Bitcoin is a bubble, but the technology behind it could transform the world

Humankind's most punctual, genuinely transformative universally useful innovations were the capacity to cross-treat plants and cross-breed creatures. All of a sudden, it appeared well and good to cultivate than to chase and assemble. The surge in rural yield implied people could do different things than stress over survival; they could live in urban areas. Human civilisation started.

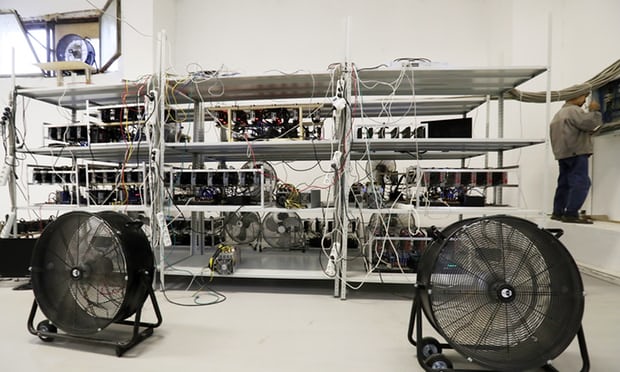

The account of the consequent centuries has been the manner by which nearly 30 universally useful advancements of equivalent power, extending from the printing press to the steam motor, have driven comparative jumps in changing our economy, our lives and our civilisation. Today, we are surviving another. Watchman Today: the features, the investigation, the level headed discussion - sent direct to you Read more Digitisation is, whether anything, significantly more capable: it is a meta universally useful innovation. No zone of human movement will be left untouched by the interpretation of the physical into computerized information. As of now, it has made shocking new limits: the odds are that you are perusing this on a cell phone or tablet. In any case, the enterprise is just barely starting. Everything – from keeping money to wellbeing – is going to encounter comparative changes. A week ago, the developing effect of blockchain and the cost of one of the digital currencies it endorses – bitcoin – hit the front pages. Controllers halted the US securities exchange exchanging the Crypto Company (a modest penny stock whose fundamental resource is its name) after its offers bounced 2,000%, so it quickly, and stunningly, joined the Fortune 500 with an estimation of $12bn. As phenomenal, when the Long Island Iced Tea Corp – yet to make a benefit – reported that it was changing its name to Long Blockchain Corp, its offers bounced 500%. The cost of bitcoin itself – $1,000 toward the begin of the year – quickly hit $19,000 per "coin" a week ago before tumbling to $11,000 and after that recouping to $14,000 yesterday. An insane ferocity, imitating each money related rise ever, has settled on US financial specialists. In any case, bubbles don't appear suddenly. People groups' creature spirits are started by something genuine that all in all catches their creative ability: blockchain and digital forms of money are that something. Blockchain is a foundational computerized innovation that adversaries the web in its potential for change. To clarify: basically, "squares" are isolated, tremendous groups of information in lasting correspondence with each other so each piece recognizes what the substance is in whatever is left of the chain. Nonetheless, just the proprietor of a specific square has the advanced key to get to it. Notice What of it? To start with, the squares are made by "diggers", singular calculation scholars and organizations all through the world (with a thick fixation in China), who need to add an information piece to the chain. There is no legislature or focal course; no authorization is expected to make a square – and unless the law is broken, no administration, controller or police specialist can shut the piece down. Similarly as the web once guaranteed opportunity, so does blockchain. The chain is self-policing. Any individual who endeavors to dispatch a trade of information outside the conventions of the chain will quickly be spotted by alternate squares – and the trade will be prematurely ended. All of a sudden, the world has obtained a framework for the quick, put stock in return of tremendous measures of information without delegates or supervision. In the way that Facebook, Amazon, Netflix and Google (the "Teeth") supplanted customary media and correspondence organizations, that prospect faces banks, insurance agencies and numerous open administrations. Our wellbeing information can be given to the entire tie for it to survey, instead of an individual specialist, and the chain would then be able to evaluate and value an insurable hazard. No delegate is sheltered. No big surprise financial specialists are salivating at the possibility of old, simple associations being driven bankrupt and super fortunes being made by the organizations supplanting them, maybe by the Crypto Company or Long Blockchain Corp. In the event that you had purchased Facebook 13 years back you would now be exceptionally rich. One of the principal losses could bank. As of now, you can exhibit your card to make a contactless installment in a store, bar or taxi. Money has moved toward becoming digitized, in spite of the fact that the payee needs to realize that a bank has approved the financial soundness of the payer before tolerating the exchange. Be that as it may, blockchain changes everything. It turns into a way to exchange computerized money – or cryptographic forms of money, of which the best known is bitcoin – in tremendous sums, over any outskirt, momentarily. The blockchain ensures bitcoin is spent once; in reality, blockchain was first designed by the originators of bitcoin to ensure there was no extortion. No £30 limits. No credit or platinum card fundamental; no national bank or government expected to ensure the estimation of the cash. Simply purchase your bitcoin from an online dealer and you have purchasing power in your computerized wallet: even better, it might go up in esteem, giving you all the more purchasing power still. The entire simple contraption of the money related framework could be as seriously tested as daily papers and retailers are by web based perusing and web shopping. The inquiry is whether banks will reevaluate themselves utilizing the blockchain as a key device and move toward becoming digital currency representatives before others. The inconvenience is that bitcoin, as other digital currencies, isn't a dependable method for putting away esteem – a key capacity of cash – when its cost can about split in seven days, as it did a week ago. Better not to consider bitcoin cash; rather, as an item that utilizations blockchain to make settlements quicker, yet it can't – and never can – be a path for the mass of specialists to get paid or make their buys. It could remove a huge number of exchanges from banks and severely twisted them, however it's probably not going to supplant them. In any case, it could in any case speak to a gigantic stun. Blockchain will control comparable stuns to protection, human services and all mass installment frameworks. Middle people in the administration ventures will confront another world in which their normal capacities will be performed by machines, customized by counterfeit consciousness, while the blockchain turns into the new intends to work together securely, speedier and less riskily. There will be new centralizations of monetary power since, similar to the Fangs, the blockchain financial model is more proficient and more successful the bigger the system. Moving always financial movement into this universe, with its anonymised exchanges and mystery keys, may satisfy the ultra libertarians – however there remains an open enthusiasm for guaranteeing responsibility, equity and reasonableness. We have, to put it plainly, to comprehend and shape this new world before it shapes us. There are valuable couple of indications of that.