Double Bubble Analysis: update

.gif)

‘Those who cannot remember the past are condemned to repeat it.’ - George Santayana (1863 – 1952)

It’s been a pretty brutal week again, with bitcoin threatening to retest that recent low, just beneath $6,000. In the event, the low was $6,427, and we have seen a sharp bounce of $1,000 in recent hours. The Death Cross occurred, as expected, but doesn’t seem to have dented the market much (as we warned, it’s not a great indicator for bitcoin).

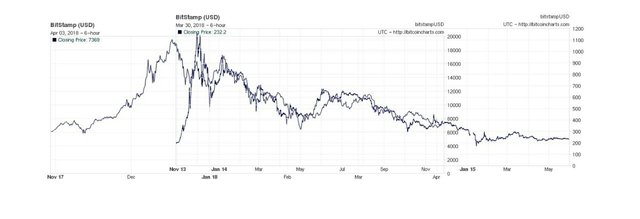

We wanted to come back to the analysis we first posted three weeks ago, because – so far, anyway – it continues to play out like clockwork. We’ve updated the chart that superimposes the aftermath of 2013’s bitcoin bubble with the aftermath of 2017’s bubble, below:

So let’s take a closer look and draw attention to a few points.

The correlation is close – freakishly close. We don’t have a good explanation for this, other than that human psychology remains the same. However, the degree to which specific bounces and brief rallies match within the overall downtrend is staggering.

The timeline remains the same: the pace of decline this time is around three times as fast as last time. What took well over a year from the 2013 high will take less than 6 months in 2018. Assuming that everything continues to play out on this timescale, we’ll be done in another month.

If that happens, then the beginning of May will offer some exceptional bargains for bitcoin.

Before that, we might well get a brief rally back above $8,000 before the falls continue.

However, we need to sound a note of caution: whilst the main part of the downtrend matches extraordinarily well, the beginning does not. The run-up in price was faster in 2013. It’s fair to expect the model to come unstuck at the end as well. The past is not a bad predictor for the future, but it’s not perfect!

The ‘capitulation’ candle on 6 February raises a question about where the Double Bubble model will cease to be useful. That day saw unprecedented trading volumes and a very convincing floor put in. $6,000 will be a tough nut to crack. It’s possible that was the bottom – and that yesterday’s fall to $6,400 confirmed that. Unfortunately, we will only know for sure in hindsight.

If the model holds to the end (and that’s a big ‘if’ for the reasons above), we can expect a brief low around $4,000, a return to $6,000 and a period of stability before the next move upwards.

The immediate picture for bitcoin will become a lot clearer over the next month or so. We believe that patience and cool thinking will pay extremely well at this point.

Red hot news, scorching wit and searing opinion pieces from Crypto Inferno.

Join us on

Telegram: https://t.me/crypto_inferno

Reddit: https://www.reddit.com/r/CryptoInferno/

Twitter: https://twitter.com/CryptoInferno_

Facebook: https://www.facebook.com/CryptoInferno/

In the first place, it don't matter actually , if you're a long term investor it's always a good news to you, and if you're a short term investor it's a bad news for you.

Long term investors have nothing to worry about, obviously. This, just like in 2014 is the time to be buying. Soaking up from the impatient ones. Bitcoin will be going sideways again before bubble number 5.

I agree short term investors are going to have to wait...multiple months, unless you are shorting bounces ;)

Cryptos may have bottomed out in the short term and are getting slightly bullish. Bitcoin needs to cross back up above $7.8k through $8k and Ethereum back up to $500. It is very interesting how when the market was at it's peak, people would have begged for these prices. Interestingly, that brings us to another point, which is how to profit during a sideways market.

i posted out lists of undervalued cryptos. So many were oversold and down from their highs. Litecoin (LTC) was around $115. Right now, it is at about $134 for a 16% gain and it is up 12% day over day. Steem (STEEM) is up about 30% in the last few days and up 25% day over day at about $2.17 right now. It was at about $1.58 when we mentioned it last week. It was even up to $2.45 for a bit yesterday. When the market bottomed out, every single crypto we mentioned is up right now since that time.

So, you can do the math for how much you could profit depending on how much you put into the trade. Also, you could sell today or see if the market continues rebounding this week, sell later, and rebuy in on another low. The goal is to build your funds and allocate some funds to longer term holds. Right now is not the time to be married to every crypto in your portfolio unless you are fine to sit back and hold for the longer term. If you have the liquidity for that, then, great. As we've said before we have a mix of long term and mid term holds as well as trading in and out of the highs and lows of the market bouncing around.

just signup get $10 http://teensmakecash.com/?ref=akankah

instant withdraw to paypal

I am signing up, how much do you earn and is it legit ?

It's fake for sure

until now i get $85

If you get paid into paypal than it's good enough, else just a useless site. Let me know if you do get paid via paypal and atleast upvote my post. I registered using your referral .

ok bro. i need 2 signup more to get withdraw,

bro join me in sphere there much people earn dollar https://www.sphere.social/hello/users/view/33842

"Purchase the plunge and HODL," said Bitcoin bull Thomas Lee, head of research at Fundstrat Global Advisor, on CNBC's post-showcase demonstrate "Quick Money" on Wednesday.

"The state of mind in crypto is ghastly right now," the regarded Wall Street examiner said. "Long-lasting holders are stressed in light of the fact that they have huge picks up and they're stressed over falling costs. Yet, Bitcoin is an incredible store of significant worth. It works extremely well. It's sort of exhausting, in light of the fact that it's not the most recent and most energizing venture. Be that as it may, it additionally is a standout amongst the most fluid approaches to get introduction to crypto."

In a Wednesday note, Lee expounded on the 10 greatest days for Bitcoin every year, contrasting them with the conventional market: "Market timing is by and large demoralized in customary value contributing. In the event that a speculator passed up a major opportunity for the 10 greatest days (for S&P 500 [an American securities exchange index]) every year, the annualized return drops to 5.4% (ex-10 best), from 9.2%. As such, the case for purchase and hold in values is the open door cost of passing up a major opportunity for the 10 greatest days."

So if a financial specialist was to pass up a great opportunity for the 10 greatest days for Bitcoin, the annualized return drops 25% yearly, Lee composes. By and large, Bitcoin was during each time with the avoidance of the main 10 day increases, as indicated by Fundstrat information. 2017, for example, had an aggregate of 12 days speaking to the entire year return of BTC.

In any case, the investigation for the S&P 500's execution backpedals to 1954, while the nine-day normal for the entire year increases of Bitcoin just backpedals to 2013. This implies it is indistinct whether authentic examination on the decades-old securities exchange is suitable for the much more unstable digital money that is just 9 years of age.

Bitcoin is exchanging at the breakeven cost of mining, at about USD 8,000, in light of a model by Fundstrat, Bloomberg included. "We see positive impetuses for Bitcoin later in 2018, including the illumination of administrative obstacles," Fundstrat investigators wrote in the note.

Likewise, Bitcoin's present low offering value, gives speculators who aren't comfortable with cryptographic money an opportunity to think about the business, as opposed to bouncing in feet in the first place, CNBC revealed refering to Lee. "As terrible as it feels at this moment, Bitcoin has significantly more upside," he said..

come back is always real.

Nice post good work big thumbs up and a resteem from my side.

Hey @crypto.inferno I am Neil the chief of the @steemit-helpers group. Today I create a post on my blog is about e-commerce

You may can visit me and you can grow your business by following this post contain video here:

https://steemit.com/e-commerce/@steemit-helpers/e-commerce-content-marketing-5-ways-to-get-started-asap

Cheers,

Neil

I think your model is pretty decent. But the recent crash down to 4,000 came, likely, as a result of the binance FUD that was circulating around today about a hack. Further, we are in completely new territory when it comes to adoption and mainstream acceptance of Bitcoin and crypto. There's really no telling what will happen in the future. I'd like to believe it will eventually reach a bottom and then rise back to new highs. But noone knows.

I will say that your current model and prediction that the low will be about 4k is sort of inline with an academic article that was released about a week ago. It theorized that Bitcoin was 4x overvalued and could drop to around 1,000 to 2,000 dollars. While your estimate was higher it's not all that much higher.

Nice work.

summary of the academic article claiming Bitcoin was overvalued at 8k. https://steemit.com/life/@cryptodivision/research-paper-suggests-bitcoin-is-nearly-4x-overvalued