Crypto Blood Bath 2.0 Obliterating Ethereum based AltCoins & ICO Mkt as SEC Issues Report U.S. Securities Laws May Apply to Offers, Sales, and Trading of Interests in Virtual Organizations

Here we go again friends, the Crypto Roller Coaster, named FUD(Fear Uncertainty Doubt), departs landing;

"Ladies & Gentlemen Please Keep Your Arms & Legs Inside the Ride At All Times!"

Full SEC report below. Basically they claim to have jurisdiction over one of the hottest new areas of FinTech based on blockchain technologies which has recently exploded in creation of new coins developed predominately on the Ethereum network and open source code. These new coins marketed with assistance of Crypto Venture Capitalists, the same who fund application development for Apple Android or PC platforms. The business plan pitched for cash to establish some sort of stand up operation with future developments tranche'd depending upon total funds raised. These new ventures were even grouped collectively and became initial coin offerings of digital currencies. ICO's indeed very closely fit the established model regulated by SEC under securities laws for Initial Public Offering of a new equity that begins trading on stock exchanges.

Companies that raise money through the sale of digital assets must adhere to federal securities laws, says the SEC report released Tuesday. ICO developers must register their new coins with the government. The SEC also included exchanges that offer trading of these Altcoins including Ethereum itself, since almost ALL of these new ICO's required Ethereum as payment for the funds raised to support the individual business plans.

Very interesting that The SEC decision comes a day after the U.S. Commodity Futures Trading Commission gave LedgerX LLC approval to offer options trading based on bitcoin. That could help mature the business of bitcoin trading by helping traders offset risks with derivatives. But it also underscored the fact that digital currencies, decentralized technologies that appeal to the libertarian-minded, probably cannot escape governments.

So why the bloodbath in altcoins? After recent ascent by Bitcoin above the $3000 USD level, we witnessed a pull back. This frenzied interest in these new ICO's had reached full fury. So an exacerbated drop in Bitcoin was accompanied by a rise in Ethereum to $420 interday, before liquidation brought back down valuation to high $300s where it held steady for maybe a week. The very requirement that the new ICOs except Ethereum only made for an artificial run on supply outstanding. Each new ICO seemed to dwarf previous in amounts of funding raised. Readers of this information should be familiar so won't waste further report on this point (it can be researched easily by search) Ultimately problems arose as the huge amount of Ethereum collected which artificially restricted supply had to be dumped on mkt by individual coin developers as cash needed to actually pay for equipment, key coders, etc. in order to get business plan started. All this aforementioned became so crazy this process labeled Wild Wild West. I've omitted additional trading carnage due to fact that successful Crypto traders akin to day trading stocks when that craze blew up, really had no idea what they were doing nor the economics behind this process. After a few years of Crypto going either sideways or straight up, traders developed false senses and to make entire process as risky as possible the bought into margin trading (positions based on loans from exchanges which have to be paid back immediately if prices fall). Of course their first education in margin liquidation was very costly. During the last month Wall Street sharks who set up these exchanges literally stripped years of gains, enough to buy fleets of Lambos, away from these very cocky know it alls, who had only experienced Gains, away from most of them in less than 10 days! Obviously this Wild West scalping as well as the entire charade brought forth by Crooked Crypto Capitalists created the SEC response.

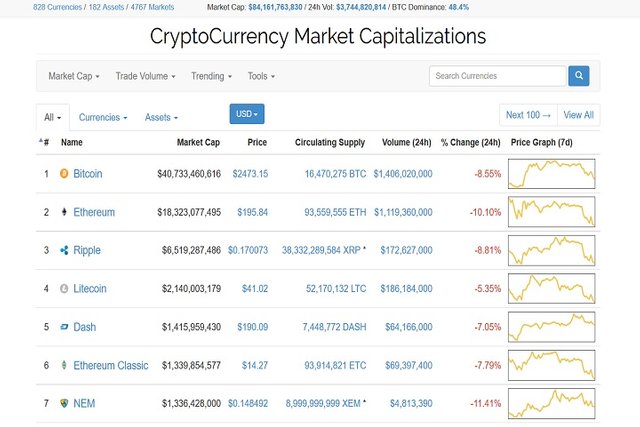

At time of this blog, the Total Cryptocurrency Market Cap is plunging back down currently ~$85 billion. Interesting that Bitcoin has, the highest 68+% of this mkt, influence on total as any time including when this measure reached a peak ~$120 billion. This means, that it is the smaller altcoins experiencing the Blood Bath. Before, everyone witnessed what happened to Bitcoin followed in altcoin space, this time it is clearly the altcoins being liquidated.

Complicating this occurrence is the upcoming Bitcoin forking Uncertainty. Not really part of this discussion but most readers will be aware that exchanges will have to cease Bitcoin trading pending outcome of final determination of exactly what will be happening to Bitcoin as we knew it. Therefore many had held false hope that Ethereum would see it's day again as without Bitcoin available in trading mkts. This report seems very strategically placed to wreck havoc upon the Ethereum based altcoins and it's working!

Ultimately the report could be very positive for Bitcoin and Litecoin as well as these came to be as alt currency without the "road show" fund raising in a different alt currency and other nuances but basically that in itself seems to escape this new SEC scrutiny. When Bitcoin returns to public mkt place, it should immediately regain past dominance as will Litecoin and most of the top valuation Cryptos with exception of Ethereum which is going to be decimated by this scrutiny. This isn't an analysis for trading, ALL Cryptos will have to wade through an entirely new level of risk! Remember too that the SEC has no direct effect in many nations around globe. Even neighbor Canada has already been on record allowing their public to involve them selves as they see fit without Fear of Canadian Government interference with their personal business affairs!

Wild Wild Ride ahead.

Comments please?

(Full SEC report)

U.S. Securities Laws May Apply to Offers, Sales, and Trading of Interests in Virtual Organizations

FOR IMMEDIATE RELEASE

2017-131

Washington D.C., July 25, 2017—

The Securities and Exchange Commission issued an investigative report today cautioning market participants that offers and sales of digital assets by "virtual" organizations are subject to the requirements of the federal securities laws. Such offers and sales, conducted by organizations using distributed ledger or blockchain technology, have been referred to, among other things, as "Initial Coin Offerings" or "Token Sales." Whether a particular investment transaction involves the offer or sale of a security – regardless of the terminology or technology used – will depend on the facts and circumstances, including the economic realities of the transaction.

The SEC's Report of Investigation found that tokens offered and sold by a "virtual" organization known as "The DAO" were securities and therefore subject to the federal securities laws. The Report confirms that issuers of distributed ledger or blockchain technology-based securities must register offers and sales of such securities unless a valid exemption applies. Those participating in unregistered offerings also may be liable for violations of the securities laws. Additionally, securities exchanges providing for trading in these securities must register unless they are exempt. The purpose of the registration provisions of the federal securities laws is to ensure that investors are sold investments that include all the proper disclosures and are subject to regulatory scrutiny for investors' protection.

"The SEC is studying the effects of distributed ledger and other innovative technologies and encourages market participants to engage with us," said SEC Chairman Jay Clayton. "We seek to foster innovative and beneficial ways to raise capital, while ensuring – first and foremost – that investors and our markets are protected."

"Investors need the essential facts behind any investment opportunity so they can make fully informed decisions, and today's Report confirms that sponsors of offerings conducted through the use of distributed ledger or blockchain technology must comply with the securities laws," said William Hinman, Director of the Division of Corporation Finance.

The SEC's Report stems from an inquiry that the agency’s Enforcement Division launched into whether The DAO and associated entities and individuals violated federal securities laws with unregistered offers and sales of DAO Tokens in exchange for "Ether," a virtual currency. The DAO has been described as a "crowdfunding contract" but it would not have met the requirements of the Regulation Crowdfunding exemption because, among other things, it was not a broker-dealer or a funding portal registered with the SEC and the Financial Industry Regulatory Authority.

"The innovative technology behind these virtual transactions does not exempt securities offerings and trading platforms from the regulatory framework designed to protect investors and the integrity of the markets," said Stephanie Avakian, Co-Director of the SEC's Enforcement Division.

Steven Peikin, Co-Director of the Enforcement Division added, "As the evolution of technology continues to influence how businesses operate and raise capital, market participants must remain cognizant of the application of the federal securities laws."

In light of the facts and circumstances, the agency has decided not to bring charges in this instance, or make findings of violations in the Report, but rather to caution the industry and market participants: the federal securities laws apply to those who offer and sell securities in the United States, regardless whether the issuing entity is a traditional company or a decentralized autonomous organization, regardless whether those securities are purchased using U.S. dollars or virtual currencies, and regardless whether they are distributed in certificated form or through distributed ledger technology.

The SEC's Office of Investor Education and Advocacy today issued an investor bulletin educating investors about ICOs. As discussed in the Report, virtual coins or tokens may be securities and subject to the federal securities laws. The federal securities laws provide disclosure requirements and other important protections of which investors should be aware. In addition, the bulletin reminds investors of red flags of investment fraud, and that new technologies may be used to perpetrate investment schemes that may not comply with the federal securities laws.

The SEC's investigation in this matter was conducted in the New York office by members of the SEC's Distributed Ledger Technology Working Group (DLTWG) -- Pamela Sawhney, Daphna A. Waxman, and Valerie A. Szczepanik, who heads the DLTWG -- with assistance from others in the agency's Divisions of Corporation Finance, Trading and Markets, and Investment Management. The investigation was supervised by Lara Shalov Mehraban.

Further SELLing during USA trading hours until midday turn and early afternoon reversal (see another blog post). At this reply, BUYing coming in very early for Asian exchanges but they control reversal presently with Litecoin and Dash posting largest gains for the Top MKt Cap Cryptos.

Bitcoin making return run to $2888 072817