Who Will Win The Internet of Money?

Remember the 90's? I do, it was a glorious time of the cheesy Disney coming of age characters and the beginning of The Simpsons. Everything was pretty great but there was a new technology on the rise that was changing the world as we know it. The Internet was the brand new speculators market for Wall Street and the profits and losses where record breaking, better knows as the dot-com bubble.

The US Stock market in 2000 was full of stocks like pets.com and a social network theGlobe.com. Use those sites ever? What we do all use is Amazon, Google, and Netflix. These companies are not currencies, they are equities.

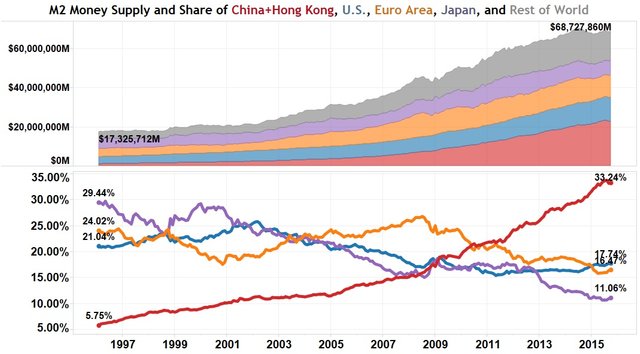

The new tech stock, cryptocurrencies, is a hybrid of equities and currencies. So how do we compare the past to today? A good place to start is to look at global monetary supply (M2)in the year 2000 the global M2 was $20 Trillion and as of January 2018 it is at $90.4 Trillion.

The central banks around the world have one trick, print more money. The trend is exponential, a doubling every 7 years. The market cap of the cryptocurrencies is $0.750 Trillion in January 2018, 10 years after the creation of Bitcoin. The trend is also exponential but the doubling is occurring every year. My estimation is that there will be $1.5 Trillion in cryptocurrencies in 2019. This basic theory results in an approximate convergence in 2025 when M2 is equal to cryptocurrencies at $180 Trillion. I base it upon the most basic linear tread line, which has obvious flaws. The cryptocurrencies are going up in price because the supply of currency is going up. According to Mr. Antonopoulos, money is exiting one system and going into another.

This is not the end of the global wealth story. We must also factor in global real estate, stocks, bonds, derivatives, and debt. Populations in China, India, and the USA also still continue to grow. The reality is that everything seems to be increasing, including cryptocurrencies.

What cryptocurrency will be the Amazon or Google that will emerge from the pile? The market will decide, not a quasi-governmental institution called The Fed or the globalist IMF. Just a short rant. My strategy is to try and actually use the cryptocurrencies that I have invested in. How is the user experience? Is it a valuable service? What is the potential for future growth? Asking the right question is often harder than finding the correct answers.