Coinfirm Provides First Ethereum and ICO Anti-Money Laundering Analysis Capability

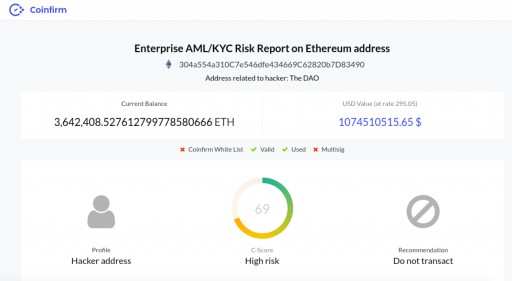

Coinfirm, a leading blockchain regtech company, announced today the world’s first known Ethereum AML/CTF analysis capability, a breakthrough that solves a major headache for the ecosystem while boosting Ethereum adoption and reducing compliance risks.

Coinfirm created the game-changing ability and service to analyze and structure data based on Ethereum for AML/CTF compliance purposes, a major requirement for the Ethereum ecosystem to become commercially adoptable. Amid rapid changes around blockchain in relation to compliance and regulations, Coinfirm now delivers a new dynamic of adoption and security for Ethereum and related applications such as ICO’s.

“We’ve been met with a great response so far from clients who use our AML reports for ICOs and token issuance. Our capability to service Ethereum for AML/CTF changes the game not just for the cryptocurrency ecosystem but compliance overall. Now one of the largest regulatory problems around ICO’s and tokens is being solved,” said Coinfirm CEO and Co Founder, Pawel Kuskowski

The proper application and execution of AML/CTF rules and regulations is a challenge for cryptocurrency businesses and a growing burden that is limiting the speed and scale of market growth as entities operating in this new dynamic space are required to apply the same standards as long-established banks and other financial institutions.

Coinfirm’s already functional service for Ethereum is being applied to multiple ICO’s. It has key features for embracing functionality behind smart contracts that enable its data analysis and helps prevent risk and money-laundering, one of the worst scourges on the world’s financial system.

Blockchain and virtual currencies as they relate to AML/CTF compliance are also a challenge for traditional financial institutions. More and more of their clients are expanding into this rapidly evolving market and the business generated by this new ecosystem cannot be ignored. Companies, financial institutions and major players around the world have lacked the proper standards, tools and data to assess risk. They are technically ‘blind” and unable to efficiently determine the potential risk associated with virtual currency or blockchain asset related entities, limiting their ability to provide services to them.

The implications of Coinfirm’s AML/CTF Analysis Capability for the blockchain industry and for traditional financial institutions are far-reaching. With regulators from China to the United States to Europe scrutinising cryptoassets, particularly ICOs, the absence of an AML/CTF compliance solution has been a barrier to the Ethereum and overall cryptocurrency ecosystem from being commercially adoptable.

Globally known for their blockchain regtech solutions such as their AML/CTF platform and the Trudatum platform, Coinfirm has garnered partners and clients across blockchain and financial industries ranging from major cryptocurrency players such as Dash and RSK to large financial institutions such as SEI.

Like most of the blockchain regtech industry, Coinfirm’s AML/CTF Platform first focused on Bitcoin but the Platform is blockchain agnostic, meaning it can technically integrate any type of blockchain and have already added Dash. Now it is the first company to publicly break out and also offer AML/CFT capabilities for Ethereum on top of their services for Bitcoin and Dash. Coinfirm is also working on additional features, blockchains and efficiencies for the platform that will be disclosed soon.

About Coinfirm

A recognized leader in their field and ranked among the most influential blockchain and regtech companies, Coinfirm serves as a foundation for the safe adoption and use of blockchain. The Coinfirm AML/CTF Platform uses proprietary algorithms and big data analysis to provide structured actionable data that increases efficiency, reduces costs and streamlines compliance to near automation. The blockchain agnostic platform benefits not only companies operating around blockchain but also major financial institutions, asset management and BI companies. In addition, Coinfirm develops dedicated blockchain solutions such as their data provenance platform Trudatum. Currently being piloted for adoption by multiple financial institutions, Trudatum is an easy to use and adopt blockchain solution to register and verify the ownership and authenticity of any type of document, file, or data.