The Biggest Frustration about the Crypto Market Dip

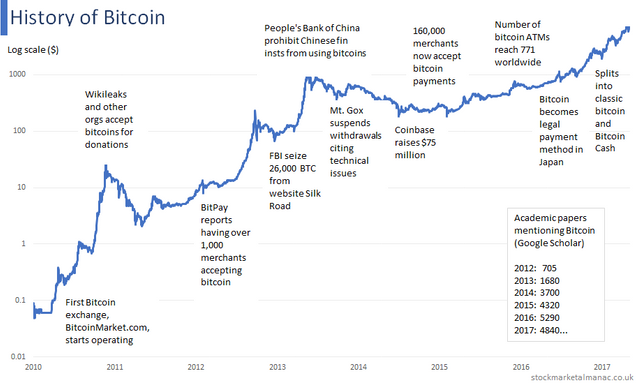

I was an 'early adopter' in crypto but not a huge bag holder or anything. I had invested spare cash on a speculative bet that they could be worth a lot more. Litecoin at average of $4 and a couple BTC @ $330 ish. I was already an investor of anti-fiat money investments and this was just another side bet for me. My first purchase was LTC in 2013, bought about 10 at $5. I remember it slowly going down in value but purchased again in 2015. In Hindsight I should have bought a lot more, I know.

Along the way I missed a few calls out of pure laziness or rather procrastination (I would have to buy btc or ltc, then go to an exchange, hey I would have to join an exchange, etc...). Ripple at low low prices, Monero at a dollar, Eth at $8, etc. These were all on my radar at the time and never got round to it in time. They would take a jump in price and I would say, damn, missed the entry, not knowing they would continue, much higher.

When the highs of December 2017/January 2018 came I was half expecting the market to take a dip due to the introduction of futures trading. I didn't trust it so I was being cautious. The problem was the noise was getting louder. That noise was the crypto buzz also known in trading circles as 'Euphoria'!

This is your warning sign, little did I know though as I was slowly seduced into thinking my already up 1000's of percent investment would continue (just a few months more) and make me quite wealthy. So with this in mind and the climb up in prices after every dip it was easy to conceive how this could continue up. After all if I pulled out now I would miss those gains. This is another form of FOMO. This isn't buying as something is going up but fear of missing out on the big move so you do not sell.

The big move is actually still expected in Crypto. We went to $830 billion market cap and people were shouting about how this was peanuts and we are going to at least $4 trillion market cap, this was partly why I didn't sell. BUT we had a parabolic rise, mainstream attention, banks getting involved so this did seem possible and as I was invested in strong alt coins a fraction of the price of Bitcoin, 1000% rises were not unbelievable.

The rest is history.

Bitcoin dropped but funnily enough my alt coins carried on up higher. Could this have been the end of Bitcoins reign as King of the Crypto's? Many thought so but what actually happened was a delayed reaction in the alts. A week or two later they dive bombed following bitcoin down and in percentage terms became bigger losers from their peak prices. I dropped all my tokens and swapped into a core few stronger coins, probably my best move. This saved some carnage but really my best move would have been straight into USDT (Tether) or USD. This shows I was unwilling to leave the market in case it recovered unexpectedly.

So the title of this post. The biggest frustration right now is sitting at what could be the bottom in the market, my portfolio about 20% of its highs and with my calculator working out just how much crypto I could be buying back in with had I got out at the top. People say its silly but to learn from your mistakes you need to feel that pain and hammer home the correct thing to do so in future you make the right calls.

You will never pick the top or the bottom of a market (rarely anyway) but if your goal is to make money then you should be happy taking a slice out of the pie.

In Crypto terms I am a HODLer not a trader BUT when you see a parabolic move in future, I will try to take some profits. The reason? Not to buy a car or a boat but you may be able to buy back in much, much lower!

I wont give real numbers on my portfolio but for arguments sake, lets say my high was $100k. One of my portfolio strong alt picks is Stratis. This had gone down over last summer and set up for a nice climb in December to a high of $22 on the back of good project progress. If you had sold at that time you would have $100, 000. If you were to now buy back in at todays Stratis prices using all of the portfolio money at a price of $3, you would have 33,333 units of Stratis.

Now lets put that Stratis price back to $22. This makes $733, 326! Just by going back to previous highs (ie, where you were before!)

Now if Bitcoin does as expected on the next run up, lets say $50k or even $100k, you could see a Stratis price over $100 creating a total price of $3,333,000!

So this is just to illustrate how a few simple moves and a clear head, can help you leap frog and grow your portfolio.

For more information on Stratis and current updates check Khilone on Twitter or his weekly blog here https://medium.com/@khilonecrypto/the-unofficial-weekly-stratis-retrospect-26-khilone-f66d3db2ef38

My biggest frustration about the current market dip, not losing money but losing opportunity to grow the portfolio for real gains!

Stay positive and work out the potentials. Make your smart moves now while nobody is paying attention!

Get a free Bible for your phone, tablet, and computer. bible.com