An Important and Historical Big-Picture Look at Bitcoin and Its Trendiness.

If you are completely lost with the Bitcoin market, and have no idea why the price is going down one month and going up another, you need to drop your worries for a moment and read on.

While it may seem like I'm divulging some facts that many may have overlooked - information that could give someone a newfound advantage in the markets - I am fairly confident that facts don't drive markets; emotions do.

Few people have control over their emotions when facing new challenges - especially challenges that trigger our survival instincts (despite our own beliefs otherwise) - so therefore this information might only help a small percentage of readers in the long run if I'm being brutally honest.

And on the topic of being honest, (full disclosure) I started out this post thinking that my conclusion would be all-round positive from all angles, but now that I'm done and getting ready to hit the Post button I'm wondering if I shouldn't just delete everything I've written here.

On the one hand, the information I'm presenting in this post is a little more hardcore than usual and may scare some people, while it might get other people really excited. I like to stay positive unless there's a reason not to be, and right now I believe the condition of the market is quite positive and I'm not worried in the slightest for the next year or so. We are entering a new phase of Bitcoin's speculative lifespan, and there is a lot of money to be made in the cryptocurrency space as a whole in 2018 and beyond.

On the other hand, if someone is investing money they can't afford to lose, then they are creating their own FUD by putting themselves in a horrible and emotionally ruinous position. How can you make money when your decisions are based on your fear of losing that money you need in the real world? This is the group of people that most concerns me, because they will be the one's most likely to lose their shirt in a speculative market, and then blame someone else for it. I don't care that they could blame me, but rather that they might be jeopardizing the well being of their loved ones that depend on that money (if they have any loved ones). To put it bluntly, I don't care about the idiot, but the people who the idiot was supposed to be protecting.

So in that light, this post is for entertainment purposes, and I am not giving financial advice to anyone. Nothing in this post should be considered scientifically or mathematically sound, and anyone investing into a speculative market is going to eventually lose all their money if they are depending only on the advice of others, and this is because at some point their emotions will get the best of them, and they will stop taking the advice of others, and they will sell at a loss. This is exacerbated if someone is investing money they cannot afford to lose. If you ignore this warning, you have only yourself to blame if you lose your shirt.

So... with my gabby preamble out of the way; on to the meat and potatoes of the article.

I've posted this jaw-dropping chart before, and I promised I would keep bringing it back from time to time. This is Bitcoin's history as recorded by the Bitstamp exchange. You're not going to see a lot of Technical Analysis on a Monthly Chart like this one because a lot of the indicators go all haywire, with a few exceptions. In this chart, Bitcoin is following what is known as a Rising Wedge or Ascending Wedge. I'll get into that later.

.png)

There's a few things to notice with this chart.

first, each peak cycle so far has spanned about 3 years, give or take a month. This is not particularly surprising, as markets are primarily governed by human emotion, and human emotion follows an almost pre-programmed pattern of behavior. In fact, it is mathematically consistent that we follow waves of behavior patterns collectively; all animals do.

Second, you might notice that Bitcoin has always remained inside this triangle. I mean, it is like clockwork. The triangle didn't exist beforehand, and yet in a way it did. If you compare Bitcoin to Gold, they follow a near identical pattern of growth (albeit Bitcoin's growth is exponentially faster).

But therein lies the kicker; once everyone starts to notice a pattern of behavior in a chart, it's not going to necessarily be predictable next time. After the first peak, the price of Bitcoin crashed hard. Very hard. We're talking a 97% loss in market capital for Bitcoin from the top to the very bottom. People who bought at the top (temporarily) lost almost all their investment.

This first crash was like manna from heaven for those that had missed the first run entirely, as they could buy in for pennies on the dollar, confident that the price would eventually hit 100 dollars again and keep on going.

They were right. The next peak hit around 1200 dollars, or a 40,000% increase from the last bottom. There is no other gain you can make in the real world (aside from robbing someone) where your gains are that great in such a short period of time.

But I wonder... how many of those who bought at the first peak of $100, are still holding those Bitcoin now?

But after the second peak the Market again crashed, but not nearly as hard as the first peak. This time, the price dropped down to 300 dollars, or by 75%. But again, those would bought at the second peak were not necessarily losers, as they could still hold and make money on the 3rd peak.

The Third peak, which happened just a month or two ago (at the time I'm writing this post), hit almost 20,000 dollars per coin, or a 66,666% increase from the last bottom. Even those who bought at the 2nd peak made 16,666% if they held.

But I wonder... how many of those who bought at the second peak, are repeating themselves like a broken record.

So we are now past the 3rd peak, and the price of Bitcoin is trying to find the bottom once more. If Bitcoin were to plunge to the very bottom of the triangle today, it could hit $2400 dollars.

I can just hear some people screaming right now:

"Oh Gawd! No!! Stahhp! Don't talk like that!!"

What? It's not like I can control the market by saying that, lol. If it happens, it happens. It's the people who are shocked by an event that end up panicking, so accept all possibilities and you'll make better decisions and feel better when the unexpected happens.

But here's the thing; if the price of Bitcoin were to drop to $2400 dollars tomorrow, would you buy? I mean, if it dropped that low it's dead right? Why would anyone buy a dead coin? Then again, why would anyone have bought Bitcoin for 3 dollars after the first big crash where the value dropped by 97%?

It's funny because the last question completely flies in the face of the ones before it. It shows that no matter how logical we think we are, and how prepared we are for the inevitable, we are not prepared to fight our own emotions and survival instincts in the moment.

Our survival instincts care about the short term. Survive.

Oh gawd Bitcoin is crashing, get out now!

Meanwhile, sitting on the sidelines are those who were watching the zoomed out chart and saving up money to buy up the bargains. The same people who were there buying Bitcoin for 3 dollars after it crashed the first time - were likely there again after the second crash - waiting and watching for the price to reach it's bottom again to buy in.

what about this time? Certainly those people who bought at 3 dollars and 300 dollars have made their money and have moved on? Why would they buy in at $8000, or even $5000 if it dropped that low?

You can be certain that those who have been panic selling for the past few days (or weeks) are selling to the very same people who bought the first crash and bought the second crash. Then, when Bitcoin goes on another Bullrun these people buy back in from the very people they previously sold to for a lower price.

So what's the morale of the story?

No, it's not to wait for the 4th crash, because maybe the 4th crash will be a breakout down out of the trend. Remember what I said earlier about patterns and predictability. Now that the pattern is clear to anyone looking at it, it's now going to disappoint anyone expecting the usual outcome.

Look at this graph

Oops, wrong link.

Look at these pictures:

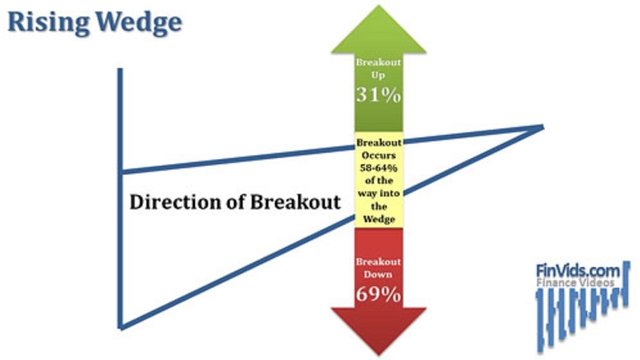

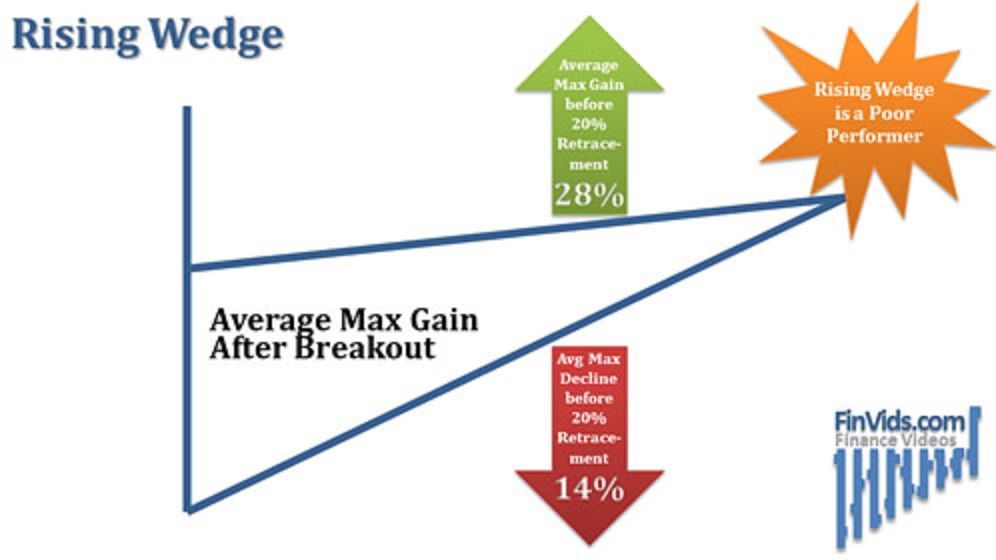

This picture shows the percentage of how often a rising wedge breaks out up or down.

This picture shows the average gain or loss in price from a breakout in either direction.

This rising wedge pattern is not a bullish pattern, and has only a 31% chance of breaking out in the up direction. Even if a rising wedge breaks up out of the trend, it's potential breakout is statistically not going to be very profitable.

The last tidbit of information about rising or ascending wedges, is that they will typically breakout in between the 58% and 64% mark along the trend. That doesn't mean they have to, it just means that the pattern has the greatest potential to breakout during or after that point.

<insert random comic strip>

Let's figure out a rough estimate for that:

Assuming the pattern started June 2010, and would reach the tip around October/November 2023, that leaves us with a total of ~13.25 years, or a total of ~159 months from the start of the pattern to the very end where the trend lines meet up.

Doing rough math, the 58% mark would be roughly 92 months, and 64% would be roughly 102 months.

Right now, we are currently in the 92nd month, or at about the 58% mark, so we at the beginning of that zone. The 64% mark would land in June or July 2019. That gives us just under a year and a half for things to (potentially) get wild. I personally expect Technical Analysis to be less accurate during this period, and maybe even reaching a crescendo of insanity by mid to late 2019. But don't take my word for it, I'm only guessing.

So what does any of this mean? And, does it mean Bitcoin could drop out of the rising wedge? Statistically, yes it probably will eventually.

As we saw in the picture above for the rising wedge, the average loss after dropping out of a rising wedge would be about 14%. not really that bad. If that happened right now, that would bring Bitcoin to about $2000 dollars. If the pattern drops out in mid 2019, then about 10,000 dollars. Still not that bad.

If that happens at any point, we could then see a declining wedge form after that breakout, which would then be a very bullish signal. Despite it being a bullish signal, you would still see people panicking. why? Because they have money invested they can't afford to lose, into something they don't understand. Their greed created their own FUD, not the market.

That should almost be a greeting message on every Bitcoin Exchange: "If you invest money that you cannot afford to lose, you will panic at some point and lose your money." (you could then insert a picture of someone saying "Duh!", but maybe that's going too far.

So either way, if Bitcoin were to actually drop to the $2400 mark or even break out below that, this does not mean Bitcoin is dead, but rather it means we would be getting a golden opportunity to buy and make massive profits. At least, that's the way I see it.

Worst case scenarios aside, I personally don't believe Bitcoin will go that low for this third crash, but if it did I would be excited for the long term. As I've said in the past, you make money on the percentages.

I don't know the future though. If I did, I might be inclined to keep that knowledge to myself because I wouldn't want to affect the timeline. But even then, I don't think you could effect the time line because markets are not controlled by facts; they're controlled by emotions. They are designed to move money from the hands of the impatient into the hands of the patient.

Thank you for reading. Hopefully this has left you with more confidence in your crypto position (if any). If not, I'm positive this post will provide some insight for those less experienced in this market.

if you want to be more proactive in this community, try using steemfollower (sign in is done through steemconnect using your steemit name and your private posting key - found in your wallet under permissions). This Video will explain how the program works. It is a great way to motivate you to produce great content, and to reward others for producing great content.

Tip Jars:

Dogecoin DDizpbLrYzFNEZtEVvUXo8kKBKu3K7yLry

Bitcoin 32p67yperYxM8dEFXESL3oeBcEn4qP32cQ

Ethereum 0x54c0387Fd48Dc8D48D30069be2e18756b8d203A5

ETC 0x067511c327Bc68b73726F4410fEAdb47ed396425

Ubiq 0x3EDb86c57f7f495aE0963855Cc37BA64B40C7685

.png)

2018 is promising to be a momentous year for the crpto industry. it will must show sustainability and deliver better fungibility.

If you recall a few months ago we were sitting right here and bitcoin was under $8,000.

It shot up to $20,000 in less than two weeks so this is nothing new. The price will boom🙂

Great thoughts and observations. I've held onto my bitcoins through all the crashes, but I also lived on my bitcoin savings even while the price remained "low" between 2014 and 2016.

I wrote up a bit on my personal btc history today... check it out. https://steemit.com/bitcoin/@doctorrevelator/my-bitcoin-story-a-little-bit-about-how-i-first-got-into-btc

I've said this several times already, but so far, 2018 is feeling a lot like 2013 did.

Very good Call.

I think a lot of people are saying okay this happened last year and then "Boom"

Now they are just expecting same to happen repeat of last year without looking at the bigger picture.

People forget that someone who bought Bitcoin for $300 had to wait about 5 years have those millions.

It is good to see what happened in 2013, 2014 and at least base an analysis on a broader Scale.

Wish I was younger to wait this out hah (like freshman in college :)

I won't be suprised if this whole entire year goes sluggish.

It is just better to face reality.

One thing is for sure. Whatever happens, its not going to be predictable.

If it was Predictable,

For example If everyone knew what was going to happen in 2017 then every single person would be Rich.

I can't say for sure if there is going to be another Boom again like last year. (20X)

But one thing I can for sure is whatever is going to happen its going to be ""UNPREDICTABLE"" So fasten your seat belts and I want to be prepared for both "flying to the Moon" or "Free Falling"

But I get your point. I feel like I can predict the long term but i think no one one can predict short term on this stuff.

Money will move from impatient to "the patient"

The funny thing is that no one knows how "patient' they will be, only time can tell. :)

Hi friend, extraordinary post with very good quality information that motivates me every day to follow your ads helps me learn easy things but I did not know them thanks

Coins mentioned in post:

Incredible publication my dear friend, you make our work easier, you explain things very simple and easy to understand, I like many your posts and I follow them every day, I hope you keep growing every day more, many greetings bro!

Thanks, I really appreciate that! It gives me motivation to keep at it.

You are like half crypto guru and half crypto counselor.

I am NOT selling my coins to the whales causing this crash to make more profit on the upswing again.

(I also wanted to post to say thanks for the steembasicincome sponsorship. I have paid it forward and sponsored someone else I feel has good content. Thanks again for the support and great articles in my feed)

wow, thank you, that's very encouraging. Sometimes I wonder if I'm just trying to punch above my weight in cryptoland TA, but the feedback helps me keep at it.

No worries about the sponsorship, I was also passing it on. Interesting concept, like an upside down pyramid.

We have seen crashes countless time , still btc manage to reach new Ath . I am not selling if it goes even lower .

i think best crypto info on steemit

wow, thank you!

Great post! Thanks :)

Thank you, Appreciate that!