BTC TA (Technical Analysis) - ANALYSTS DAILY SUMMARY - JUNE, 14th

NOTE ABOUT BLOG

The blog is still in it's infancy and I ask that you guys give me feedback on analysts being reviewed, layout etc. I've removed "The Moon" and "Coin Mastery" as analysts. I'm playing around with a few analysts, so 'bear' with me. Also, I've changed the sentiment summary to an overall 'bearish', 'bullish' or mixed sentiment.

JD Marshall

Type of Trader: Medium/Long Term Trader

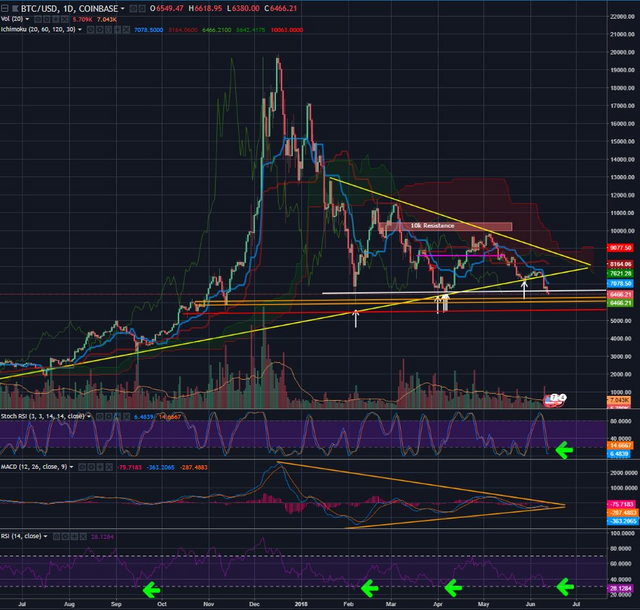

[Macro argument is that BTC is consolodating at these levels and building steam for higher highs in the FUTURE is still his macro perspective. In his opinion we're not seeing BTC reaching all time high any time soon. BTC next big resistance is the top of $9990. Since Feb. BTC's seen 3 major bottoms around the 6k-7k level. Which is an indication of forming higher lows and confirms a macro bullish trend (Green Line on Chart). Patience will be the key word for medium/long term investors in the BTC Market]

As said BTC revisited the downtrendline and even broke it to the downside, showing the massive selling pressure in the market. Marshall expects BTC to revisit the $6k bottom, but doubt that it will hold, as it's very weak support. Keep an eye on the selling volume.

@chartguys (NO NEW UPDATE)

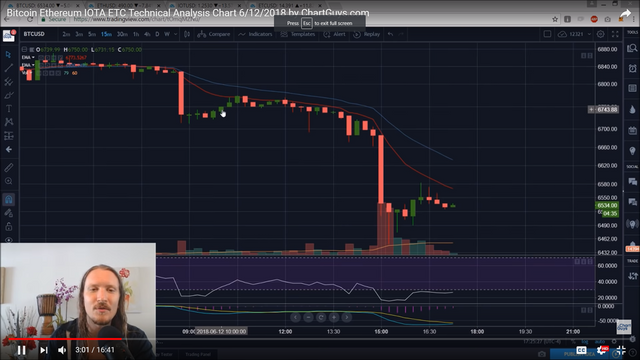

Type of Trader: Short Term Trader

MACRO TREND: Because of the dramatic sell-off and the RSI is oversold, we might see BTC recover and, before a dramatic bear break to below $6k. Expect bounces along the way to a lower low, to cool off the RSI levels.

On the shorter term (15-min chart) BTC is unable to break the 12 period exponential resistance, so watch this significant resistance. THE EMA's are brilliant guides to follow. The bears are clearly in control as long as BTC remains below the EMA's.

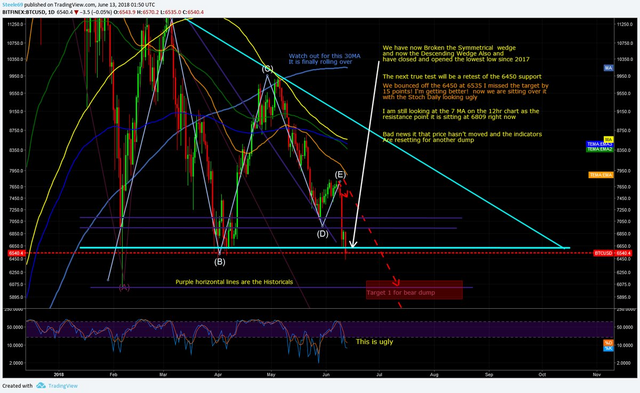

@tradedevil (NO NEW UPDATE)

Type of Trader: Short Term Trader/ Day Trader / E.W. Analyst

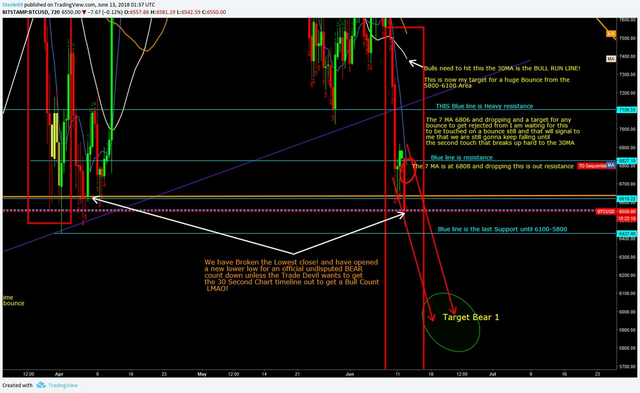

chris L $ChartVampire$ _(NO NEW UDPATE)

Type of Trader: Short Term Trader/ Day Trader

Warning POSTED already! the RSI is in the oversold Range and he;s looking for a bounce.

Lower your Stop-loss if your in a short to over the 7MA on the 12hr chart he would give it a little more room.

Targets are: 5800-6100 (Below charts for context)

Nick Cawley

Type of Trader: Long Term Trader/Investor

The weekend’s heavy sell-off continues with all tokens showing double-digit losses. The charts also look ominous with recent support levels broken seemingly with ease, indicating a floor has yet to be found. Some of the hardest hit tokens are now nearing multi-month lows, wiping out any gains seen in 2018.

Bitcoin (BTC) – Support @ $6,438 (currently being tested), $5,932 and $5,622.

While the market may be showing no signs of recovery yet, any bounce back should be treated with caution while the long-term downtrends persist in all the major tokens. We also spoke about how cryptocurrency ‘whales’ are in control of the market and how the ongoing CFTC investigation into potential market manipulation is weighing on investor sentiment.

Trading Room

Type of Trader: Short Term Trader

Chart from 10th June when $BTC price was 7294. If you postponed your buying decision, you can now get 20-50% extra coins for the same amount! Expect SLOW & BORING $BTC price action with 1 ounce & Downside resumption!

Crypto Guru

Type of Trader: Short Term Trader

Bitcoin is getting ready for a bounce based on indicators on the daily and weekly. Stoch RSI is oversold / aligned on both time-frames and MACD is ready for a breakout. Lastly, check out what happens each time the RSI gets to this level.

Coindesk Markets

Type of Trader: Short Term Trader

#BTC/USD #Bitcoin US Snapshot (1hr)

OUTLOOK: Neutral/Bearish

$BTC is hunting for support after a considerable rally from yesterdays low ~$6111

Resistance was hit at the previous support level of ~$6619 and prices have dipped to minor support ~$6368

Crypto Wolf

Type of Trader: Short/Medium Term Trader

Selling with leverage into support is a risky speculative move. If bears won’t manage to close daily below support {6430$} bulls will catch up all your stop losses.

Lord Ray (NO NEW UPDATE)

Type of Trader: Short/Medium Term Trader

BTC/USD SHORTS (4 hr chart). An absolutely textbook rounding bottom has occurred. Momentum of the shorts has taken over and we are breaking above a critical area of resistance, The RSI is currently 86 with the all time record at 90.

Also, a shout out to @famunger for his daily Analyst Summaries.