Bitcoin Trading Generates More Revenue Than Schwab / @byenes

Recode reported that Coinbase, a cryptocurrency exchange, generated $1 billion in revenue last year and recently turned down VC funding. Trading in cryptocurrencies such as Bitcoin, Ethereum, Litecoin and Ripple have exploded in the past few months, and when you compare Coinbase’s 2017 total revenue to Charles Schwab’s trading revenue, it appears that Coinbase has surpassed Schwab. (Note for this article I’ve abbreviated cryptocurrencies as CCs).[Ed note: Investing in cryptocoins or tokens is highly speculative and the market is largely unregulated. Anyone considering it should be prepared to lose their entire investment.]

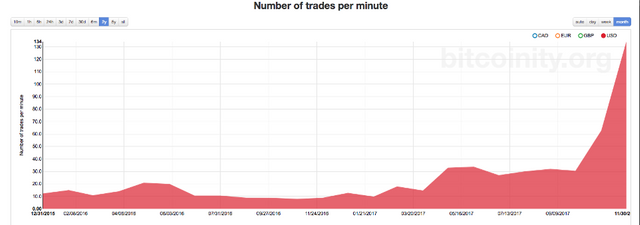

Bitcoin trading exploded in 2017Similar to its price, Bitcoin's trading volume exploded in 2017. Bitcoinity.org tracks Bitcoin’s price, trading volume and other metrics on multiple exchanges. As you can see in the two year graph below, Bitcoin trading volumes on Coinbase were subdued through March last year, jumped to a new level until October and then took off in November and December.Note that the graph’s November 2017 data point is actually December’s trading volume. I downloaded and computed the daily volumes to confirm this. The graph’s Y axis is trades per minute, which I have multiplied to make trades per day.

- December 2016: 15,857 trades per day

- October 2017: 64,251 trades per day

- November 2017: 139,332 trades per day

- December 2017: 301,930 trades per day

- January 2018: 227,417 trades per day

I have calculated the trading volume for January through the 23rd. So far it is down 44% from December but up 25% versus November.

Coins mentioned in post: