What's Ether Worth? A Probabilistic Valuation

Is Ether worth $260+? Should I recommend it as an investment to friends at its current price? These are the questions that have been nagging at me after watching Ether increase 10x in value over the last four months.

In March, I first learned about Ethereum. Its coder-friendly smart contracts resonated with me. "This is the next step, a platform for blockchain applications," I murmured during late night research sessions on Epicenter. I emailed tech savvy friends to spread the word.

The friendly price helped my recommendations. I told friends to buy Ether (the token underlying the Ethereum blockchain) at $16, $22, $32. I made small, gleeful investments at these prices.

My enthusiasm has since been mimicked around the world. The price of Ether broke $50 in April and $200 in May. It now sits at $261, and Ethereum’s $24 billion market cap is second only to Bitcoin’s in blockchain.

Ether’s huge gains are a microcosm. The blockchain space as a whole has experienced a massive influx of capital: from $23 billion in March to $101 billion as of this writing. A broad cross section of the world is excited about the disruption and new capabilities blockchain will create.

A New Asset Class

Before we answer those questions, a little housekeeping. This analysis assumes a basic understanding of blockchain technology, and this IBM article can help.

And some Ethereum basics. Ethereum is a distributed protocol (set of software code) running on computers all over the world. Applications running on Ethereum pay “gas” in Ether to use the platform. For more, read Fred Ehrsam’s explanation of why Ethereum is the the leading digital asset.

It's important to understand that blockchain protocols are a new beast. These assets provide value and have use cases different from gold, fiat currencies, and stocks. Bitcoin has consistently low correlations with other asset classes. This novelty means that it is difficult to value these assets. When analysts value Amazon stock, they can use well established techniques. We need to get a bit more creative with our thinking about Ethereum.

Current Gas Levels

Gas is one of Ethereum’s main metrics, and today it is relatively pedestrian. The network charges about 10 billion gas daily, worth about $55,000 (10b * 0.000000021 Ether gas price * $261 per Ether). Gas is perhaps the closest thing that Ethereum has to cash flow, and not much is being burned.

While most of the top blockchains applications are built on Ethereum, none have much traction. Many of these applications are “middleware”: fundamental protocols that other developers can leverage to build user facing applications. Think cloud based storage, prediction markets, identity protocols, etc. We are at least a year or two out from the first killer app on Ethereum.

Ether’s market cap is over a thousand times the annual gas fees. Clearly, investors are betting on Ethereum’s future potential or valuing it using other considerations.

Probabilistic Valuation

I’ll build on thinking from more experienced investment minds. Bill Miller, a prominent value investor, wrote a probabilistic valuation case for Bitcoin in 2015. He posited that Bitcoin had two success scenarios:

- becoming a store-of-value equal to gold (a $6.4 trillion value), with a .25% probability of occurring

- replacing payment processors like VISA, MasterCard, etc. (a $350 million dollar value) with a 2.5% probability

Combining those scenarios gives a probability weighted value of $1210 per Bitcoin. The formula: (.25% * 6.4t + 2.5% * 350m)/21m bitcoins. Even with a high likelihood of being worth $0 in the future, the potential to be worth tens or hundreds of thousands per coin gave Bitcoin a $1210 probability weighted value.

As of this writing, a Bitcoin costs $2711, more than double Bill’s valuation. This increase aligns with his analysis. The Bitcoin blockchain has survived an addition 21 months without a security breach, the kiss of death for a digital asset. And Bitcoin has seen growing adoption as a unique digital store-of-value like gold.

In February, tech investor Nick Tomaino did a probabilistic analysis for Ether. His scenarios for Ethereum:

- becoming the infrastructure for the web and mobile apps (a $1.763 trillion value) with a .7% probability

- becoming a niche developer ecosystem and small digital currency ($2 billion) with a 19.3% probability

Combined, these scenarios gave Ether a price of $59. Clearly, a lot has happened in three and a half months. My analysis benefits from those developments, and uses shorter time period success scenarios for what Ethereum can become.

I’ll map out scenarios five years into the future. That’s long enough for the platform’s current developments to mature, but short enough that emergent capabilities will likely not play a big role.

Part of the excitement around Blockchain tech is that it will enable decentralized networks with new functionality that we can’t even imagine. Its hard enough to model the value of a protocol that helps self-driving cars pay each other when they changing lanes. Its borderline impossible to model totally emergent functionality today.

Supply in Five Years

First, we need to estimate the supply of Ether in five years. That will allow us to calculate the value per coin in the network.

There are currently 92m Ether. Under the current consensus system, 15.6m coins are produced each year to reward miners for running the network. But Ethereum is moving to a new system. Casper is a proof of stake system: participants “stake” Ether and run the network in exchange for Ether rewards. While it is not finalized, the plan is to have much lower inflation rates with Casper. With a likely range of 0-3%, let’s estimate 3%.

The Ethereum team is finishing designing Casper, and it will take some time to transition. It will likely be live by late December, about seven months from now.

Given these assumptions, in June of 2022 there will be 115m Ether (another 9m mined before Casper and then 4.4 yrs of 3% inflation on those 101m coins).

The Dominant Blockchain Application Platform

In five years, Ethereum could still be the dominant blockchain app platform (or DBAP). This is precisely the groundbreaking vision of Vitalik Buterin, Ethereum’s creator. It’s the first success scenario we’ll explore here.

Ethereum was designed to allow distributed applications to piggyback on its secure blockchain platform. This saves applications developers from reinventing the wheel. A coder who wants to build a blockchain app can just start coding in Solidity, Ethereum’s coder friendly language. The coder saves tons of time and effort from not having to design both a blockchain platform and the application.

There are many ways that blockchain applications can disrupt entire industries:

- Stable digital currencies enable micropayments and effortless transfer across borders.

- Distributed computing aggregates surplus computing power worldwide.

- Decentralized cloud storage may be cheaper, faster and more secure than today’s centralized solutions.

- New advertising platforms allow content consumers to directly compensate creators.

- Prediction markets accurately foretell future events and enable wide scale gambling.

All of these use cases are already being implemented on Ethereum, but the projects are in their infancy. In five years, many of them could be in regular use all over the world. What would Ethereum be worth as the dominant blockchain application platform?

$150 Billion

Let’s say that heavy use of Ethereum leads to a 500x increase from today in gas spent. Given the plethora of global use cases and the fact that we currently have no user facing apps on Ethereum, this conservative.

In that case, gas would generate $10 billion a year in fees for stakers. The staking value of all coins would likely be around 10 times that, or $100 billion. I’m using a valuation of 10 times yearly profit for a growing global network.

Also, applications and users would need Ether to pay their gas fees. The utility demand for liquid Ether would likely be half of the staking value, giving the Ethereum network a total valuation of $150 billion in this scenario.

Let's use the smell test on that number. Google hit a market cap of 150 million in today’s dollars around 2005, when it was 7 years old. In five years, Ethereum will be that age and have comparable potential. If it extracts value from users on the distributed web at a similar proportion to how google has extracted value from today’s web, then this all adds up.

Perhaps the more difficult question: what is the probability that Ethereum becomes the DBAP? First, let’s look at its strengths.

Developers Love It

Of the top 20 blockchain apps, 15 are built on Ethereum. They account for 80% of the market cap of the top 20 digital assets. Ethereum is currently the DBAP.

Many large companies are also validating the technology. The Ethereum Enterprise Alliance connects Fortune 500 enterprises and academics with Ethereum experts to make the tech enterprise-grade. The Alliance has over 100 members including Microsoft, BP, Intel, Toyota and UBS. The Alliance is proof that Ethereum is currently the most promising blockchain application platform.

Vitalik Buterin, Blockchain Visionary

Leadership & Funding

Ethereum has adept leadership: Vitalik is an elfin genius. Fostering a successful blockchain protocol requires a special kind of intelligence and insight. Vitalik has it. Skim his Search for a Stable Cryptocurrency article and you'll see complex technical analysis explained clearly. He’s been commended for both his community building skills as well as his blockchain vision and crypto economic expertise.

The Ethereum team is also well funded. The Ethereum Foundation, a Swiss non-profit, received 12 million Ether during Ether’s Initial Coin Offering in 2014. That amount of Ether has a current value of $2.6 billion. While much of that initial Ether was exchanged to fiat currency and has been spent, the foundation still has plenty left to fund their mission. Last February when Ether cost $2, the team had 4.5 years of runway.

To sum up, Ethereum has a big head start, leading technology, great leadership and plenty of funds. What stands in its way?

Competition

The blockchain space is evolving constantly, so another protocol could dethrone Ethereum. It probably won’t be Bitcoin. Bitcoin was designed as a proof of concept to securely manage a simple asset: Bitcoins. It wasn’t designed to handle smart contracts or anything beyond very simple applications.

Rootstock is a project to build smart contracts as a “side chain” on the Bitcoin blockchain. They are focusing on private, not public, blockchains, and have taken several years to release their testnet version. Ethereum is live and focused on public blockchains where network effects are strongest.

The strongest competitor might be one that hasn’t launched yet. Tezos is an upcoming platform that also handles smart contracts. It will launch with a built in governance mechanism to help the platform evolve gracefully through voting. It also allows for formal verification of code which may make it easier to write secure and effective code.

Any competitor has its work cut out for it to usurp Ethereum, unless Ethereum lacks an important feature and has trouble getting consensus to update the platform. That could open the door for a competitor. The ongoing block size debate in the Bitcoin community is a good example of the challenge of evolving a decentralized network. Of course, the Ethereum community has already successfully executed several hard forks (changes to the blockchain ledger, which is generally unchangeable). That bodes well for future evolution.

Security Breach

A security breach is another potential pitfall. Digital assets must be secure. If a blockchain is hacked, then the network’s value is destroyed. For this reason, much of blockchain development theory focuses on defending against various network attacks.

So far, so good. Ethereum has only been live for 22 months, but given Ether's high value, it is safe to assume that plenty of hackers have tried to abuse the network. Of course, there is still some chance that a security flaw will be exploited and cause the value of Ether will sink to $0.

Shift to Proof of Stake

The shift from proof of work to Casper is a huge deal. The team has every incentive to make sure that it goes smoothly. They will test all aspects of the new system heavily and then transition to it by implementing it alongside the current mining system. However, if this transition does not go smoothly, that will seriously undermine the longterm vision.

BDAP Value: $260

The goal to bring blockchain applications to the world is ambitious. Ethereum is optimally positioned for it, but there are clear challenges to be overcome. And, as with any blockchain project, there are likely unforeseen difficulties to be navigated.

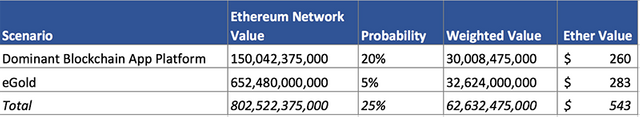

Taking all this into account, Ethereum has a 1 in 5 chance of wearing the DBAP crown in five years. That gives Ethereum a probability weighted value of $30 billion (150b x 20%). Divided by the estimated 115m coins in 2022, each Ether has a current value of $260. Interestingly, this is roughly what Ether costs today. Perhaps the current market is more informed than some think.

Note that as Ethereum jumps hurdles, its likelihood of being the DBAP in five years increases accordingly. If the implementation of Casper goes smoothly, the probability of remaining the BDAP might jump from 20% to 30%. That will bump the probability weighted price of Ether up to $391.

Electronic Gold

The second success scenario for Ethereum is becoming a global store of value. This is gold's $6.4 trillion market that Bill Miller pointed out.

People invest in gold in the hopes that value will rise or stay the same. Gold has a limited supply which is crucial for this role. Unlike most fiat currencies, inflation cannot slowly erode the value of gold.

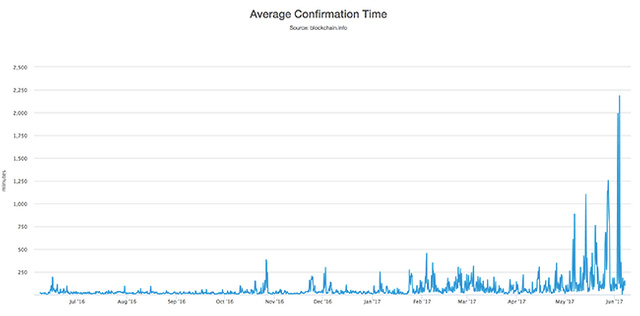

Bitcoin currently embodies eGold, thanks to its set supply of 21m coins, secure network and name recognition. But it has been having issues with transaction times. Today, each transaction takes about 36 hrs to process. That’s awfully slow for a blockchain. The Bitcoin community is working on this issue, but they have been at it for years. Fast transactions are most important for purchase and exchange, so the issue is most troubling because it shows the Bitcoin community's inability to solve problems. That lowers trust in the platform as a whole.

How valuable would this scenario make Ethereum? Let's use Bitcoin’s market cap to approximate the current value of eGold. This is Bitcoin’s main value proposition, so let’s say half of Bitcoin’s value is from that: $20b. Over the last seven years, Bitcoin has seen an average growth rate of 616% each year. With a growing world population and blockchain tech becoming steadily more accepted, predicting 100% growth for the next five years seems reasonable. By 2022, eGold will be worth $653 billion, one tenth the value of gold.

eGold Value: $283

While Ethereum focuses on having more functionality than Bitcoin, it could also be a superior eGold. Ethereum has quick transactions and a nimble dev community.

Ethereum is also rapidly catching up to Bitcoin in name recognition, number of transactions (193k vs 347k on 5/30) and market share (currently at 52% of Bitcoin’s up from 12% a year ago). It’s unlikely that all of the money flowing into Ether is speculation that Ethereum will become the DBAP because that value is more difficult to understand. Many people are already using simply Ether to store value.

If Ethereum becomes the DBAP, it’s more likely to become the prominent eGold. A massive, trusted network that is used heavily by blockchain apps would also make for a secure home for a digital asset that stores value. Gas prices adjust to account for the price of Ether, so there isn’t an obvious reason why it can’t play both roles.

Much will depend on the inflation rate after Casper. It must be low and stable in order for Ether to be a candidate as a digital store of value. This is the major unknown for this scenario.

Due to its focus on other goals and the supply questions, Ethereum has only a 1 in 20 probability of being the main eGold in five years. This scenario gives Ether a value of $283.

Ether @ $543

Adding these two success scenarios together gives a probability weighted value of $543.

Smell test: an Ethereum network value of $62 billion is less than Uber market cap. It's easier for a platform like Ethereum to scale than a traditional company and Ethereum has several paths to success. To answer the questions that prompted all this, Ether seems well worth its current value, and if anything it is undervalued. Personally, I'm still excited to tell tech savvy friends about it.

I hope this analysis helps you further understand Ethereum’s potential and supports your continued interest in this revolutionary tech. Looking forward to your comments and questions!

Obligatory disclaimer: The article is merely my opinions and it is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice.

Lot's of bases covered here. You may be very correct. Many pieces in this puzzle.

And we have to remain open and improvise as well; since all the rules can change when a new player shows up to rock the boat.

I think you have a strong grasp here, but I do want to understand better if EOS affects this view and how it could build on top of ETH, as well as add value to ETH, and of itself as well?

Thanks for the kind words. I'll be researching EOS heavily and will likely do a full analysis. I'll be sure to cover how it relates to Ethereum.

Hello, I am new to crytocurrencies valuation, and noted that you're using "traditional" valuation method, such as cashflow and earning multiples in valuing ETH. If I am to invest in ETH, will I be benefited from the cashflow generated from the Ethereum platform as a coin holder? (i.e. will the cashflow flow back to the coin holders like a shareholder does in holding shares in a company?). Thanks for educating us.

good informative post.

Thanks!

loved ethereum before, love it even more now. Great article

Thanks man!

Lot of ifs in the calculations but I liked it, thanks!

Definitely. Its hard to predict where the space will go. I tried to make my assumptions clear so that readers can plug in their own values where applicable.

I actually saw your post in the Facebook Ethereum group. Great article! Better content than the usual there...

Welcome to Steemit!

In your next post, you might want to use the tag introduceyourself

So people know who you are and why you are here.

Enjoy!

Great call, will do!

This is the best post I've ever read on steemit.

Perhaps another thing to consider is it's value based on the quantity theory of money if it is widely adopted to pay for other goods and services.

Glad you liked it! And good call; I need to learn more about stable digital currencies and the quantity theory of money - any articles or sources you recommend?

wow, very detailed analysis, well done! Thank you for sharing, this is the kind of content we need to support, and spread the word, beautiful!

Thanks so much!

Holy shit this must be one of the most insane first posts ever :)

; )

going to stock up, i think it only goes up

Congratulations @chainstudy! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!