How and why to invest in bitcoins, the new refuge asset

In a time of high volatility and uncertainty due to the latest economic and geopolitical changes, investors around the world are focused on giving the key to some safe haven that allows them to protect their savings.

The market is immersed in a level of uncertainty rarely seen, due to the uncertainty aroused by Donald Trump's economic policy in the United States, as well as the possible effects of the rise in interest rates of the Federal Reserve ) On 15 March and electoral events that could shake Europe this year, such as the elections in the Netherlands (March 15), France (April 23) and Germany (September 24).

In the market these issues have been contemplated since 2016 and for that reason, many have since chosen to seek protection for their investments.

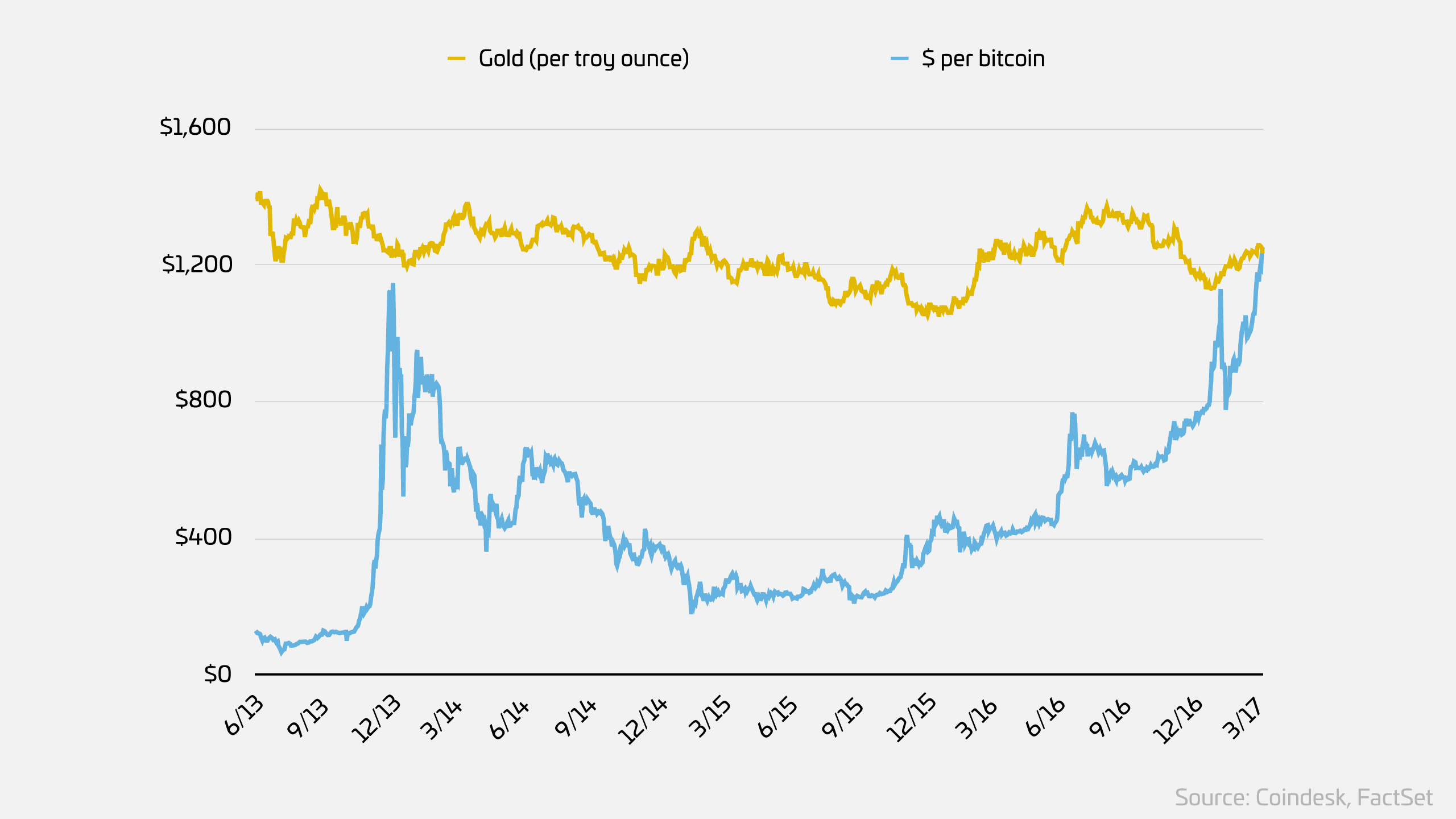

However, to everyone's surprise, gold has not been the most demanded alternative as a safe haven: the precious metal is being displaced by bitcoin . E-currency has become so popular that it has outperformed the commodity in terms of value.

What's new with bitcoins?

Bitcoin is the most popular cryptomoneda on the market.

It can be bought freely and without intermediaries. Unlike ordinary currencies, it is not impacted by inflation or devaluations, as it does not belong to any state.

Last year, the electronic currency began to be on everyone's lips thanks to its strong revaluation, given that in 2016 this currency appreciated around 79%, standing above $ 730 per unit.

In 2017, the rally has been sustained and in the first two months of the year, the bitcoins reached a price of 1,000 dollars, which began to hit the heels at the price of gold.

Greater acceptance of the cryptomoneda in the markets, the slowdown of its offer, as well as the increase in the control of capitals worldwide were the explosive combination that triggered the price of bitcoins. But his progress did not stop there.

Recently, the bitcoins accelerated again their escalation, and in their new historical highs has clearly left behind the quote of the ounce of gold.

Bitcoins vs gold as an asset refuge

Since its resumption, the bitcoins accumulate a 125% revaluation.

With this rise that puts it above $ 1,280, the currency marks a new record and far exceeds gold, which is currently in full correction.

The latest Fed messages triggered expectations of a rise in interest rates at the March 15 meeting as dollar hikes slowed gold prices below $ 1,230 an ounce.

Recently, more than 90% of the operations on the virtual currency have been made from China. The spectacular increase in interest in bitcoin in the Asian giant has occurred in parallel with the drop in the Chinese yuan .

The 125% rally that hit bitcoin contrasts with the 7% drop in the yuan during the same period, its biggest annual decline since 1994.

Chinese investors who are not resigned to the depreciation of their currency have been the most active in seeking an alternative in the bitcoin to the point that the Chinese authorities tightened their controls to avoid a capital flight

The proponents of bitcoin take advantage of the wind in favor of describing the current scenario to highlight that the virtual currency is consolidated as a kind of digital gold.

Therefore, bitcoins are an interesting alternative shelter that is gaining more and more confidence in the market, and you can consider it among your financial options to protect your savings.

Very good information. As you can see is another alternative of savings in this criptomoneda, apparently the conditions are given to do so, thank you @briansss for this interesting material and your point of view