Blockchain's Expected Impact on Industries - Crowd Companies Report

Jeremiah Owyang of Crowd Companies has a new report out covering a broad range of topical aspects of blockchain technologies and their implications for much more than just currencies as a store of value and simple business transactions. The report is informed by the work of Crowd Companies’ associated digital experience analyst Jaimy Szymanski, and the team gives us good insight on a basic understanding of the tech, roadblocks to its adoption, and provides direction for leadership on how to “stay ahead of the blockchain revolution” in the 1st comprehensive report on all industries impacted.

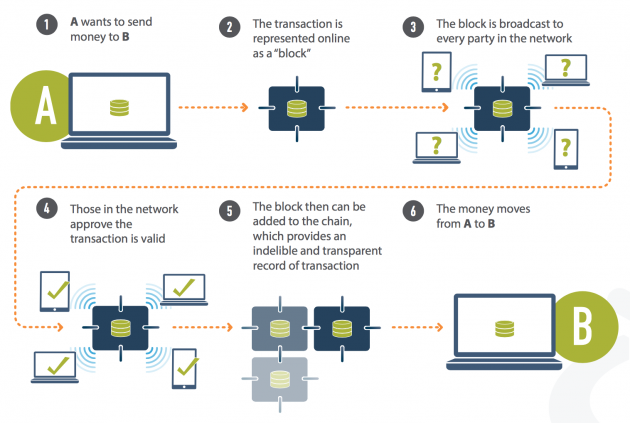

There’s an old piece of investment wisdom that says to not invest in anything you don’t truly understand. For leadership with a background other than software engineering, blockchain technologies present a bit of a challenge because without such a background, attempting to digest white paper explanations always requires the reader to accept that he or she is only understanding most of what is written, perhaps even 80 to 90% but rarely 100% without an actual coding background. For this reason, every blockchain technology primer for general audiences utilizes analogies, some of which are more effective and less confusing than others. Jeremiah’s report, taking an infographic seen below from Financial Times, performs well in giving the non-developer reader a concise explanation which can provide leadership with an understanding from which to move forward and explore with adequate confidence.

For leadership facing the exponential change realities of the day, the responsibility for strategic planning and the required awareness of the landscape and horizon creates the need for the kind of expert overview Crowd Companies offers. The Roadblocks to Adoption and Industry Impacts sections work together for the executive serving whatever major sector to formulate medium and somewhat long-term strategic planning.

The Roadblocks to Adoption section translates into specific implications for readers across various spaces. Financial services leadership is alerted to the need to follow the ongoing scaling issues affecting transaction speeds, healthcare leadership is alerted to the need to follow related developments in the PHI (protected health information) regulatory environment, and so on.

Thereafter, the Industry Impacts section paints numerous images of future operations across industries that are entirely likely according to popular consensus. As expected, one of the running themes across industries is drastic reduction in cost structure as a result of reduced human capital requirements.

Blockchain brings a historical and unprecedented change in not only the exchange of information, goods, or services, but also in systems of mass human organization; that trust is no longer a critical component of the equations.

One of the most challenging aspects of blockchain to understand is the concept of of a trustless society — the idea that we now have a non-entity into which we place our trust, or rather, that we no longer have the need to trust throughout performing operations. To wrap one’s head around it generally leads to some skepticism followed by a therefore necessary dive into explanations of just how robust the security of the so-called distributed ledgers really is. Ultimately, inquisitive minds typically settle upon agreement with the larger consensus on the security level’s validity with the explanation of what it would take to ‘hack’ the network, which is that a majority of users would have to unite in malicious intent, and doing so would actually create for them a computing power majority by which they would benefit more from simply participating in the support of the network than from attacking it.

And then there is international speaker Andreas Antonopoulos’ clever measure of security levels directly tied to a dollar figure. Antonopoulos says that any thus far not yet hacked blockchain with an underlying coin market cap of let’s say, $100 million, is exactly $100 million secure. That’s because the existing valuation of $100 million creates a honeypot that would be thought to attract hackers to a degree in exact proportion to the valuation’s size. And if the value remains, it must be secure at exactly that level of value. It’s a cheeky notion of how to measure security but is perhaps the most valid we’ve seen. Security levels named after poisonous fish and such (eg. 256-bit Blowfish) effectively evoke a certain level of confidence and do have a history of resilience from which to boast, but an X amount of dollars worth of security may be to some a more readily usable and concrete measure.

Leadership may utilize this measure as part of its risk management analysis and planning for new projects. If for example an investment group, hospital group, or government has the need to explore risk implications of building a blockchain on top of one of the existing technologies that facilitates doing so without having to create everything from scratch, such as the wildly popular Ethereum network, it may use the dollar figure security level measure of the underlying network as something of a proxy for the level of security the project would enjoy.

These new models of risk analysis and management are only now made possible by these techologies and have no history of reliability, but appear to be valid.

The trustless society idea is seeing wider acceptance in the social conciousness as what were once thought of as valued intermediaries serving the important role of trusted guarantors, accepting operational integrity and outcomes responsibility, are increasingly seen to be superfluous middle men as economic pressures and the appreciation for work that contributes more to social good, that is more ‘meaningful’ continue to grow.

Jeremiah’s report helps leadership prepare for the disruption in organizational structuring that comes with job displacement as well as the opportunity for alternative investment. More than anything else, the Industry Impacts section offers numerous examples of possibilities for industries to serve more effectively than their legacy versions, which many believe is an opportunity for great strides in humanity as legacy versions of government, finance, healthcare, etc., have legions of critics for the costs and perceived failings that have come along with their otherwise effective stewardship and care of populations.

Crowd Companies has always been an excellent resource for news and insights on the sharing economy and is now strongly positioning its membership-based model as an excellent home for ongoing exploration of the opportunities and implications brought forth with the blockchain. We will continue following the Jeremiah Owyang and Jaimy Szymanski research team to inform our readership.

Congratulations @camineet! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @camineet! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @camineet! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP