The Cryptoeconomy Rally

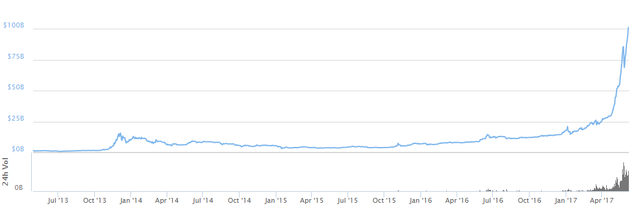

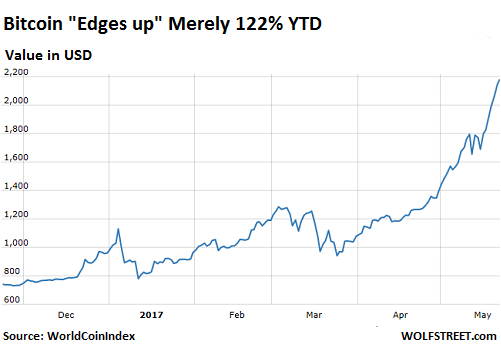

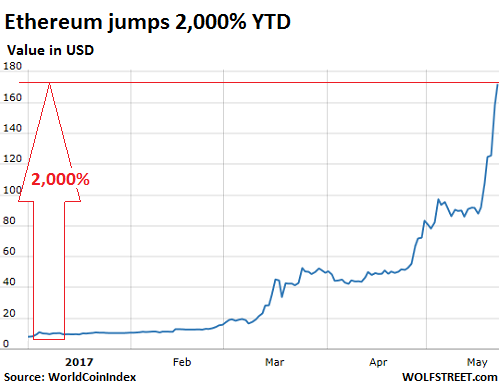

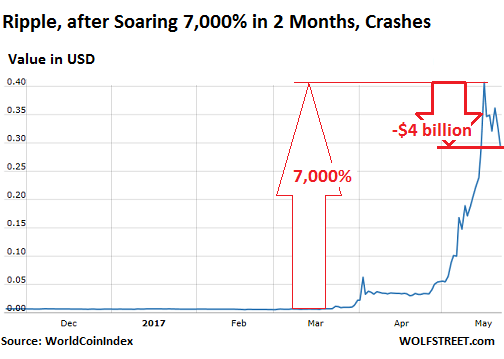

The recent growth in the cryptocurrency market has been breathtaking. In less than two months, the price of Bitcoin has doubled, but compared to many other cryptocurrencies, Bitcoin has almost been standing still. Since the altcoin rally started picking up the pace in mid-March, several major blockchain tokens have risen in value more than one thousand percent. Most notably Ripple (XRP), valued at $0.005 (half a cent) in the beginning of March, rose almost 10,000 % to a high of $0.42 (42 cent) on the 17th of May, seeing its total market cap surpassing 16 billion dollars on that day. If that was not enough, the cryptocurrencies Stratis and DigiByte received the public’s attention even more recently, reaching staggering price gains of 10,000 % and 20,000 %, respectively, from only three months prior.

(source: coinmarketcap.com)

The staggering rise in price has obviously created massive attention towards the cryptocurrency space, and the massive coverage in turn creates even more demand this modern asset. In this article, we will take a closer look at some of the key factors behind the latest overwhelming increase in value.

A brand new asset class

The cryptocurrency market comprises different types of projects, with Bitcoin being the cornerstone. However, it is being challenged by an increasing number of new projects. Among these are other types of coins which focus on anonymity, storage distribution, solar energy and transaction capacity to name a few. There is also a new trend with startups issuing their own cryptocurrency or blockchain token, in addition to or instead of a traditional company share, when crowdfunding new projects.

(source: cryptocurrencybitcoinnews.com)

Many of these cryptocurrencies are offered through so called ICOs (Initial Coin Offerings), similar to IPOs (Initial Public Offerings). Rather than shares, the company issues a cryptocurrency, which is often linked to the company’s own blockchain or decentralized application (Dapp). Another term for ICO is ITO (Initial Token Offering), but ICO is most commonly used. A “share” issued as a cryptocurrency is significantly more liquid than a traditional share since it can be easily traded as a currency. It is as if our paper bills were actual securities and we used Apple stocks as a medium exchange in the grocery store. Thus, many of these cryptocurrencies can be considered to be something in between financial instrument (security) and currency/money.

One of the most important differences between traditional financial instruments and cryptocurrencies/blockchain tokens is the extreme low barrier of entry. The world of crypto finance is almost completely unregulated across the planet. For instance, there are strict requirements in the United States to become an accredited investor. On the ICO market, however, there are no restrictions for retail investors as to how much one can invest in startup projects. This is because the cryptocurrencies do not have the status of financial instruments. Thus, the “stocks” can be traded freely without brokerage, fees, contracts or KYC requirement procedures, to name a few.

An insight into the liquid nature of cryptocurrencies

There is an ongoing race for developing solutions that facilitate Bitcoin/fiat currency trades. For the average person, acquiring Bitcoin can still be seen as a bit of a hassle. However, once you own Bitcoin, all of the other cryptocurrencies become readily accessible. It is very easy to transfer Bitcoin to trading platforms such as Poloniex and Bittrex, on which there is an unlimited supply and where trades can be executed almost without transaction fees.

The alternative cryptocurrencies (altcoins) are experiencing extreme runs and dips in price. However, this is nothing new in the world of Bitcoin. From being worth just a few cents back in its early days (2009/2010), Bitcoin has gone through several hype cycles seeing its value increase by orders of magnitude in the course of days or weeks. In relative measures, this year’s price increase of 100-200 % is not particularly sensational in Bitcoin standards. Bitcoin’s volatility index is decreasing steadily, and day-to-day changes above 10 % are now rare.

Enormous price movements in altcoins, however, do occur frequently, and the minds of people who regularly use the exchanges may be subject to desensitization. While daily moves of 10, 15, 20 % are considered dramatic on traditional stock exchanges, these numbers are nothing to get excited about in the crypto space. A token doubling its value in 24 hours is not particularly noteworthy. Over the last few years, with an increased frequency there have been coins shooting up several 100 % in just a matter of hours. In this highly volatile market, Bitcoin thus becomes the “boring” cryptocurrency that is the least attractive to speculation since it is the most stable one.

In this very early cryptocurrency phase, which is regularly compared to the internet in the early ‘90s, traders get incentivized by the low friction to spread their money across several cryptocurrency projects in the hope that maybe one of them goes viral. The cryptoeconomy is like a global casino where droves of new people from all over the world are continuously pouring in, and everyone is trying to be first in line to the newly opened tables. Tales of people who have earned a thousand times their initial investment lead to a self-perpetuating spiral of greed. In this environment there is not much room for the relatively slow and conservative Bitcoin.

If one regularly checks in on the various cryptocurrencies and how they trade on exchanges, we typically find daily increases of 10 % or more, creating an expectation that this kind of volatility is normal. As long as most of the numbers remain green, the self-selected youth who like high-risk investments become even less risk averse and move into trades with even higher risk, at a faster pace. The boredom of “low-yield Bitcoin” and the hunger for newer, faster and riskier investments, frictionlessly pushes money over the low barrier into ever more risky cryptocurrencies. At the time of writing, over 250 different cryptocurrencies are valued at over 1 million dollars.

Cryptocurrency in a global context

So far, we have explained cryptocurrency as a new type of asset class and how it is characterized by its extreme liquidity. But how does one explain why the market has skyrocketed in the past 6-12 months? In a global, unregulated market such as the Bitcoin market, no one can give a clear, unambiguous answer, but there are probably several factors at play. One is that, during the course of the year, Bitcoin has achieved recognition from governments in a number of countries, including Japan, where in April, the authorities stated that the currency is now to be regarded as a legal payment method.

The announcement was immediately followed by a large spike in the price. During the following weeks, the sharp rise in the demand for Bitcoin in Japan caused the trading volume in JPY to match the USD volume. In Norway as well, the year started out well for Bitcoin, when the tax authorities officially removed sales tax from Bitcoin, similar to EU regulations.

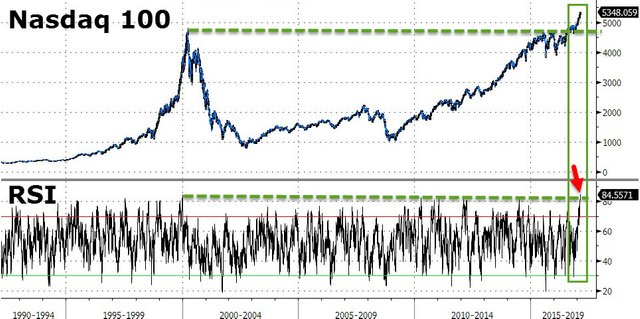

As mentioned earlier, blockchain technology is now said to be at the same stage as the Internet was back in the early ‘90s. At the moment ever more ICOs are launched, and and many consider purchasing blockchain stocks as once in a lifetime opportunities. We all know how the dot-com story played out, but still the market was bigger after the bubble burst than only three-four years before, not to mention that the technology-based Nasdaq Composite index as of today is higher than it was back at its high in the 2000 rally. It is not unthinkable that blockchain will go through a similar cycle, with a giant wave-top hitting in the not too distant future.

Moreover, Austrian School economists predict that today's debt-based monetary system is not sustainable and that a major global currency crisis will occur by the end of the decade. This is referred to by the passionate, precious metal enthusiast Mike Maloney as the biggest wealth transfer in history. It is expected that the faith in money issued by central banks will drastically fade away, as attempts are made to prop up the economy by interest rate stimulus as well as the purchase of government debt (quantitative easing), by creating ever more money out of thin air. Gold and silver are predicted to play a key role in this transition, and since Bitcoin is limited in its amount in addition to being outside the financial system, many people think Bitcoin will become a safe haven asset when the market tumbles.

Additionally, the limited supply makes Bitcoin a so-called deflationary currency, where the value per unit does not diminish over time, in contrast to today’s traditional inflationary currencies. As unprecedented low interest-rate policies have seem to become the new normal, it is difficult to find savings rates that exceed the rate of inflation. People who do not want immediate consumption, but who would prefer to save their money, are thus incentivized to get their money out of their savings accounts and into something. Real estate investments have traditionally been a safe bet, but housing bubbles tend to burst eventually. 2017 has also been an incredible year for global stock markets, but it is hard to say how long this can go on. Overall it is not entirely clear where one can place one’s money in the traditional market without taking a significant risk. With the current monetary policy, where market bubbles are abundant, money is withdrawn from savings accounts and placed wherever it might grow instead of eroding further. Thus, there is reason to believe people are considering Bitcoin as a viable saving strategy.

Conclusion

It is difficult to know just how early or late we are in the current cryptocurrency hype cycle. The question is: Are we already in a bubble, or is the recent run-up only a small foreshock of what is about to unfold?

The last weekend of May saw the first significant correction to the mind-blowing run-up that has been going on since March. However, considering the solid rebound the following week, it seems to have been just a quick breather. It is important to remember that the combined market cap of all cryptocurrencies is still only a drop in the ocean in the scale of global finance, and after 8 years, most people have barely heard of Bitcoin. In that respect, it is difficult to determine a ceiling for this market. Yet, as an investor, one must be aware of the high risk associated with trading cryptocurrencies; there is no guarantee they will survive their infancy and mature into established societal institutions.

Article by @ola-haukland for @bitspace

great article. upvoted followed resteemed

4 times thank you :)

Good article, I like how much the Nasdaq looks like btc when it broke 1000 for the second time. Nasdaq to 15,000?

I just want to point out that ripples real market cap is nearly 3 times higher.

Thank you! Yeah, the stock market doesn't seem to have any resistance these days.

Amazing article, Ola. Great work!

Obrigado!

Yes, If you invested 2 bitcoin in ETH ICO and hold, you'll be millionaire now.

Damn! Even at bitcoin's low price at the time?

Some great details and analysis - enjoyed this!

Thank you very much :)

Great article. I appreciate an objective view when it comes to comparing the various coins. Followed.

Thank you. Yes, although it may be a bit challenging these days, we try to stay calm!

Great analysis! Followed. Upvoted!

Appreciate that x3 ;)

Great post, deserves a follow!

Cheers liad242 :)

good analysis

useful for investment

Glad it helps!

Superb article, skillfully written. The best I've seen yet on this platform. Thank you! Resteemed and followed.

Wow, thank you so much! That is very kind :)

I meant it! Your content is expertly presented and (pedantic me) mistake free. It honours us, the readers, when the writers take the trouble to compose their posts well and check for grammar and spelling errors before posting. More value all around!