Bitcoin - Projections and Analysis

Introduction

As recently promised on Twitter, this post is an update which aims to cover recent BTC price movements, as well as to describe probable future price movements.

It is crucial to note that what I say in this post today is not new, this is but the latest post in a series of Bitcoin projections, the first of which was published on 5 January. This is important because these projections have held and have been accurate to a large degree, suggesting that they may continue to do so for the next few months.

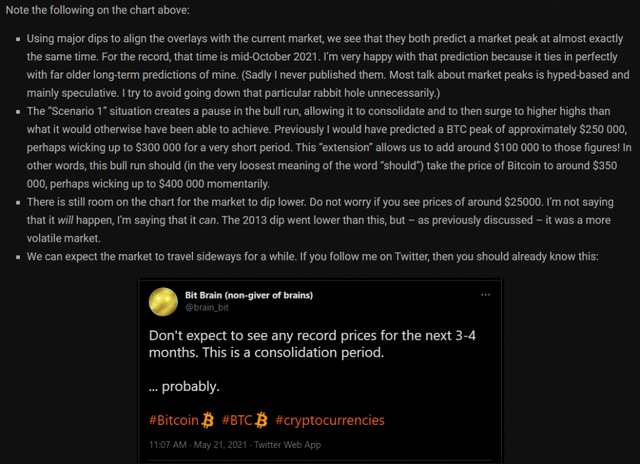

I also remind my readers that I publish small updates on Twitter if there is something important happening that's too small to justify a post of its own. But for those who really want to stay in the loop, I give preference to my TIMM readers. TIMM is the first place where I always publish my blog posts (I publish on several platforms). It's also the only place where I will amplify some of the information I share on Twitter, giving a little more detail than what one can fit into a quick Tweet or two. An example of such an amplifying post may be seen below:

From mentormarket.io. Of course we now know that this scenario played out as a double-bottomed recovery.

Okay, let's take a look at BTC...

Bitcoin

2021 Predictions and Considerations

"Bitcoin – Yesterday’s dip" was a post published on 5 January. It spelt out the possible BTC scenarios for the year - at least as I envisioned them at the time. In that post, I shared this all-important image, one which I referred back to over and over again in later posts and Tweets.

From "Bitcoin - Yesterday's Dip"

The three possibilities, referred to as "Scenario 1, 2 and 3" have formed the basis of my BTC predictions for 2021 (though "Scenario 3" hasn't featured). At the time of publishing, I argued against a "Scenario 2" because I felt that the market was not ready for another fully-fledged bull run yet. But the dip which we have since experienced has changed that, the market IS now ready for a major bull run. It turns out that "Scenario 1" was indeed the closest to what we are experiencing now (probably).

Before I go any further, let me share a very important quote from my January post - once which I have repeated many times since:

"Of course one should always remember that markets RHYME, they don’t repeat, so don’t make the mistake of using previous price action as an exact template."

On 23 April I published another post: "Important – Bitcoin Price Movement Analysis". The "Important" part of this post was that I wrote it to discuss the April market peak. In that post I called the market top (ten days after the peak), and more importantly, labelled it a "faux peak".

From "Important – Bitcoin Price Movement Analysis"

I also went on to confirm that we were looking at a "Scenario 1" and suggested that people don't sell prematurely, because a far greater price rise was only a few months away.

Included in my April post was a link to "Taking Profits – Further Considerations", a post from March in which I discussed how I look for a market top, and in which I recommend how to trade the markets. It's part of a two part series, a series well worth reading if you're thinking about taking profits in the bull run. Here are the links if you're interested:

What remains for Bitcoin in 2021?

The million dollar question (possibly literally), is "what happens to BTC next?".

On 28 May I published "Bitcoin: Update and Projection". In that post, I overlaid "Scenario 1" on the current chart (current in May) as a template of how future price movements could look.

As projections go, it wasn't bad, it wasn't bad at all! The markets did indeed rhyme. In addition to "Scenario 1", I also created a "Scenario 2" (next most likely scenario) overlay, though I did give additional evidence to indicate that a "Scenario 1" scenario was the most correct one. That remains my viewpoint to this day.

In addition to that, I drew a rough line on my chart - using Scenario 1 and 2 as guides. This showed how I expected the price of BTC to move, not only for the remainder of 2021, but for 2022 as well. Here is that chart:

And here is what the chart looks like today:

That's IMPORTANT, because it shows that my projection has been fairly accurate so far. And what THAT means, is that we can expect BTC to continue to roughly follow my dashed line in the chart above, perhaps with a slight delay. (I fitted the overlays as best I could at the time, it's always far easier to fit them more accurately with the later benefit of hindsight!)

I fully appreciate that it may be a big stretch of the imagination to expect that BTC will suddenly soon start to skyrocket as my chart indicates - just because it roughly followed my projection for a few months - but there's more to it than that.

This chart is only one factor that leads me to believe that BTC is about to skyrocket, the other factors generally take the form of intangible market fundamentals and/or are based on my experience in crypto markets. And once again, I know... what a cop out, right? The analyst says "intangible market fundamentals" and then just expects you to take him at his word! Well... that's not really true. I EXPECT you to make up your own mind. I expect you to do your own research - even if (tragically) - most people seem completely incapable of conducting anything even vaguely resembling what I would call proper "research". I expect you to take a look at my track record and decide if I'm a better analyst than you are, or if I'm just an amateur throwing out wild guesses. I expect you to decide if there's someone else you should be following instead - because they have pretty Elliott Waves (which I consider to be the astrology of the TA world) or more support and resistance lines on their charts.

[Pro tip: "more" is not "better" with crypto analysts. Find a FEW good ones you can trust, then ignore all the noise from the rest.]

If you do decide that I know what I'm talking about, then you may want to be reminded of this: these notes accompanied the overlay chart when I originally published it. They are still valid, though note that the time of the dip (the possible $25k I speak about) has now passed and that (as mentioned earlier) there may be a slight delay between my dotted line projection and reality. This is good, it means the market peak may occur a little later and a few thousand dollars higher than what I mentioned (though not significantly so).

Please remember! After the peak, there will be a crash, probably a large one. Prices will not keep on climbing forever!

Markets HAVE TO crash. This is why:

If Cardano, XRP or Dogecoin are your idea of good coins, then I'm afraid I have some bad news for you...

Conclusion

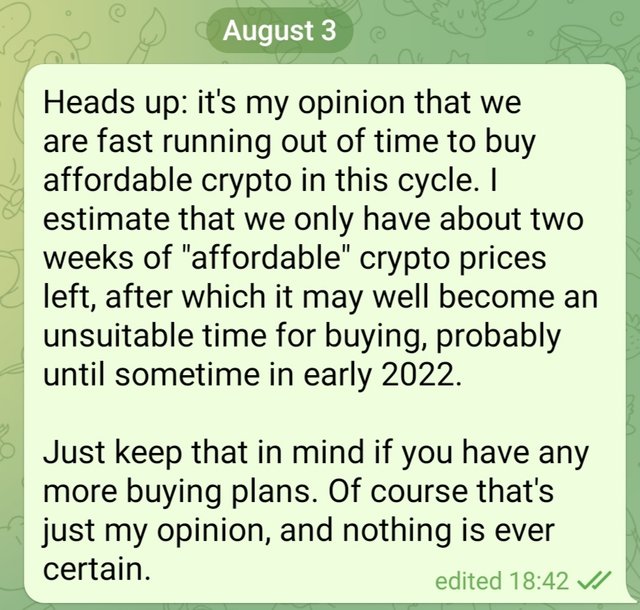

On 3 of August I sent out a message to the few friends and family members who depend on me for crypto signals: "you have about two weeks left in which to buy affordable crypto in this cycle". I based that on a BTC price of $50000.

See? I really did.

Since $50000 is a realistic thumb-suck price which BTC could drop to early next year, I'm not recommending that people buy above that level. Do with that information what you wish.

P.S. Gold and Silver are currently at bargain prices thanks to the manipulation of major banks. The reasons behind this are interesting (generally linked to Basel III), but rather complex. Bit Brain recommends a balanced portfolio of hard assets, which includes some Gold and Silver.

Take care and, as always, feel free to ask me anything which you think I may be able to help with.

Yours in crypto

Bit Brain

All charts made by Bit Brain with TradingView

"The secret to success: find out where people are going and get there first"

~ Mark Twain

"Crypto does not require institutional investment to succeed; institutions require crypto investments to remain successful"

~ Bit Brain

Bit Brain recommends:

Crypto Exchanges:

Yours in crypto

Bit Brain

All charts made by Bit Brain with TradingView

"The secret to success: find out where people are going and get there first"

~ Mark Twain

"Crypto does not require institutional investment to succeed; institutions require crypto investments to remain successful"

~ Bit Brain

Bit Brain recommends:

Crypto Exchanges:

SILVER AND GOLD