Scary Smart Theory on Crypto Market Manipulation -- Must Read

I can not claim credit for this brilliant analysis. Found while trolling the cryptoverse.

maybe the author should make a Steemit account :P

My theory is that the crypto markets, being unregulated and volatile, are just what institutional investors have been looking for. For the past few years they've been starved of volatility due to stagnant equity markets.. a common investment to have in the portfolio of a hedge fund is XIV, an ETN (exchange traded note) that increases in value as the volatility of the stock market decreases.

The question is, how do they enter the market without causing a massive bubble and thus exposing themselves to significant risk? The crypto market cap is currently very small in comparison to other markets. They need to take control of the supply.

Step 1 - Accumulation

Accumulate loads of bitcoin at low prices (sub 8k), buying without making it look like you're buying/driving the price up. This is done by buying when other people are selling. e.g.

Jamie Dimon calls bitcoin a fraud, Institutions sell off some of their stockpile to spark a sell off, 8% drop the next day, weak hands get scared and sell their crypto as well creating a snowball effect, Institutions buy back more crypto than they sold, so they have a net gain without driving the price up too much, The price of bitcoin recovers quickly

I believe that this was repeated for most, if not every boom/bust bitcoin had in 2017, only the news each time was different. They wait for news to sell to make a crisis seem much worse than it is and to persuade retail investors to sell.

Next phase - the mark up

Once they have accumulated enough crypto, they start to really pump up the price - Bullish news comes out - e.g. bitcoin futures rumoured to be launching in December - Institutions start pumping the price, mainstream media covers the rise, new investors get involved, this causes the price to go parabolic to 20k

At this stage, the big investors are sitting on a pile of bitcoins, with a cost average of probably way under 10k per coin. Yet, they still have a small percentage of the overall number of bitcoins in existence. To lock in profits, bitcoin futures release and they short bitcoin futures at 20k which hedges their positions without tanking the price of bitcoin.

Distribution phase

They slowly sell their bitcoin without driving down the price, this is done by spreading bullish news and selling on the rallies. This is why the price increase seemed to be slowing down between 15-20k. (If you know how to interpret technical analysis, there is huge bearish divergence in the december charts which indicates that there was more selling going on than shown in the price alone)

They then dump the majority of their bitcoins onto the market (See flash crash from 20k-10k) but of course this gets bought up as people are accustomed to 'buying the dip' on 50% flash crashes. The institutions are now net short.

The price returns to the highs but any good trader would've been able to spot the divergence using TA and would probably sell/short at the next top (bull trap)

Step 3- Taking control of the market

FUD begins to show up (south korea ban, bitfinex/tether). Every time new FUD comes out, the institutions dump some more of their coins with the intention of driving the price down. They still turn a profit on these coins as they were accumulated at low prices. This goes on until the end of Jan and people begin to panic as this doesn't feel a normal crash. People are still in denial and blame it on various reasons (christmas holidays, chinese new year, futures manipulation)

By this point, the price of a bitcoin is approx 10-12k and the institutions have made profit twice - from shorting the futures at 20k to 10k, and from selling bitcoins between 15-20k that were bought at under 10k a coin.

Most of the bitcoins are now in weak hands i.e. investors who got in at 20k because of FOMO. The institutions proceed to dump the rest of their bitcoins on the market and drive the price down to a range where they will once again accumulate coins (5-10k). They time the dumps so that it wrecks any technical analysis or previous trends. People are not convinced that this is a normal crash and begin to panic.

When the 'bubble' reaches the capitulation stage (5-7k) the institutions begin accumulating again. They buy until it reaches the top of the range, and then they set up huge buy walls (support) on exchanges. They then sell into their own walls with huge market orders that scare retail investors into selling, driving the price down to the bottom of the range.

They manage to keep the price rangebound until the strongest handed retail investors get bored/frustrated and sell their assets. At this point, the institutions have a huge share of the cryptocurrency supply and are ready another mark up phase which they coincide with news events (SEC meeting, litepay, etc) to give it the impression of a genuine recovery. This time round, they have a large share of the supply and the strongest HODLers are hungry for coins to 'buy the dips'

Why do they need a big share of the market? Because if institutions all entered the market at once, the market cap would be in the trillions and a single bitcoin would probably be worth 100-500k. You would still have people who invested early on and had thousands of bitcoins. These people would be able to tank the market at any time just by selling a small fraction of their holdings. This is an obvious risk for institutions who wish to get involved with actual crypto, rather than crypto derivatives.

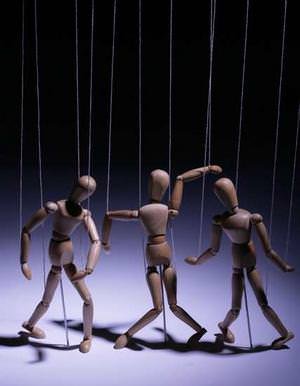

This is a good example of market manipulation:

More info:

https://steemit.com/bitcoincash/@michiel/be-careful-with-bitcoin-cash-all-the-value-is-created-by-manipulation-and-it-is-not-bitcoin

Spot on. During the rise from Nov to the drop in late dec everyone was all ecstatic. And it's clear that's institutional money pumping it only to pull the rug out to like you pointed out to make money or what I think to weaken the confidence in the commodity

I know that's my take and I think many others.

What happens if a good chunk of the market knows about what they're doing? Is #HODL actually a battle cry in the new economic warfare?

For those who believe in the technology, HODL on. It's for those new people looking to jump in that the banking cartel are trying to keep out by undermining the market. And your right it's economic warfare- and they have nearly unlimited printed paper to manipulate with. And we saw how far and how fast they can take it. With that in mind, know the support levels. Particularly the one before the huge pumps go in.

#HODL is only good if you are willing to accept that which you invest in may never see the initial investment return. Sell off at lows is only good if you believe your sell off put into another market/crypto will off set initial losses. Its a game and one only to be played among those willing to take the calculated

risks

Everything happens for a reason and this theory might not be that far from reality.