EOS up over 160% since December 2018 lows - looking to move up higher

Out of the Top 10 cryptocurrencies in market capitalization, EOS is handily outperforming its peers. It is showing extremely bullish pressure and is predicted to move even higher from its current value area. Even strong near-term resistance has failed to pull EOS back down – and now it’s knocking on the door of $4.00.

EOS outperforms the market, more than doubles

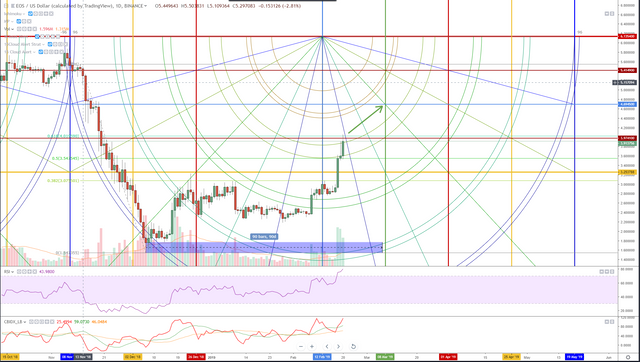

EOS is the 4th highest market cap coin in cryptocurrencies, behind Ripple (XRP), Ethereum (ETH), and Bitcoin (BTC). No one would have predicted that EOS would be performing so well against its peers. So well, in fact, that every single piece of resistance that would have led to a predictable pullback has been shot right through. The gains EOS has made are significant. The 2018 low of 1.5473 was on December 7th, 2018. Fast forward to the present and EOS has moved to tag the 4.05 value area. This move represents a 161.75% gain in only 74 trading days. EOS is now trading where it was back on November 21st, 2018. Again, no one would have predicted the moves EOS has made since the beginning of 2019 – but there is an even more impressive measure of EOS strength.

Consider this: the capitulation move that the cryptocurrency market suffered in November of 2018 hit EOS on November 11th, 2018. If we measure the Fibonacci range from the December 7th, 2018 low at 1.5474 to the swing high at 5.5477, then EOS has reversed over 50% of its losses since that time. In fact, EOS not only has driven past that 50% Fibonacci range, but is currently sitting against a shared confluence zone where the 61.8% Fibonacci level is. There is a just a massive collection of some powerful resistance where EOS is currently trading. There is a 2/8th inner harmonic pivot at 3.974 which acts as a powerful reversal when tested. There is the 61.8 Fibonacci level. There is also the very powerful 1x4 Gann angle – which also acts as a swift reversal when price nears that angle. And finally, the all-important psychological level of 4.00 is here as well. But instead of seeing some normal bear market selloff – EOS is actually consolidating right in that zone. If we were to ‘zoom’ into a faster time frame, predictably, we would observe a strong continuation pattern forming: a bullish pennant.

Predicting and forecasting the next move for EOS

There is a significant amount of information to warn against a further bullish price action here, but from a time cycle point of view (Gann’s cycles), then there is still some room for EOS to run higher. Using one of Gann’s cycles of an inner year to forecast a turning date, we can use the 90-day cycle to identify ‘when’ a change in trend may occur. 90-days from the December 7th, 2018 low is March 7th, 2019. This date falls one day before a time pivot in the current Law of Vibration on March 8th – so we have a shared zone in time that will act as a stopping point for any trend EOS may be in at that time. Predicting the price level may be more difficult, but certainly, any breakout above the present value area to the 4.00 zone is going to generate some significant activity. I would predict a high of 4.69 on or before March 7th before a pullback would be seen. We are only 74 days into the current 90-day cycle, so there is still a significant amount of time for EOS to trade higher.

I should note that if EOS fails to break above where it is currently trading, a deep pullback down to the 1/8th Major Harmonic at 3.25 is the most predictable price move.

Who loves healthy life?

How do you produce that cool looking chart?

Have to draw a lot of it manually, grr.

dare I say..to the moon?

Much much higher

Posted using Partiko iOS

Great job, thanks for the analysis.

EOS 🔥

Posted using Partiko iOS

Congratulations @captainquenta! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPmy main investments are in EOS and ETH hope they will start to do good this year :((

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

me gustaría aprender