Bitcoin (BTC) Price Watch: Support Holding, Bullish Pattern Forming

Bitcoin Price Key Highlights

Bitcoin price looks tired from its selloff as it starts to show bullish moves.

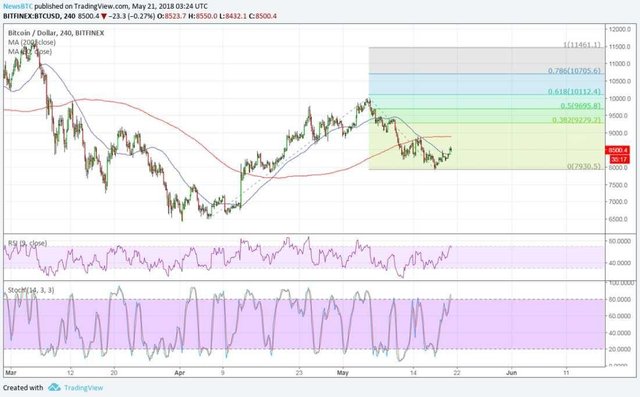

Applying the #Fibonacci extension tool on this potential bounce shows the next upside targets.

Technical indicators are still suggesting that sellers have the upper hand.

Bitcoin price seems to be done with its correction and ready for a climb, but technical indicators have yet to catch up.

Technical Indicators Signals

The 100 SMA is still below the longer-term 200 SMA to signal that the path of least resistance is to the downside. This suggests that the selloff is more likely to resume than to reverse. However, price has moved past the 100 SMA dynamic inflection point as an early signal of bullish momentum.

RSI is on the move up to show that there’s some buying momentum left, but the oscillator is nearing overbought conditions to reflect exhaustion. Similarly, stochastic is heading north so bitcoin price could follow suit, but the oscillator is also approaching overbought levels. Turning back down could draw sellers in once more.

BTCUSD Chart from TradingView

If bulls are able to stay in control, they could push bitcoin price up to the next potential resistance at the 38.2% extension or $9279. The 50% extension is near the $9700 major psychological level while the 61.8% extension lines up with the swing high around $10,000. Stronger bullish pressure could take it up to fresh highs at the 76.4% extension or $10,705 level or the full extension at $11,461.

For now, though, market watchers are paying extra close attention to the energy costs related to mining bitcoin. This casts doubts on the sustainability of this particular cryptocurrency, but the improved sentiment in the industry to start the week appears to be providing enough support.

Looking ahead, the FOMC minutes could turn the spotlight back to dollar movements as stronger tightening hints could boost the US currency higher against bitcoin price once more. To top it off, a return in geopolitical risk could weigh on the riskier asset.

https://NewsBTC.com / Sarah Jenn

#bitcoin #btc #eth #ethereum #ripple #xrp #litecoin #ltc #dogecoin #iota #monero #xrm #dash #blockchain #blockchainnews #crypto #cryptocurrency #cryptonews

#ico #iconews #analaysis #trading #chart