History for the future: Bitcoin and the 1781 Bank of North America Act of Congress – Bitcoin might be special but it’s nothing new

There is no argument that bitcoin has the potential to be revolutionary and is already starting to be. However, to predict what might happen in the future, we can look to the past.

In a nutshell; in the 18th century, there were lots of different banks and currencies with new ones popping up all the time. The new banks led often to crashes and bubbles. Eventually, governments saw the potential for profit and the need for regulation and took overall control. Further development came from the need for banking being pushed by the industrial revolution to fund investment and growth.

If you swap the 21st century for 18th the century and Information revolution for Industrial, does it make you think of anything?

History (you can skip this bit if you are well read or easily bored)

The origin of banking and money is a fascinating one and well worth a read. (See below) here is a very rough history for you. The origin of paper money comes from China in AD 700ish where they also came up with the word cash. It didn’t take off in Europe until much later where promissory notes started to replace hard currency in the 18th century, this happened at the same time as the creation of stock markets, a number of bubbles (Tulips, South Sea) and a change in the way governments funded war (i.e. the British needed a way to get money to fight the French).

In the US, the desire to have separate currency was a cause behind the wars of revolution and the post war years led to the creation of a large number of banks at state and federal level, several of which were fraudulent or corrupt with people swept away with the potential for profit. Alexander Hamilton (of the Musical fame) even ended up losing a duel to the vice-president of the US (Aaron Burr) built on a hatred gained from the creation of Banks. The 1781 Bank of North America lasted 6 years before corruption destroyed it and after another wait, there was a second and more successful federal attempt.

In this manner, creating for ourselves our own paper money, we control its purchasing power, and we have no interest to pay to no one." Benjamin Franklin

The Chinese created paper money as part of millennia long campaign of innovation and ideas growth, the British created a state monopoly (Bank of England) to ensure the money and control stayed with Britain and the Americans were hugely entrepreneurial, had a fight about it and ultimately settled on the government option (which importantly meant tax revenue).

What does this tell us about today?

Drivers for development and success – the development of central banks and paper money were driven by in particular, the industrial revolution which required a new method of finance to fund and support growth in technology. In a period of huge disruption and change in industry (which can be strongly argued is much larger in scale to the disruption of this age. i.e. think of the impact of a horse ride of a day being reduced to an hour on a train.) The underlying drivers supported the development of the system and the fundamentals of finance changed towards debt and investment without which the progress would not have been as quick or as ‘sticky’. Britain at the time as the leaders in industry and war, became the leaders in finance too.

Skip to 2017 and look at the drivers in today’s market.

Global disintermediation – like the Americans in the 18th Century who didn’t want to be beholden to the British to run their finance, the unstoppable force today is towards a reduction in intermediaries and the closer connection globally between any two points. The power of globalisation is both driven by and enabled through Blockchain and Bitcoin.

The fundamental disruption of the information age is doing what the industrial revolution did, providing huge change and therefore growth opportunity. One of the biggest constraints to global trade for small business is risk/confidence and efficiency in transfer costs (FX etc). If you remove that then there will be a huge change – what does Blockchain/Crypto do again??

There was no stopping central banking once they got going and there’s every evidence showing the same now for Crypto.

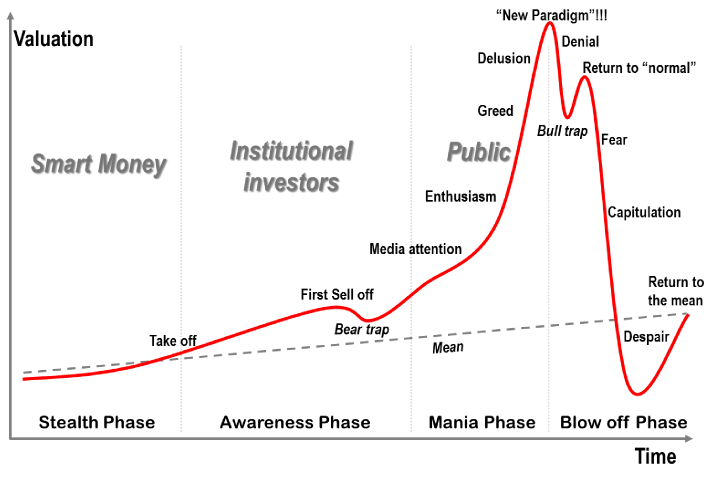

Boom and bust – any new wave in finance is usually met by some aspects of a bubble. Namely, there are some first movers who know enough to profit which builds as demand grows, the less informed public jump in pushing the price higher until it’s unsustainable and then collapses. If there is value in the product then there is a return to a more sensible long run price.

There is the example of the East India Company who in the 18th century tried to convince the government to convert government debt with the Bank of England into shares in the East India Company. It came close to tying the British nation’s finances to a bubble. Consider the range of ‘Initial Coin Offerings’ today mirroring the myriad of new banks and ventures in the US and UK at the time.

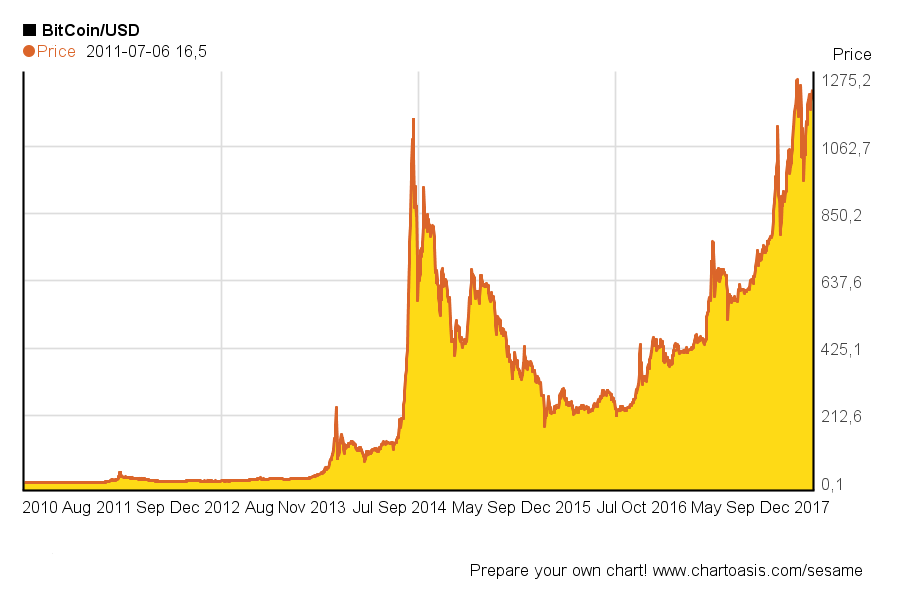

Have a look at these graphs below, the first is the share price of Amazon over the last 15 years, the second is the price of bitcoin and the last is the classic view of a bubble.

The question is, is the Bitcoin one like Amazon which went through a correction (couple of spikes and drops) and then run into a sustainable period of growth? Or is it going through the mania phase before a real drop?

It was only after a period of adjustment and a few false starts that the systemic, controlled and stable banking system came to pass. Which takes us to;

Government regulation – there came a point where the government stepped in to take charge of the banking system. Partially as a response to the range of newly created banks; the risk of fraud, boom and bust, in order to protect its citizens. More importantly perhaps in order to take control and ultimately build in taxation to create revenue. Central banks use a range of levers to steer the economy which includes the management of money supply, debt, interest rates etc. At the point that Crypto reaches (or threatens to reach) a scale that it can influence economies, there will most certainly be a desire to bring it under the wider banner of the government. However, because it is decentralised like theinternet, there will be a need to have an international joined up approach.

However, power talks so whoever takes the initial control in regulation will take the lead in better leading its adoption. It may be most prominent in Japan but it’s the Chinese interest pushing the Americans into regulation. This was not the case with the Internet.

https://news.bitcoin.com/chinese-officials-travel-to-us-to-discuss-fintech-and-cryptocurrency-regulations/

For all you Brexit fans out there, this is type of thing that Britain used to lead a couple of centuries ago. It is demonstrably not the case now. For all the America First Trump fans; it’s time to start getting a bit worried that it’s China leading the way.

So then…

All in all, if you are betting on an outcome. You can put your house on Crypto being a huge part of international finance and business in the future. If you want to consider what might happen as part of that transition, it’s worth turning to history.

‘ "Let me issue and control a nation's money and I care not who writes the laws." Mayer Amschel Rothschild, 1790

My website with all my recent blogs and some further information- www.thecorporatefuturist.com

Further reading

The 20 second option - https://en.wikipedia.org/wiki/History_of_banking

The great fiction but still informative option - https://www.bookdepository.com/Conspiracy-of-Paper-David-Liss/9780804119122?ref=grid-view&qid=1508195359685&sr=1-1, History of paper money and the stock market (with some sex and violence) https://www.bookdepository.com/Whiskey-Rebels-David-Liss/9780812974539 History of US banking (with some sex and violence) – both books are brilliant, ask me about my money back guarantee

Crypto trading – have a chat to my good friend at VANAM - The transparent trader

Background to blockchain - Blockchain guide

✅ @corpfuturist, congratulations on making your first post! I gave you an upvote!

Please give me a follow and take a moment to read this post regarding commenting and spam.

(tl;dr - if you spam, you will be flagged!)

There are some good points on your article, but i don't think that in 5 to 10 years bitcoin will be number 1. Bitcoin is number 1 at the moment because it was the first coin and has a lot of hype but there are a lot of other coins with more potential :)

Congratulations @corpfuturist! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!