Forecasting Bitcoin Price in 2018 using Monte Carlo Method

This post would describe regarding my calculation result in forecasting Bitcoin price in year 2018. Actually, I'm really curious in Bitcoin investing, and my purposes in this research are to investigate the possible moderate prices to enter and exit the market (buying and selling bitcoin). I prefer to calculate the projected prices using Monte Carlo Method, since the market movement is considered random.

-Assumptions-

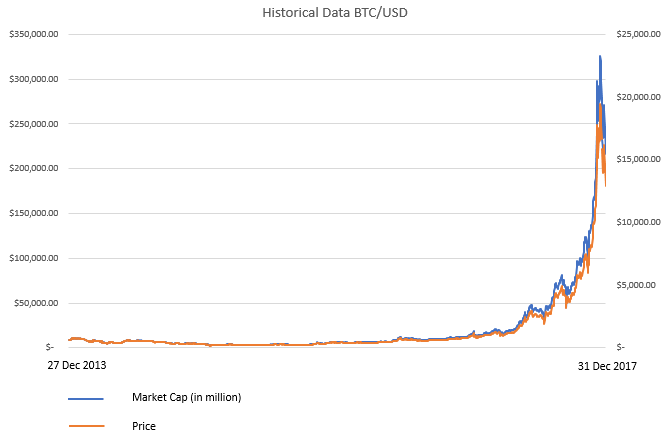

There are several assumptions in simulating the projected prices. First, I assumed that the circulating supply is similar to total supply. So, the circulating supply would be assumed as linear time series function, and it is limited to 21 million BTCs (BTC maximum supply) until it is in steady state phase. Second, I assumed that all market activity both buy and sell would follow Central Limit Theorem (CLT). So, I prefer to adjust all random activity with Normal/Gaussian Distribution Function.

1. Basic Equation

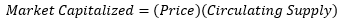

The basic equation for simulation is derived from Market Cap equation, as you could see in here.

to simplify, the above equation would be transformed into :

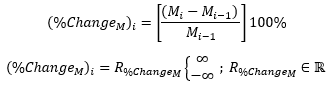

In this case, Market Cap would be defined as random variable which is unlimited positive real numbers from 0 to infinite. We know that the major factor which is affecting the prices of BTC is its Market Cap Changes. So, we have to simulate the Market Cap Changes that have random behavior. Hence, the equation would be transformed into :

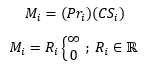

According to the aforementioned assumptions, Circulating Supply would be assumed similar to Total Supply of Bitcoin. Total Supply of Bitcoin would be simulated as linear time series function.

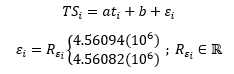

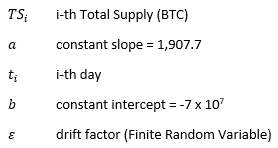

Note :

2. Random Walk Model

Since the Market Cap is assumed as Random Movement (it could increasing or decreasing as the time goes by), we have to simulate the Market Cap randomly. In order to build a proper simulation, we have to know the increasing or decreasing changes from certain timeframe (eg. daily, monthly or annually). In this simulation, I utilized the daily timeframe for simulating Random Model.

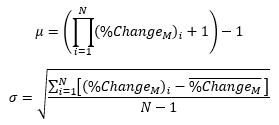

All random activity would be assumed in accordance with Normal/Gaussian Distribution Function. So, we have to calculate the mean and standard deviation of Market Cap Changes.

Note :

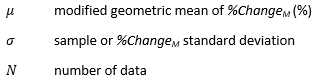

Last, we could forecast the next day Market Cap Changes by putting those variables into the Inverse Normal/Gaussian Cumulative Distribution Function equation.

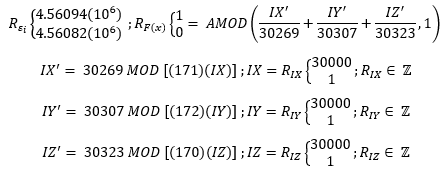

In this simulation, Pseudo Random Number Generator (PRNG) would be utilized to generate randomness in possible market movement. The basic algorithm would be described in the following equations.

Note :

According to the above Random Number Generation, Random Movement could be visualized using bitmap as seen below (only 5 steps random movements).

This randomness would be utilized to forecast possible market activity in our simulation.

3. Data Collection and Simulation

- Data Collection

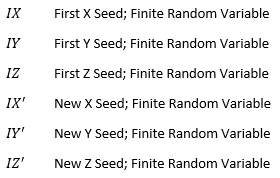

Before building a simulation, we have to collect historical data in order to have relevant behavior for the simulation itself. I have collected daily historical data of BTC/USD pair, exactly from 27 Dec 2013 until 31 Dec 2017. It consists of Market Cap Data and Weighted Average Price Data, while the Circulating Supply Data would be adjusted to the aforementioned equation as linear time series function.

- Simulation

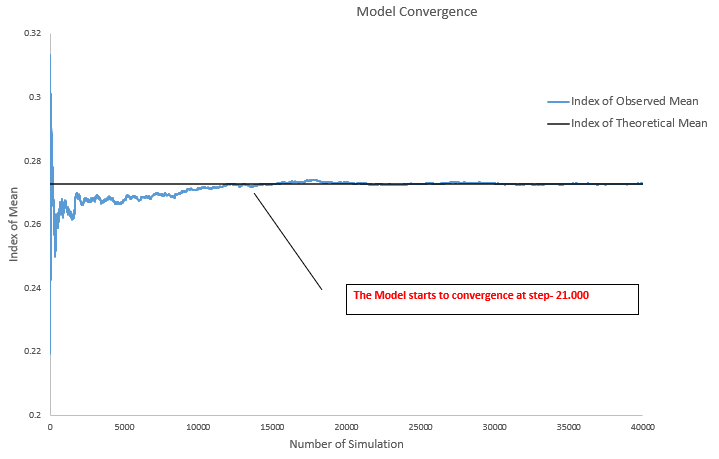

The simulation would consist of 40.000 steps due to convergence matter and iterative calculation would be performed from 1 Jan 2018 until 31 Dec 2018. Below, I have attached a video of simulation, however I only show it from 1 to 300 time-steps. Actually, the simulation should run at least 21.000 steps to achieve convergence and I have ran the simulation until 40.000 step as seen in the model convergence chart.

4. Conclusion

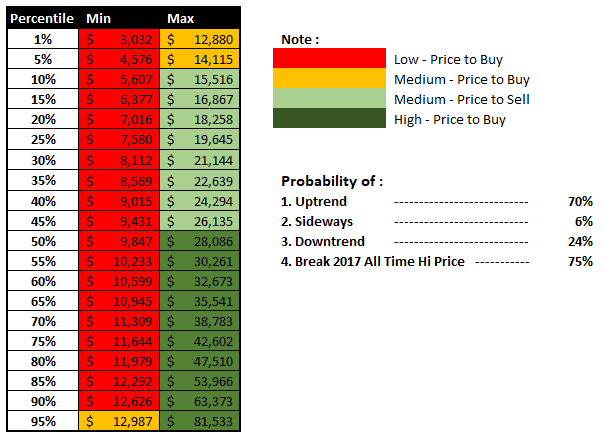

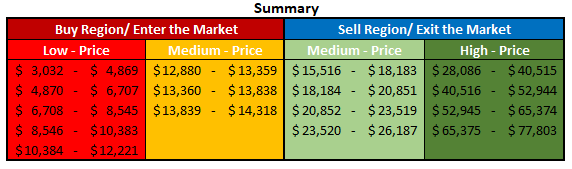

After finished the simulation, next we could calculate percentile values from the simulation result and the probability of trend projection for 2018. Those prices would be a benchmark for me to buy/sell my bitcoin in 2018. I have summarized them in a table as attached below.

-Enclosure-

I am not a financial or trading advisor, I am just an ordinary engineer who have interest in cryptocurrency. By posting this result to steemit, I just want to share what I have done in my leisure time. I do not enforce you to trade or investing in my way. Every people has their decision and unique trading way. Thank you for reading my post. Enjoy your crypto!

BTC : 1KZQipWvGBL6PijbeE1QEGMDpe18U9zJkY

ETH : 0x9f7d072e407d2f79ea165a02b38c8d05d1fcd3d2

Nice post! Keep up with posting this astounding material.

Thank you! Actually, this is my first post on steemit. I hope this is helpful for all steemit members and readers.

Excellent post, I worked in my final Master Project using Arima and RNN-LSTM, the last one produce good forecasting, I only made prediction for one month.