Bitcoin Manipulated, First by Willy and Markus Bots, now by Tether

Tether, since it’s inception in the cryptocurrency world has always sparked a fair bit of controversy and conspiracy theories. But the two main, and recurring themes of them, are that Tether is not backed by 100% of it’s assets and it heavily influences the crypto markets. Fortunately, one of those claims is easily proven true. And the other one, is harder to determine.

100% backed or only 26% fraud?

For a very long time, on the Tether website, had the following statement:

But this was back in March 14, 2019. More recently Tether has changed it’s tune after a lawsuit revealed, that in fact, it is not backed by 100% USD. Indeed, only 74% of Tether (USDT) is backed by cash. After this revelation by the courts Tether changed the 100% backed to this:

Further you can see the reserves here.

However, even with the updated transparency page on the website, it’s still not clear why the courts found something different than what is on the website. Nor do they provide a breakdown of the assets they are using to count against the liabilities. Either way, we can be sure that they are not 100% backed by straight cash.

Tether’s Influence on the Cryptocurrency Markets

But, in my opinion, the most interesting question is not really the backing (although, that’s important for other reasons), the important question is:

What impact does the issuing of new tethers has on the marketplace?

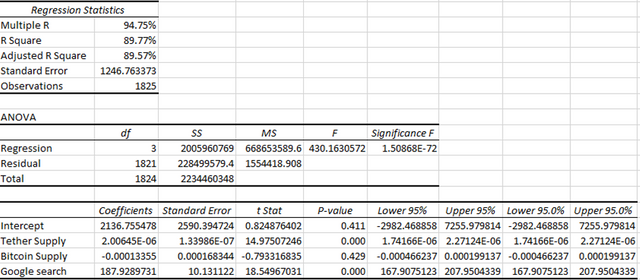

To begin my research I started collecting some fairly simple data to explore the issue. I created a regression model using Tether’s supply, Bitcoin’s supply, and Google trends data to produce a model.

The results are fairly surprising. First the most important thing is that both Tether’s supply and Google trends (or search volume) have a significant impact on Bitcoin’s price. Oddly, it’s more significant than Bitcoin’s supply. Which implies that the halving won’t do a whole lot for Bitcoin’s price.

But here we can see that for every Tether issued we should see a $0.000002 increase in Bitcoin’s price. So clearly Tether’s impact has SOME impact on Bitcoin’s price. However, this is over the past 5 years, averaged over the entire course of it’s existence (well since 1/11/2015, I collected daily data since that date on the above three variables). Wouldn’t it make since for Tether to potentially have a greater impact in the market if, say, it was timed well or right before/after major market moves?

The Timing of Tether

Fortuatenly, there are two well done studies produced by others into this subject – one was published this last October and the other was published in January of 2018.

Lets first touch on the second report. The summary says that Tether’s printing moves the market “printing moves the market appreciably; 48.8% of BTC’s price rise in the period studied occurred in the two-hour periods following the arrival of 91 different Tether grants to the Bitfinex wallet.” And “If there is questionable activity, the author believes a 30-80% reduction in BTC price could be forecast.” The author of TetherReport.com wished to remain anonymous but claims that given the unusual timing and statistically significant outliers of both timing and price increasing, that Tether is not demand pulled (meaning driven by market conditions rather than natural investor influx) and has large positive price impacts.

The findings are similar for the more recent article. They test both a demand pulled hypothesis (Tether driven by investors) and a supply pushed hypothesis (Tether produced due to market events). What they find is interesting.

The answer is: they found price manipulation

“More-over, Columns (3) and (4) show that the effect exists only after a negative shock to Bitcoin prices. Finally, Column (5) shows that the effect is even stronger with 8.13 basis points increase in returns when conditioning on both Tether authorization and a lagged negative return.”

Interestingly, or maybe not interestingly, they found that after Tether supply increases happened the effects were only felt on the bitfenix market place. Further, they also studied Tether printing on the six other leading cryptocurrencies:

“We also examine whether the effect related to Tether printing spills over into the six leading cryptocurrencies listed on Tether-related exchanges. The effects are generally larger across all coins when conditioning on both days after Tether authorization and following a negative return. For the equivalent of a 100 Bitcoin increase in the flow, the average future return goes up by 7.89 to 10.19 basis points for different coins”

Further, they found that the hours with the largest Tether printing – representing 1% of all the instances they studied – had a significant positive impact on prices.

“the 1% of hours with the strongest lagged Tether flow are associated with 58.8% of the Bitcoin buy-and-hold return over the period”

Meaning, (as they lagged the Tether flows between Bitfenix wallet) that if you had purchased Bitcoin during the 1-3 hours after Tether authorization you’d see, around a 58.8% return. They run multiple models testing the assumptions on timing and returns. And even with the lower volume Tether authorizations there is still a relatively high, 30%+, return to the buy and hold strategy over those periods.

“Overall, the findings indicate that a large player moves Tether out of Bitfinex in exchange for Bitcoin in such a way that she/he would either have to exhibit extreme market timing, or much more likely and consistent with the price impact literature, have a large price impact on Bitcoin price.”

Tether Summary:

In other words, if you are building a trading model for personal use, and it doesn’t include when Tether authorizations happen, you’re missing a VERY important data point that harms your returns. At least, that’s the impact of all this literature for the average investor/trader. The other point is for both investors and policy makers, the space is still ripe with manipulation and fraud.

Ever since Mt.Gox collapsed back in 2014, revelations have came about how Bitcoin and the cryptocurrency market is widely manipulated – first by bots (R.I.P. Willy and Markus) in Mt.Gox case – and now by unbacked Tether printings.

The ironic thing is, now with more stable coins being produced Tether might have less impact than it initially did. Although, because Bitfinex and Tether are big players in the market place, I could easily see other stable coins banning together to manipulate the price – but only time will tell.

The take way is that, yes Bitcoin is (still) manipulated and investors have been lied to. Be careful out in the crypto markets as it’s a scary place. Tether is probably responsible for around half of Bitcoin’s price increases and it certainly is more supported by influxes of “money” during bear markets.

Disclaimer and Author's Bio:

Kendon started TheCryptoDivision in 2017 in order to help people understand cryptocurrency/finance and learn about the unique opportunities in the cryptocurrency world and in the financial world. Kendon is an economics graduate from BYU. He worked for an investment bank in the foreign exchange department.

If you haven't invested in cryptocurrency yet, Kendon recommends using Coinbase as a good jump start. Invest $100 dollars into Bitcoin and you'll get another $10 dollars’ worth of Bitcoin for free using the coinbase link.

Kendon recommends trying to fight the fed's devaluation of your dollars by using SoFi's free banking and getting around 2% on your checking accounts. You'll also get a free 25 dollars.

The author gets support/income for this website by donations, using affiliate marketing, and google ads. But he has never taken any financial compensation for any research or post. This is not meant as financial advice.

If you want to get into contact with me, DM on Twitter, or follow on the crypto-social media platform steemit or email [email protected]

Learn more about cryptocurrency If you have liked the content and feel like supporting the page, anonymously, feel free to donate:

Bitcoin Wallet: 31xJ7rmDTD5TSS62wg5ipg2Nv6RvMPoXmN

Eth Wallet: 0x641a67147FE99E438F74cD868a4C8D97adFf51b2

Monero Wallet:

4262AwLVeLwVem8JNzLuQ73kjdjRJEpSygyGncSwnWZsCXC7v4a9WtvhTZopoJBeF8f5Z3SMyHUArHrpssobJbJU972137B

Follow me on:

Website: http://www.thecryptodivision.com/

Twitter: https://twitter.com/CryptoDivision

Facebook: https://www.facebook.com/TheCryptoDivision/notifications/

Steemit: https://steemit.com/@cryptodivision

Congratulations @cryptodivision! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!