👩💼 Market Manipulation, Its a Real Thing

Ever since we hit highs of $20,000 at the end of the year in December 2017 the markets have done nothing but slide down to $6,000 and now hovers around $7,500 still a solid increase in money but could it all come down to simple market manipulation?

The answer is a resounding yes.

From the looks of it these market manipulators are losing their power though as wealth in bitcoin is being distributed to more and more people which is what we need. But ever since futures market orders have been allowed to enter the market we have seen a steady decline in price. Not even that though we have seem wild swings to the positive and then the same sell off.

We can see that just a day after future contracts where added the price dropped and then quickly went back up then price doped again and back up where it now looks to be leveled out with a bump between $9,000 - $7,000. If this prediction pans out then we should see growth shortly to about the $9,500 - $10,000 level in the next week or two.

The sad part of this all this manipulation is done by big money people and is totally legal!

Perhaps instead of regulations on bitcoin we need regulations on people with billions of dollars in their hands.

- First image pulled from - https://tacticalinvestor.com/market-manipulation/

- Second Image pulled from Coindesk.com

I'm selling everything for bitcoin private BTCP because John Mcafee said it will take over bitcoin :)

Is that why you have those 160+ SBD on your wallet? If you are going to lie, at least make it believable.

Oh ya nice, pocket change lol

lololololol........ Yes! The second half of the year should be pretty epic for the cryptosphere..... can wait for the Bull to come back!

i don`t think market is manipulated

Do the big dips correlate to when the futures contracts expire?

Just think back to when the whole ETH rally started in the summer. Bitcoin was what, around 1400 on May 1st. Lets look at just the rally itself. If you bought BTC on May 1st and held til mid June, you would have made 127% on your money. If you had bought ETH, you would have made 760% by mid June.

Now, lets go back to May 1st. On this very day, on Bitfinex, ETHBTC is shorted to 0.0098 in a flash crash at 3 PM UTC, at a low price of 0.0098 btc per Eth. If you were to have accumulated those orders at the bottom of that candle, you would have been able to ride the rally in ETHBTC for a 1464% gain in BTC. Even someone who didnt get flash crash prices would be able to ride a 200% gain buying on the next daily candle.

Lets look where the big play happens. Some clever fellow shorts the shit out of ETHBTC in particular, using BTC as collateral. Whoever gets in on this play accumulates quite a line in ETH. They sell the ETH in June, which sees a drawdown over the next month to 30% of its 400ish top by mid July. BTC also has a drawdown, but only to 61% of its top. 61% of 1464% is still 893%. 61% of the aforementioned 200% is still 122% up. Lets look at what that means for the holder of bitcoin who got in on this play. The worst case scenario is that they more than doubled their money after the drawdown. Their overall cost basis for the bitcoin they purchased is less than half of what it used to be. The risk/reward for staking this quantity of money on margin is now too good to pass up, because they have doubled their collateral. And that's someone who converted straight back to BTC. What about the person who went to fiat and had no drawdown, and accumulated a line of BTC throughout the bear market?

Knowing this, is it any surprise that we had seen such a huge rally of BTC by the end of the year? Follow the money. These cycles have everything to do with accumulation and distribution of positions by people with huge accounts that can move markets. Nothing is different now than it ever has been other than the volumes of money pouring in.

Of course is a manipulation! We all saw Warren Buffet and even Bill Gates talking about shorting on Bitcoin, which is the way to push for drop levels and now thanks to Goldman Sachs and all other Wall Street players that are coming to the crypto environment they have the legitimate tool to do that.

Traditional investors are seem like the saviors of the crypto market, every time a bank or an investment firm talks about Bitcoin everyone gets excited, but actually these actors have the means and probably agenda to just manipulated the market at their will. I mean, Bitcoin Futures trade on Wall Street! What can go wrong? ... everything.

It's true, and happens much more on smaller, newer cryptocurrencies.

SteemitPanel

Congratulations ! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on @Steemitpanel.

For more information about SteemitPanel, click here

If you no longer want to receive notifications, reply to this comment with the word STOP

The power lies in the hands of the rich, its just like stock manipulation. The pump and dump and go home with the big bucks, its sucks but legal... for now

its tru dude

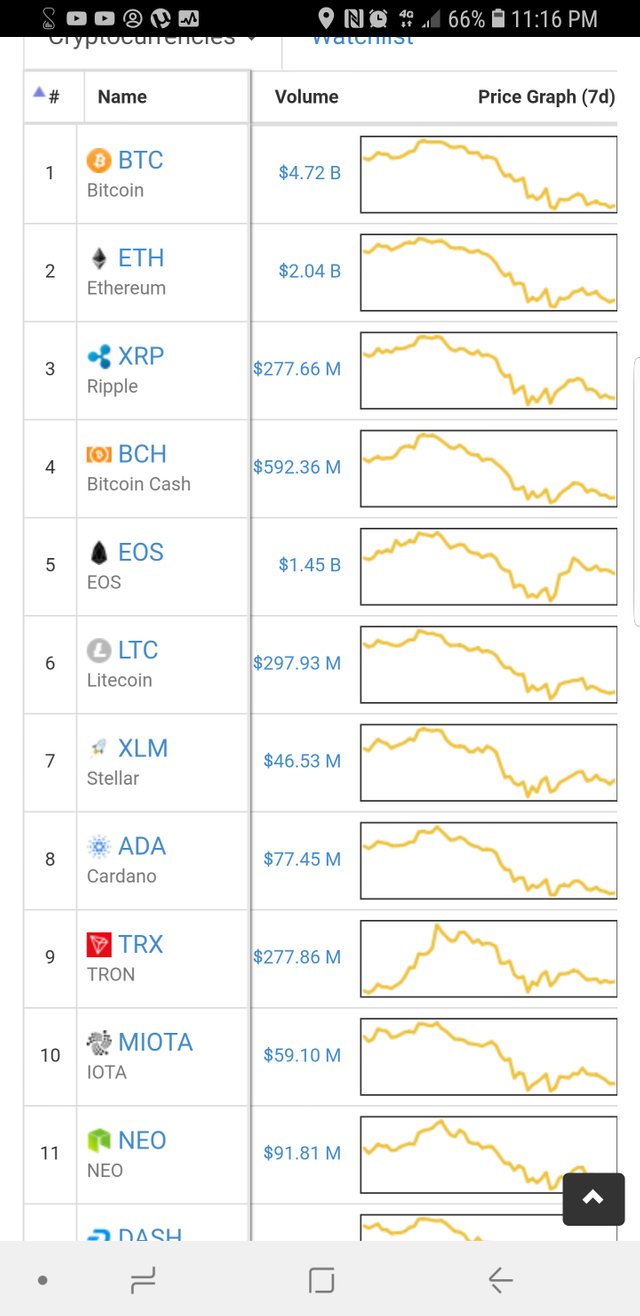

When all the coins make the same moves with billions of dollars exchanging hands every day you know something is up. Been saying this since January!

yup but that also proves to you that just about everything is tied to bitcoin

Very interesting article, thanks for sharing. I've smashed the upvote button for you and i look forward to the next part. There is always going to be manipulation of any ecosystem that is profitable.

Also, if you are looking to get some tokens without investing or mining check out Crowdholding (https://www.crowdholding.com). They are a co-creation platform were you get rewarded for giving feedback to crypto startups on the platform. You can earn Crowdholding's token as well as DeepOnion, ITT, Smartcash and many other ERC-20 tokens.