Japanese listed companies provide loans, guaranteed by BTC, BCH, ETH

Japanese companies listed on the Tokyo Stock Exchange provide loans guaranteed by three encrypted currencies: BTC, BCH and ETH. Customers can borrow up to 300 million yen(about 2.7 million US dollars) at different interest rates. The company also set up a subsidiary overseas for its encryption business

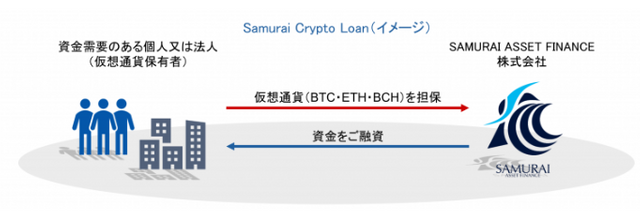

A Japanese company listed on the Tokyo Stock Exchange has begun accepting applications for secured loans in encrypted currencies. Samurai Ltd.. (TYO :4764) Recently, through its subsidiary Samurai(Samurai), a loan program called Samurai was launched.

The company explained that the loan would be provided to the encryption owner with BTC, BCH or ETH as collateral. Customers can obtain yen funds without having to liquidate their encrypted positions. According to Japanese reports, in Japan, clearing encrypted currency may generate up to 55 tons of taxes. Bitcoin.com has previously reported that.

Customers can borrow 20 million yen(~ 179,000 US dollars) and 300 million yen(about 2.7 million US dollars) within a year and can be extended. The interest rates on these loans range from 7.0 % to 15.0 %, including commissions and extension fees, details of Samurai. The arrears amount to 20 per cent per annum.

Samurai was founded in 1996 and formerly known as Digital Design Co.. Ltd.. , engaged in global information services business. Samurai was founded last year. In addition to secured secured loans, the company also provides loans for real estate, securities, deposits, credit, movable property, foreign currency, members and precious metals.

ICO programs and competitions

Samurai first proposed entering the encrypted guaranteed loan business in May. The proposal was submitted to its board of directors and subsequently approved by its board. The company also established an overseas subsidiary to launch the initial coin(ICO). "We will carry out ICO and expand our business scope," Samurai announced at the time.

Recently, Abic Corporation, another Japanese company, announced a loan plan guaranteed by BTC. Abic's loan terms range from 2 million yen(approximately US$ 18,260) to 1 billion yen(approximately US$ 9.13 million), and annual interest rates range from 2.98 to 15.0. Customers can borrow from one month to five years; The arrears amount to 20 cents per year.

Last week, the encryption financial service platform Libra Credit partnered with Binance Labs, Binance's investment division, to bring BNB[ Binance coin] "Users as collateral provide legal and encrypted pricing assets," the company said in detail.

Coins mentioned in post: