A Short introduction into blockcchain technology

It seems Bitcoin has become very popular since its inception in 2009 and with this, a lot of positive and negative headlines are seeming to pop up on the news. Among the confusion and uncertainty, one thing is for sure, people are taking notice of bitcoin and some are probably seriously considering to invest in it. Taking this into account, understanding how cryptocurrencies work becomes imperative to make informed decisions for having succesful investments.

To understand bitcoin, one needs to understand the underlying technology that drives it, namely, the Blockchain. In the following paragraphs, we look at the driving mechanisms of the blockchain and convey possible implications of blockchain technology in our everyday lives.

A brief history of the blockchain

October of the year 2008, marked the day Satoshi Nakamoto (a pseudonym for an as of yet, unrecognized individual/group) released a whitepaper named; Bitcoin: a Peer-Peer Electronic Cash system. In this paper, Satoshi proposed a design of a system for a digital currency that would solve the double spend problem and would allow for peer-to-peer electronic transactions without the requirement of a central authority. This system became known to what is considered to be the “bitcoin-blockchain” and would pave the way for, as some call it; the “blockchain revolution” (Tapscott, D. and Tapscott, A. 2016). This infographic created by gem.co, depicts the development of blockchain technology since the inception of bitcoin.

Understanding the blockchain

Since blockchain technology is fairly new, there exist no concrete decided upon definition for it. In his book, the Business Blockchain, Mougayar, W. defines the blockchain in the following contexts:

| Context | Definition |

|---|---|

| Technological | The blockchain is a Back-end database that openly maintains a distributed ledger |

| Business | The blockchain is an exchange network for the movement of value between peers |

| Legal | The blockchain is a transaction validation mechanism that does not require intermediary assistance |

Taking all the three contexts into account, the blockchain can be more generally defined as follows:

The blockchain is a distributed network of computers (nodes) that maintain a decentralized (public) database/ledger, in which a historical record of transactions (i.e. valuable data) is timestamped and structured through a mathematical consensus algorithm that utilizes cryptographic security and public key infrastructure to authenticate, validate and transmit data thus establishing trust without the requirement of an intermediary.

This definition is a mouthful and difficult to understand when reading it for the first time. However, the definition can be broken into chunks that are easier to comprehend. Essentially the blockchain is comprised of the following elements:

- Distributed ledger technology

- cryptographic security

- public key infrastructure

- value transfer

Distributed ledger technology

First of all, a distributed ledger can be seen as a digital file on which data can be recorded (kind of like how data is recorded on a registry or a database) that is replicated and shared (distributed) across a network of interconnected computers or servers which are geographically spread out.

Next, essentially a blockchain ledger is immutable, meaning that it’s record history cannot be changed or tampered with, the ledger can only be updated moving forward. When the ledger is updated on one of the computers in the network, the data is replicated on all other computers in the network. Ledgers on distributed systems are different then ledgers on centralized or decentralized systems.

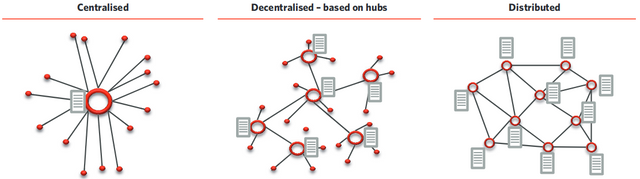

Also, when looking at centralized or decentralized computer networks there is the notion of clients and servers. The server acts like the information hub, so all of the information is stored on the server which is then fed to the client (often a desktop or browser) upon request. Kind of like in a restaurant, the client orders something and the server then provides the client with his order. In a distributed network, the client and the server are one. Going back to the restaurant analogy, the client is now able to order and serve his own food and the same applies for the server. Having understood this basic concept it becomes a bit easier to understand the difference between a centralized or decentralized computer network and distributed one.

Furthermore, distributed systems have multiple points of access in general do not require a central administrator for access as is in the case of centralized and/or decentralized systems (see figure 1.). Also, distributed systems are more resilient towards system failures and attacks compared to the latter systems since, the computers in network are interconnected. Therefore, if one computer fails, information can still be transferred to all other computers. Also, in case a computer or server is hacked, the hacked computer can be blocked out of the network, thus leaving the other computers practically unharmed.

Figure 1: comparison of a distributed ledger with other centralized and decentralized ledger (Innovalue, 2015)

What is also important to mention is that there exist two types of distributed system in the blockhain sphere namely: a permissioned (private) blockchain or a permissionless (public) blokchain. In a permissionless blockchain anyone can become part of the network and take part in the maintenance of the ledger e.x. the blockchain of bitcoin and ethereum are essentially permissionless.

On the other hand, in permissioned blockchain, the network consist of a few “trusted” parties that are allowed to maintain the ledger, i.o.w if a person wants to join the network and take part in the maintenance of the ledger, they will need to get permission from the owners of the network. Ripple for example, is blockchain company that utilizes a permissioned ledger. This video also explains what a distributed ledger looks like.

Cryptography science

If one thinks about sending money from one point to the other or store it, one generally would want this to happen in a secure way. Normally the a bank is authorized as a trusted institution that makes sure that the money is transacted in a secure way by being the one that verifies transactions by checking whether the transaction is authentic and valid. It also provides for a safe space to store your wealth (e.g. a heavily guarded vault or server). Conversely, a blockchain utilizes cryptography science to create security, validity, authenticity and veracity. In general a blockchain applies cryptography science in the following ways:

cryptographic hashing

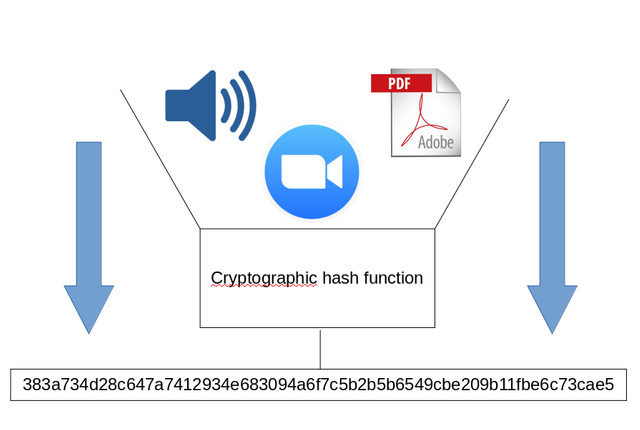

cryptographic hashing is an encryption method in which a cryptographic hash function - this is a deterministic mathematical function, that given a certain input, will always produce the same output – is used to convert any type of arbitrary data input (e.g. video, audio or text) into a fixed-size alphanumeric string, which is commonly referred to as a “digest” or “hash value” (see fig 2). Hashing functions can be used to create a so called “digital fingerprint” which can be used for verifying information and creating digital signatures.

Figure 2: simplified illustration of cryptographic hashing

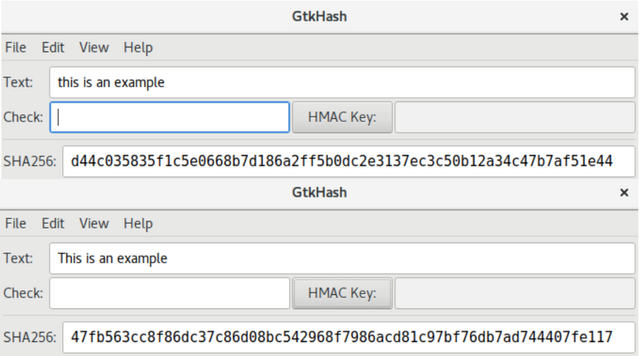

The encrypted data can only be decrypted by the hash value by using it as an input in the reversed version of the hash function. An example of a hash function is the SHA256 – created by the American National Intelligence agency, SHA stands for security hashing algorithm and the number 256 refers bit size digest string –, which is used in the bitcoin blockchain. figure 3 shows how data can be encrypted using the SHA256, you can replicate the values yourself using this online calculator. As can be observed from the figure, changing the t to a capital T in the input, produces a digest that is completely unrecognizable when compared to the output produced from the initial input.

Figure 3: Hashing with the SHA256

public key infrastructure

The public key infrastructure PKI of the blockchain refers to the public addresses and private keys that are assigned to the digital wallets used on the blockchain. A public key, serves as the address of a particular wallet and is used to encrypt (sign) transactions that can only be decrypted by the owner of the private key. To conceptualize this idea consider the following analogy as proposed by Mougayar, W.;

“It’s a bit like your home address. You can publish your home address publicly, but that does not give any information about what your home looks like on the inside. You’ll need your private key to enter your private home, and since you have claimed that address as yours, no one else can claim a similar address as being theirs”.

digital signatures

A digital signature is referred to as a mathematical computation, that is used to authenticate a message. It is like the signature you put on a document as proof that is was actually you that signed the document. In the case of the blockchain, your private key is used to sign a message and produce a digital signature. This digital signature can be used by anyone, in order to verify that the message is sent by you, without actually revealing your private key. The mathematical process is further explained in this video.

Value transfer

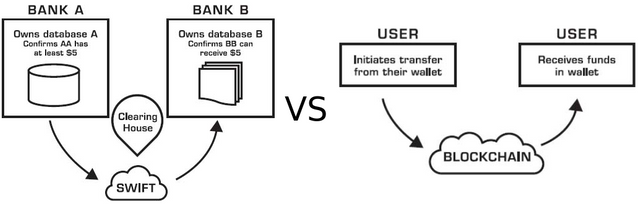

Another important element of the blockchain is the actual transference of value. Value transfer on the blockchain happens peer-to-peer via the blockchain, which means that instead of using a middleman (e.g. bank), the transfer happens through the blockchain (see fig 4). The following steps can be considered in the process of transferring value.

- Initiation of transaction – a sender will initiate a transaction by providing the public address he/she wants to send funds to.

- Input value – the amount (e.x. 5 euro) is entered as an input

- sign transaction – the transaction (message) is signed using the private key and the digital signature is broad-casted to the network so that it can be verified and validated

- validation – the transaction gets verified and validated by the blockchain network (note, this is where the consensus mechanism kicks in)

- the balance is updated

Figure 4: Conventional value transfer vs value transfer via the blockchain (Mougayar, M., 2016)

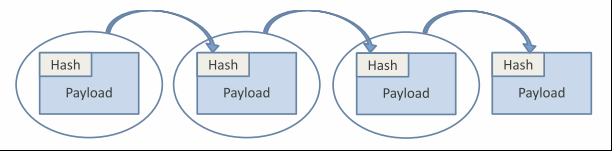

Verified and validated transactions are bundled into “blocks” of an agreed upon size (e.x. 1 mb), these blocks are then hashed and stored on the public ledger and structured in such a way that they resemble a unique chain of blocks in which each successive block contains the hash of the previous blocks (see figure 5). The key mechanism that drives this sequence of processes is called a mathematical consensus mechanism (algorithm).

Figure 5: Chain of hashed blocks on the blockchain (Mazonka, O. 2016)

A mathematical consensus mechanism is a set of rules that are programmed into the blockchain infrastructure which allow for the achievement of consensus (agreement) on the state of the public ledger (e.g. this comes down to the length of the blockchain). The enforcement of these rules is all automated because they are essentially programmed software code. Furthermore, the concensus mechanism differs depending of the blockchain for example, bitcoin uses proof of work (POW) to achieve consensus, while ethereum uses proof of stake (POS).

Because consensus mechanisms are complex processes that can be quite difficult to understand. These will be covered in depth in the upcoming articles on the different companies that utilize blockchain technology, so keep an eye out for those.

Value creation on the blockchain

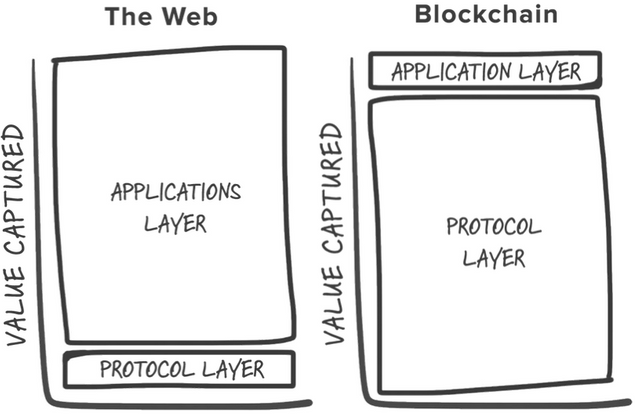

An Internet/blockchain stack is generally comprised of a protocol layer, think of HTTP or TCP/IP, and an applications layer. The protocol layer refers to the infrastructure that is required in order to run the applications (software programs, web apps, wallets etc.).

Value is captured differently on a blockchain application stack than it is on a traditional Internet application stack (see fig). On an Internet stack, the value is mostly represented by the data that is acquired through the use of applications built on top of the protocol (data) layer. Furthermore, individual applications control access to the data layer. Because of the way a traditional Internet application stack captures value, it is also considered to be a so called “thin” protocol with “fat” applications (e.x. google, facebook, youtube etc.)

Figure 6: Blockchain application stack vs Internet application stack

On a blockchain application stack most of the value is captured by the shared data layer (protocol) – think of the distributed ledger – which is represented by cryptographic “access” tokens (e.x. bitcoin tokens) that have some speculative value. The applications layer represents the web apps, exchanges, wallets etc. built on top of the protocol. This form of value representation is regarded as a so called “fat” protocol and “thin” applications. Furthermore, the total market cap of the network itself (the shared data layer) always grows faster than the combined value of the applications on built top of it (exchanges, wallets etc.). This is the result of the positive feedback loop that occurs; first the token increases in value, this then draws in early adopters consisting of speculators, developers and entrepreneurs who then buy a stake of the protocol, because these early adopters are now financially invested in the success of the protocols they start to build applications on top of the protocol, this drive the token price up hence, restarting and continuing the cycle.

In a traditional internet application stack, the total value is consolidated into one single point, often enough a single application that is owned by one individual or company. A blockchain application stack changes this into a situation where value is now distributed amongst multiple stakeholder of the protocol.

Innovation on the blockchain

Smart contracts have gained popularity in recent years. Eventhough the concept has existed for at least 2 decades, it could not be applied because the technical infrastructure did not exist. However, the trustless – meaning that there is no need for a third party to provide trust – environment that blockchain technology provides, has made it possible to run smart contracts. Blockchain’s like thos of Ethereum and NEO are built to especially run smart contracts.

So what is a smart contract ? Nick Zsabo was the first person to conceptualize this Idea in 1996 and he defined it as follows:

“A smart contract is a set of promises, specified in digital form, including protocols within which the parties perform on these promises”

Essentially, what a smart contract comes down to is a set of programmed conditions, that once they are met, trigger a certain action to occur. An analogy to consider is that of a coffee vending machine; once a certain amount of money is inserted in the machine and a button is pressed for black coffee, a cup comes out of the machine and fresh hot coffee is poured into it. This video gives a simple non technical explanation of what a smart contract is.

What makes smart contracts interesting is that contractual agreements – which in generally are hard to manage, prone to errors and prone to fraud – can be transformed into automatically executable code. Think of when buying, renting or leasing a house, all of the agreements e.x. rent, mortgage payments, transference of ownership etc. can be coded into a smart contract and interacted with through a blockchain. Once the agreements are recorded on the blockchain they cannot be changed since the ledger is immutable.

Furthermore, so called “decentralized autonomous organizations (DAO) ” can be created through the application of smart contracts. A DAO is an organization in which stakeholder management is automated. A smart contract or set of smart contracts can function as an escrow thus automating business administration.

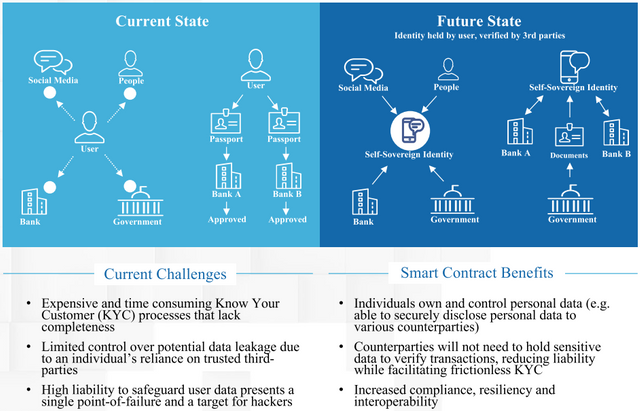

Smart contracts show much promise for creating new industries and new forms of businesses in the near future. However, the technology itself is still young and needs to develop for a few more years before it’s full potential can be experienced. But regardless of this fact there are already multiple applications for smart contracts that already exist: digix.io, the DAO, multiple initial coin offerings and many more. Also, there are several use cases that exists, one of these use cases is portrayed figure 7. Furthermore, the Chamber of Digital Commerce has listed a number of use cases for the blockchain integrated smart contracts, which include but are not limited to the following sectors:

Digital identity

securities

Trade and finance

Derivatives

Financial and data recording

Mortgages

Land and Title recording

Supply chain

Insurance (health, auto, etc.)

Clinical Trials

Cancer Research

Figure 7: use case smart contracts for digital identity (Chamber of digital commerce, 2016)

Challenges for the blockchain

Even though the blockchain has brought with it many positive changes in the way we transact and value money and is on a path to drastically transforming the way we do everyday business, there are some challenges that need to be considered, these include:

Regulation – currently there exist little to no regulation for blockchain tech, this is because many governments do not understand the technology and it’s impact yet. However, some countries like China, Russia and to some degree, the United States of America, are taking steps to regulate the technology. This will allow for some authenticity of the tech and lead the way to mass adoption

Scalability – As more and more people are starting to use blockchain related technologies like for example bitcoin or ethereum the network will need to scale up in order to provide better service. To give you an idea, there are only around 17 million wallets currently on the bitcoin network, the transaction rate is around 7 transactions per second (tps). Compare this to VISA or Paypal, which handles around 4000 tps and 115 tps respectively, while covering far more users than bitcoin, it becomes obvious that scalability is going to be a challenge. However, the technology is still young and there is a lot of room for further development.

Integration – the integration of blockchain’s (distributed) technology infrastructure into businesses that are function on a centralized model is proving to be a hurdle. One reason is that the technology is fairly new, the infrastructure on which the technology is build upon is in a lot of cases completely different than the infrastructure used by the company that wants to integrate. Another thing, there also is a steep learning curve associated with understanding the technical concepts that underline the technology, especially for new comers.

Costs & speed – currently it takes around 10 to 30 minutes for a transaction (any type of transaction, incl. international) on the bitcoin network to be completed. Next to that, the average fee for a bitcoin transaction has also seen an increase in the last couple of months, currently the average fee is around $ 4,35 (this is because of congestion on the network. Compare this to the transaction speed of from a typical bank (which can last up to days or weeks) with fees that very dramatically with the type of bank transaction (generally 3%). Nevertheless, it is still cheaper and more efficient to transact with bitcoin. Also, fees will decrease and transaction speed will increase as new scaling methods are developed and applied.

The importance of blockchain technology

After all this talk about the blockchain, where it comes from and what it is, some readers are probably wondering, why is it important at all to notice or engage in blockchain and how can it benefit me. Ofcourse this question of why blockchain technology is so important completely depends on the use case. By looking at the flaws most of our existing social- and economic institutions bring with in terms of trust, privacy or security, we can get good picture of why blockchain technology is important. Some real world examples of these flaws include: violation of trust through e.x. funding of wars by banks, violation of privacy through mass surveillance, the incompetence in data security and many other examples. In fact the examples of flaws are so many that one could write an encyclopedia about them. In this interview, Anreas Antonopoulos explains vividly why blockchain technology is so imporant.

A more neutral perspective on the benefits of blockchain technology are noted by Mougayar W., in his book; the bussiness blockchain. The benefits of blockchain technology can be listed as follows:

Cost saving – direct or indirect

speed – reduction of time delays

transparency – more visibility of what is truth full information and what is not

better privacy – cryptographic science applied to data management, provides for great privacy

lower risk – the resiliency of the distributed peer-to-peer network allows for more security as failures occur and time progresses, because the network can learn from failures, adapt and prepare for future potential impacts

access – on a permission less ledger, anyone can have access to the system, regardless of gender, ethnicity or economic status

productivity – more work output

efficiency – faster processing or reporting

quality – less errors more satisfaction

Outcomes – profits and growth

future developments for the blockchain

It is no doubt that the blockchain is a revolutionary technology that will transform or disrupt centralized industries and institutions. As a matter of fact, the application of of blockchain technology is already being realized in the following industries: the banking industry, cyber-security, supply chain management, forecasting (through prediction markets), networking and the Internet of things, insurance, transport, cloud storage, charity, voting, government, healthcare, energy management, online music, retail, real estate, and crowd funding. However, the blockchain’s potential does not end here, in fact the blockchain can be applied in any industry in which a trusted intermediary plays a significant role. This video by future thinkers, explains very well how and what industries will be disrupted by blockchain technology.

Summary

The blockchain is a distributed ledger that utilizes cryptography to create a trusted environment for recording transactions. Using blockchain technology means that traditional trusted intermediaries are replaced by a network of computers, owned and controlled by a community of individuals rather than by one person, corporation or institution.

The advent of smart contracts is leapfrogging the blockchain´s abillity to be adopted in any industry that requires a trusted third party. However, the technology is still young and it still has a few more years to go before it has matured to the point where it can be effectively utilized.

Eventhough blockchain technology has shown to be a very useful application for currency, it faces some serious challenges in terms of regulation, scalability, integration and speed & costs. However, solutions will be found for these problems as the network grows and attracts more investors, developers and entrepreneurs. Furthermore, the very open-source nature of blockchain technology will open the doors to innovation and thus significantly lower the barrier for improvement.

Blockchain is a revolutionary technology, it is the Internet evolving and it is here to stay. Many applications for blockchain have already been realised in industries which include government, healthcare, insurance and many more. It will only be a matter of time until we start to see the true potential of blockchain technology.

References

- Bitcoin: A Peer-to-Peer Electronic Cash System | Satoshi Nakamoto Institute

- TAPSCOTT, Don and TAPSCOTT, Alex. Blockchain revolution : how the technology behind bitcoin is changing money, business, and the world. [2016]

- MOUGAYAR, William. The business blockchain : promise, practice, and application of the next Internet technology. [2017].

- MAZONKA, Oleg. Blockchain: Simple Explanation. [ 2016].

- INNOVALUE. Blockchain and financial services industry snapshot and possible future developments. [2015].

- SMART CONTRACTS ALLIANCE. Smart Contracts : 12 Use Cases for Business & Beyond. Chamber of Digital Commerce. [2016].

note that post was written by @rassenguy, he is a member of the @cbn