July Why the SEC WILL Approve a Bitcoin ETF in 2018

The SEC is proposing "plain vanilla" ETFs, which will opening-up access for Bitcoin to the $3.4 trillion ETF market, sometime in 2018.

We are now on the cusp of a Cumbrian moment for Bitcoin with the realization of the so far elusive Bitcoin ETF. The SEC is now proposing to lower costs, delays and the entry barriers to new ETFs by allowing less established issuers to operate an ETF fund without the need for a special order, provided the issuer's fund is a “plain vanilla ETF" and not an exotic financial instrument that allows for complex leveraging techniques, such as inverse leveraging.

A recent statement from the SEC has also signalled this more modern, streamlined approach;

SEC more ETF Choice.png

The SEC's decision to modernise the ETF requirements with "plain vanilla" ETFs, "greater competition", "more innovation" and "more choice" means that institutional investors, such as hedge funds, pension funds, sovereign wealth funds etc, will have access to a Bitcoin ETF, and/or ETFs that include Bitcoin, as part of a more diversified portfolio that includes stocks and bonds, in accordance with Modern Portfolio Theory.

The decision by the SEC to open-up the ETF market in this way will no doubt have been prompted by soundings from institutional investors of their desire to invest in an index style Bitcoin ETF, as cryptocurrencies are viewed by institutions as a new asset class that has the potential to offer more attractive returns compared to the traditional asset classes of shares, equities, bonds and real estate and cryptocurrency also provides a safe haven during political and economic uncertainty, akin to gold.

Cryptocurrency is the best of both worlds.

Previous Refusals Header.png

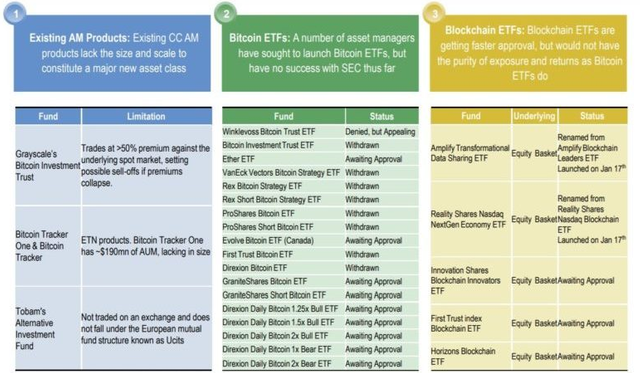

A number of historic applications for a Bitcoin ETF have already been denied, including those made by the Cboe and the Winklevoss twins. The SEC had previously indicated that it denied and will continue to deny any applications for a Bitcoin ETF, until the following issues in the cryptocurrency market are resolved;

However, the reason the SEC's statement about allowing "plain vanilla ETFs" is so significant is that it would remove one of the main reasons  for the SEC's previous denials of Bitcoin ETFs, custody, which has prevented an influx of institutional capital from entering the cryptocurrency market. It's almost as though the SEC has proposed the opening-up of the ETF market with cryptocurrencies in mind.

for the SEC's previous denials of Bitcoin ETFs, custody, which has prevented an influx of institutional capital from entering the cryptocurrency market. It's almost as though the SEC has proposed the opening-up of the ETF market with cryptocurrencies in mind.

Whilst trading platforms such as Coinbase and Circle are targeting institutions with custodian agreements, a “plain vanilla" Bitcoin ETF would function in the same way as vanilla options: institutions would able to speculate on the price of an index style ETF fund that tracks the price of Bitcoin without owning the underlying asset and having any concerns for its secure custody, in cold wallets stored offline. A Bitcoin ETF could now be created by a less traditional authorized participant with enough buying power to purchase large amounts of Bitcoin and assemble them into a Bitcoin ETF, or an ETF that includes Bitcoin. An independent accountant, prescribed by the SEC, would have to verify that the authorized participant is holding these large amounts of Bitcoin and institutional investors will be able buy a share in the pool of the Bitcoin ETF.

The newly proposed SolidX Bitcoin ETF marks the third attempt by asset manager Van Eck Associates and SolidX Management for approval of a proposed Bitcoin ETF, which Cboe Global Markets is seeking permission from the SEC to list and trade and having previously denied Bitcoin ETFs, the SEC is now called for comments on the SolidX proposal.

https://www.sec.gov/rules/sro/cboebzx/2018/34-83520.pdf

The cryptocurrency market is also likely to mature sufficiently in 2018 to satisfy the SEC's other previous objections. As stated in my previous post, regulatory oversight from the DoJ, CTFC and the SEC to root-out market manipulation is being ramped-up and the call for uncomplicated ETFs has been made with consideration to manipulation. Trading venues are also seeking to provide institutional grade data to their prospective clients.

ETF Transformative Header.png

JP Morgan has described a Bitcoin ETF as "the holy Grail for owners and investors", which would "have a transformative impact on the cryptocurrency market...similar to the first gold ETF".

Gold ETF.png

JP Morgan also have stated that the launch of a Bitcoin ETF would entail the following benefits;

ETF benefits JP Morgan.png

Bitcoin ETFs, such as the newly proposed SolidX, will clearly be focused on institutional investors, as reflected in the minimum entry point of one SolidX share, this being 25 BTC—which is roughly $165,000, as of 7th July, 2018, thus creating a substantial influx of institutional capital waiting on the sidelines.

SolidX may prove to be too complicated and exotic for the SEC's liking and its denial would impact negatively on the crypto-market, but the SEC's new approach will lead to the formation of a Bitcoin ETF this year, which would be traded on global stock exchanges, validating Bitcoin and increasing its legitimacy and credibility.

We could then also expect other cryptocurrencies with a utility case, such as Ethereum and XRP, to also be included in future ETFs.

Arthur Hayes Quote.png

Strutton quote.png

The SEC's more modern, streamlined approach is further evidence that the future of Bitcoin and cryptocurrencies with a utility case will be super exciting. Once institutional money enters the cryptocurrency market, the ability of whales to manipulate the market would be limited. A Bitcoin ETF could arrive next week, next month, in a few months' time, or later in the year, but when a Bitcoin ETF is approved this year, Bitcoin is going to moon!