The Next Mark Zuckerberg? Interview with Founder of Bitquence, Shingo Lavine

Bitquence has the ambitious goal of bringing cryptocurrencies to the masses. In this exclusive interview I ask Shingo Lavine the hard questions which media outlets don't ask. I spent 12+ hours researching and writing the most comprehensive review about Bitquence that you will find, putting me in a position to ask some of the toughest and most interesting questions. You won't find these any of these questions and answers in any other interview online, I know since I've read and watched them all.

If you had 10 billion dollars to your name, what would you do with that money? How would your life change?

Well first, I would diversify to make sure I’m not overexposed to the dollar.

Second, I would donate half of it to worthy causes since no matter what I do, I won’t need 10 billion dollars.

Third, I would take 2 Billion and start a VC fund investing in early stage fintech/blockchain technology companies. I believe that blockchain is a new paradigm in computing and has the ability to improve many aspects of our society.

With the remaining 3 Billion, I would put 1 Billion into investments diversified across blockchain assets and stock/bond market and use the last 2 Billion to fund any crazy ideas that I thought had any potential.

You mentioned in your interview with CryptoFizz that you were very excited about the ledger of truth and the potential for decentralised applications in relation to blockchain technology. What applications exactly excite you the most and which do you think have the most potential?

What I was referencing there was using blockchain as more than just a store of value, but as an uncensored, untampered repository of information. Factom is using that to help banks comply with regulations and make banking more transparent. Zencash is using the blockchain to create a secure, uncensored publishing and messaging platform. Ethereum is creating decentralized applications. I think in the future we are going to see even more interesting projects with interesting new applications.

What makes you a great fit for the CEO of the project compared to other team members? What would you say to people who say you are too young to be the CEO of a project like this with many other older and more experienced team members?

This isn’t the first project I’ve pulled together and I know a lot more about business than most people expect. A number of business journals have said that the difference between most executives and employees is the ability to get “it” done, no matter the circumstances. Also, at the end of the day, nobody really cares how old you are if you can deliver results. I’ve assembled a team of highly experienced people with an exciting mission and once people see what we can do, I don’t think anyone will care how old I am, after all, Mark Zuckerberg founded Facebook at 19.

What is the biggest business challenge you faced in your life? What did you learn from it and how did you overcome it?

The biggest challenge has always been budget. How do you get the most mileage out of a limited (if not almost non-existent) budget and build something that feels real out of it? The answer is usually two-fold: hard word and negotiation.

In Jobs University, we were developing courses on an enterprise LMS called Totara that normally costs thousands a year, but we got for free by having someone by having them buy into our vision and believe in what we were doing. All the hard work you put into an endeavor is usually to keep the costs down until you have a revenue stream to scale up the process. For Jobs University that meant painstakingly writing, recording and editing every single lecture and piece of course content by hand. We ended up putting the JU project into steady-state on Udemy and made it into a passive income stream that could fund future projects like Bitquence.

How much time will you spend on Bitquence compared to your studies at Brown University or your latest project Jobs University? When will you graduate?

I'm planning to get Bitquence to the point where I don’t have to commit to it full time and have dev be cranking out features for the roadmap. I plan to complete my studies at Brown and graduate in 2020

You stated that you, Link, Adam, Dennis and Pete are working full time on the project. Where are you all currently situated?

Me, Link, Adam, Dennis and Pete are working full time on this project. The core team is situated in silicon valley.

Several of the team members of the Bitquence team including yourself were involved in Funmobility, with Dennis being a key player there. Are you all still working on Funmobility?

I am not currently working at Funmobility anymore, but Dennis is. Funmobility is transitioning to be recurring revenue without much maintenance and the dev team was looking for a new project to work on. They saw the opportunity in Bitquence and jumped on

You are the CEO of a company in which your dad is working. Have you both worked together on projects before? Do you foresee any potential issues?

We both worked together in Jobs University, Funmobility and Motzie and we work very well together. We have never had any issues working together in the many years we have done projects

I read that the first cryptocurrencies which will be available in the wallet will be voted on by the community, is that correct? Can you elaborate on that, i.e. what will the cap of Number of currencies be for the beta version?

That depends on how much the developers want to take on and how much they want to work on currency integration versus other features

We are going to be focused on the low-hanging fruit first (Bitcoin, ETH, ERC20 etc.) and then get feedback from the community on what they want

The whitepaper states that Coinbase keep 98% of their funds in cold storage whereas Bitquence has assets which are more liquid and transferable. What % of your funds will be kept in cold storage?

This depends on how much outgoing versus internal transactions we have to process. If the liquidity network works as envisioned where almost ALL the funds are kept in cold storage because the transfers happen over the network.

Expense ratio fees in hedge funds usually are made up mostly of the fund manager’s fees. What will your revenues from these fees be spent on?

Expense ratio is being turned into gas fees to maintain baskets. Part of these fees will go towards operating expenses and another part will go back to the community through the proof-of-stake pools that reward people participating in the consensus process.

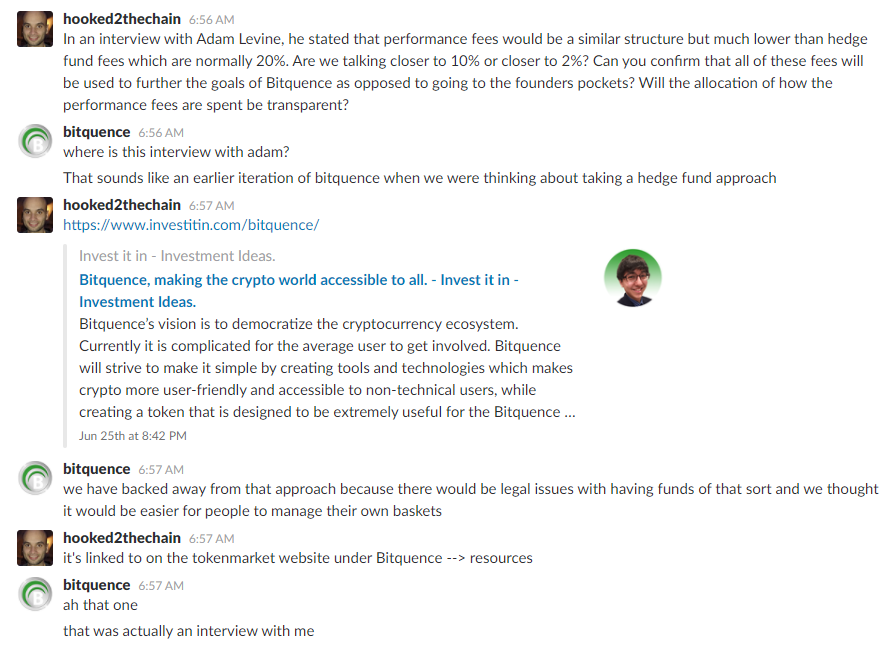

The following question was based on this interview

To my readers, I hope you enjoyed this interview and if you want to still join the tokensale, there are less than 12 hours to do so and you can buy them here

If you enjoyed this interview and want to find out more then the most unbiased resource you will find is this review of Bitquence in which there are many links to the official Bitquence websites.

Be sure to upvote & resteem this interview and follow me on Steemit for more quality cryptocurrency articles and interviews.

Enjoyed reading this! I got in on BQX a little late ($1.05). Well if it goes up and up as many have predicted I'm still pretty early :)

Indeed, once they get their working product up and going, BQX could explode again.

Good article. I invested in Bitquence and I hope the do well.

Great times ahead for bitquence. So exciting, can't wait.

Awesome article. I went back four time to reinvest in the bitquence ICO. (Bummed I didn't just do all four ETH when they were 5000 BQX/ETH.

I am extremely excited to watch this platform grow and be part of the coin ranking process. That's what I'm most curious about regarding the project.

If they can capitalize on even 10% of coinbase' market share, this will be a homerun. But I think, in order to do that, they have to get approved for fiat instant deposits. And we all know how much of a pain in the ass that is in the US. Shingo did tell me that was their ultimate goal. As a wallet and investment platform, this has the potential to rise to the top.

Thanks for the info!

The value of bitcoin is really appreciating and giving one the zeal of exploring, the for the piece @macdonaldfebi