12 Reasons Bitcoin Could Fall Below $1,000

Bitcoin continues on its roller coaster ride falling from a high of $19,870.62 on December 17 to around $12,000 this morning. Cryptocurrencies and especially Bitcoin more than caught the attention of investors in 2017 when they became infatuated with it. Bitcoin started 2017 at $963.38 and ended at $13,850.40 for a gain of 1,338%. It nearly reached $20,000, coming close at $19,870.62 on December 17. This has led to Bitcoin and other cryptocurrencies getting huge media exposure and the creation of thousands of new ones. (Note for this article I’ve abbreviated cryptocurrencies as CCs.)

There are many reasons that Bitcoin and CCs could increase or fall in value but the underlying reasons should be supply and demand. I wrote an article with 9 reasons that Bitcoin’s price could rise to $100,000 or more. However since Bitcoin and the other CCs are in a nascent stage, I believe there are at least 12 reasons that Bitcoin could fall back to $1,000. It was not even a year ago, March 26, 2017, to be exact that it traded for under $1,000. To get a handle on what could drive the price of Bitcoin significantly lower I’ve outlined the reasons below.Regulation could have the biggest impactRegulators could have the biggest impact on Bitcoin and CC prices as multiple countries have either implemented some regulations or have discussed plans to limit them. If the regulations become too burdensome they could negatively impact the usage and therefore price of CCs.

South KoreaSouth Korea has implemented some regulations and is considering additional ones. A few days ago it announced that CC traders would be fined if they do not convert from virtual accounts where they could trade anonymously to real-name accounts.One indication on how much regulations could impact a CCs price is when South Korea’s Ministry of Justice issued a premature statement on banning CC trading. After the statement was corrected the price of EOS, a popular CC in South Korea, jumped 40%.

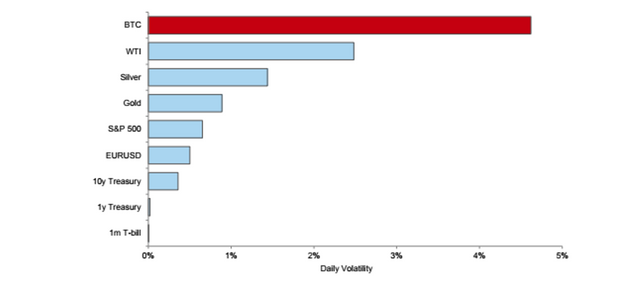

JapanJapan started to regulate Bitcoin and other CCs after Mt. Gox, a Bitcoin trading platform, collapsed and went out of business in 2014. It also passed legislation last year that legalized Bitcoin and other CCs as legal currency and an asset. These were positive steps in helping them become more mainstream but as with any legislation additional rules could be put in place to hurt them.ChinaThere is a Reuters article this morning saying “authorities should ban centralized trading of virtual currencies as well as individuals and businesses that provide related services.” This would be in addition to the country’s ban on ICOs or Initial Coin Offerings, CC trading exchanges and limits on Bitcoin mining.U.S. regulationThe SEC Chairman released a statement last month on “Cryptocurrencies and Initial Coin Offerings.” It laid out where the market is currently (wide open so investors should be very careful), what questions an investor could ask and that the SEC is very interested in this new technology.The U.S. Senate is planning on meeting with the SEC Chairman and the Commodity Futures Trading Commission or CFTC Chairman next month. While I wouldn’t expect much to come from the discussion, at least initially it could bring CCs more into the regulatory framework.The challenge with many of the current and potential regulations is that even though one or multiple countries could ban trading or exchanges it doesn’t necessarily keep investors from executing trades in another country.There is no “value” to itBitcoin or CCs don’t generate revenues or profits in the traditional sense. Miners do create revenue for themselves and traders charge a commission but a Bitcoin doesn’t do anything. There isn’t a physical presence to it (pictures such as the one at the beginning of this article are just representations) as it and other CCs are bits in computers.Since it doesn’t generate profits or cash it can’t be valued in ways that most other assets are. While a commodity such as gold can be used to create something of value, a Bitcoin resides in a computer. If enough uses aren’t eventually developed for them their demand could decrease.Volatility can create nervousnessGoldman Sachs has a chart that shows the daily volatility of Bitcoin vs. other investments such as WTI (West Texas Intermediate or oil), Gold, the S&P 500 and a few others. Bitcoin has been much more volatile than any of the other assets. This is good for traders (as long as they know what they are doing) but is mentally tough for longer-term investors. If this continues I believe it dampens demand from a wide range of investors.

Leverage can be very badThe CBOE, or Chicago Board Options Exchange, and the CME Group started to make a market in Bitcoin options last December. These can be leveraged investments where only 44% of the total value needs to be covered. While the 44% is higher — too much higher — than other future contracts, given the volatility and risks involved it makes sense. However if Bitcoin’s price moves too much it could force contract holders to liquidate, putting more pressure on Bitcoin’s price.