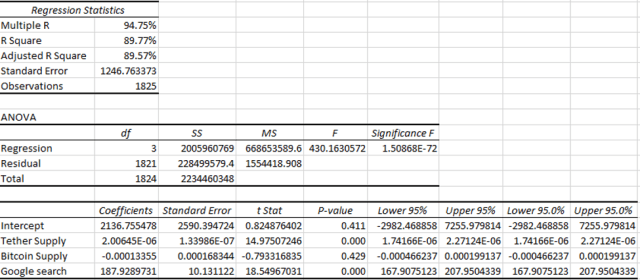

The Regression:

Looking at this, my regression isn't too bad. our chosen variables explain 89.57% of the variation in the price of Bitcoin - meaning Tether, Bitcoin's supply, and Google trends explain 89.57% variation in Bitcoin's price after adjusting for the amount of variables present. The difference between R-square and adjusted R-square mean that I likely don't need to remove any variables since it's such a small different - although I could probably remove Bitcoin's supply.

The reason I could remove it, is because the p-value is so high (and the T-value is so low). Both tell me that it's significant and adds no real value to my regression. However, we should leave it in because economic theory dictates as such, since price is impacted by quantity.

Next we see that Tether's supply has a T-Stat of 14.97 which is quite high and it's significant at the 99% level too (noted by the p-value). That means it's significant at the 99% level and has predictive power on Bitcoin's price. In our regression here we can see that for every one dollar (or tether) that is issued Bitcoin's price increases by 2.00645E-06 or $0.00000200645.

Next the other significant variable in our regression is Google trends. It has a T-Stat of 18.54 and a p-value of, well basically zero. That means it's significant at the 99% level and has predictive power on Bitcoin's price. In our regression here we can see that for one percent google trends increases (it's a relative rating) Bitcoin's price increases by $187.928.

Summary:

So in other words, the variables that have predictive power on Bitcoin's price are Tether's supply with a slight positive correlation and google trends (more like people searching for the word Bitcoin, on google) with a fairly significant boost to just 1% in searches. a $187.928 increase in Bitcoin's price is about a 1.83% increase in it's price. So, if you aren't including both tether supply and google search trends into your trading model, you're doing something wrong. Next I'll take a look at twitter data too - when I get access. But if you haven't taken a look at my Tether article, I'd recommend that. I go through some studies produced by academics on the impacts of Tether on Bitcoin.

Disclaimer and Author's Bio:

Kendon started TheCryptoDivision in 2017 in order to help people understand cryptocurrency/finance and learn about the unique opportunities in the cryptocurrency world and in the financial world. Kendon is an economics graduate from BYUI. He worked for an investment bank in the foreign exchange department.

If you haven't invested in cryptocurrency yet, Kendon recommends using Coinbase as a good jump start. Invest $100 dollars into Bitcoin and you'll get another $10 dollars’ worth of Bitcoin for free using the coinbase link.

Kendon recommends trying to fight the fed's devaluation of your dollars by using SoFi's free banking and getting around 2% on your checking accounts. You'll also get a free 25 dollars.

The author gets support/income for this website by donations, using affiliate marketing, google ads, and a shop on his website. But he has never taken any financial compensation for any research or post. This is not meant as financial advice.

If you want to get into contact with me, DM on Twitter, follow on facebook or follow on the crypto-social media platform steemit or email [email protected]

Learn more about cryptocurrency If you have liked the content and feel like supporting the page, anonymously, feel free to donate:

Bitcoin Wallet: 31xJ7rmDTD5TSS62wg5ipg2Nv6RvMPoXmN

Eth Wallet: 0x641a67147FE99E438F74cD868a4C8D97adFf51b2

Monero Wallet:

4262AwLVeLwVem8JNzLuQ73kjdjRJEpSygyGncSwnWZsCXC7v4a9WtvhTZopoJBeF8f5Z3SMyHUArHrpssobJbJU972137B

Follow me on:

Website: http://www.thecryptodivision.com/

Twitter: https://twitter.com/CryptoDivision

Facebook: https://www.facebook.com/TheCryptoDivision/notifications/

Steemit: https://steemit.com/@cryptodivision