Story from Markets Market Wrap: Bitcoin Price, Dominance Slips; Ether Hits Fresh Record High Over $2.6K

The market is clearly choosing other digital assets over bitcoin. Ether hits a fresh record price and BNB dominates.

*Bitcoin (BTC) trading around $52,612 as of 21:00 UTC (4 p.m. ET). Slipping 4.7% over the previous 24 hours.

*Bitcoin’s 24-hour range: $52,889-$55,233 (CoinDesk 20)

*BTC below the 10-hour and 50-hour moving average on the hourly chart, a bearish signal for market technicians.

Bitcoin had its fourth day of weak market action. The world’s oldest cryptocurrency was seeing some selling action as of press time, causing the price to dip to $52,612.

Pankaj Balani, CEO of crypto derivatives venue Delta Exchange, notes that when looking at a larger trading chart time frame the outlook is starting to look bearish for bitcoin. “BTC has slipped below the 50-day moving average support that it held sacrosanct through this rally, and looks like there is more downside here,” Balani told CoinDesk.

As a result of last weekend’s bitcoin dump, BTC’s spot price is now below its 50-day moving average, the first time that has occurred since October 2020, according to the daily charts from TradingView.

“We might see a sharp bounce in bitcoin, but until it moves above $60,000 the possibility of a bull trap cannot be eliminated,” Balani added.

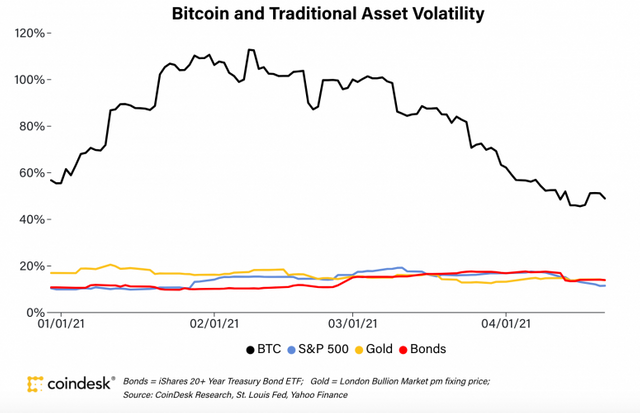

Perhaps one benefit of this drop in price, at least from a store-of-value perspective many bitcoin proponents advocate, is that BTC volatility continues a slow decline. Bitcoin’s 30-day annualized volatility, as measured by CoinDesk Research, was at 48.9% on April 21, a long slow fall from 2021’s high of 112.8% 30-day volatility on Feb. 9.

As a result, traders are clearly focused on other blockchain-based assets in the crypto ecosystem, Delta Exchange’s Balani said. “We are seeing strong signs in [altcoins]; ether is the focus here.”