Analytics: heavy bitcoin recovery

Despite yesterday's bearish sentiment on the market, the sale in the world's largest crypto currency for market capitalization stopped and the price of bitcoin returned to around $ 14'000, gaining the opportunity for short-term growth.

According to the index bitcoin (BTC) found the bottom at $ 12'878, today at 00:44 GMT, and moved to intraday maximum at $ 13'773 .

A sharp recovery indicates that the markets reacted positively to reports of a suspension of the ban on cryptotrading being considered in South Korea. In addition, investors realized that South Korea is unlikely to announce this move in the near future, if at all, it will.

Thus, bitcoin found a short-term bottom, but this does not mean that the crypto currency will return to record highs, as fears about Korean sanctions still bother the participants of cryptology.

While the BTC can achieve some success in the short term, technical analysis points to the consolidation of the market.

Technical analysis.

The above chart (prices in accordance with Coinbase) shows:

*Despite the bearish sentiment, BTC defended the uptrend line, based on the lows of November 12 and December 22.

*Bitcoin today caught a wave of demand, after the bears could not break through the support line.

*The 50-day moving average (MA) continues to grow, indicating a bullish mood.

*Bear crossover between 5-day and 10-day MA and 5-day and 50-day MA.

Weekly timeframe

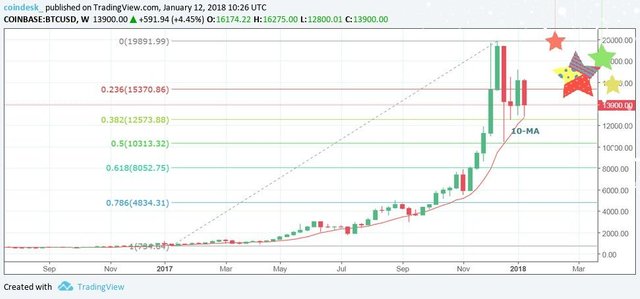

The above chart (prices in accordance with Coinbase) shows:

*Sales ended around a sliding 10-week MA (currently $ 12'743)

*The level of 38.2% of Fibonacci, located at $ 12'573 was strong enough.

*The last week's candlestick indicates signs of depletion of the bearish trend near the Fibonacci level.

Overview

The 10-week and 50-day moving averages indicate an upward sloping move, and a bearish depletion near the 38.2% Fibonacci level , at $ 12,573. Any dips below $ 12,000 are likely to be short-lived.

In the short term, the Crypto-currency can hardly be kept above 16'000 dollars. Thus, bulls need to benefit from the successful protection of the rising trend line observed in the last 24 hours.

Nevertheless, the bearish scenario (breaking the wedge earlier this week) for BTC remains possible. The chances of a new sell-off and a price cut to $ 8'000 will increase if bitcoin can not consolidate between $ 12'000 and $ 16'000 over the next few days.

Very insightful analysis. I am new to cryptocurrency investment and I am using this fall in price period to accumulate some bitcoin.