Bitcoin Outperforms Gold, Following Post-Halving Pattern

Ecoinometrics: The star cryptocurrency continues its rise, driven by strong fundamentals and a favorable macroeconomic environment.

A recent report from Ecoinometrics reveals an encouraging outlook for Bitcoin post-halving. Not only is the leading cryptocurrency following the historical pattern of post-halving growth, but it is also outperforming gold as a store of value. Furthermore, analysis of Federal Reserve communications suggests that interest rates will remain elevated for longer.

Bitcoin has managed to outperform gold in terms of total returns, with a growth of 152.53% in the last year / Econoimetrics

Bitcoin Follows Post-Halving Script

According to Ecoinometrics, Bitcoin is meeting expectations and following the historical pattern of post-halving growth. After the April 19 halving event, the cryptocurrency experienced initial consolidation, followed by a strong rally. Bitcoin is currently 55% above its post-halving low, approaching the lower end of the historical post-halving growth range.

Bitcoin vs. Gold: A New Dynamic

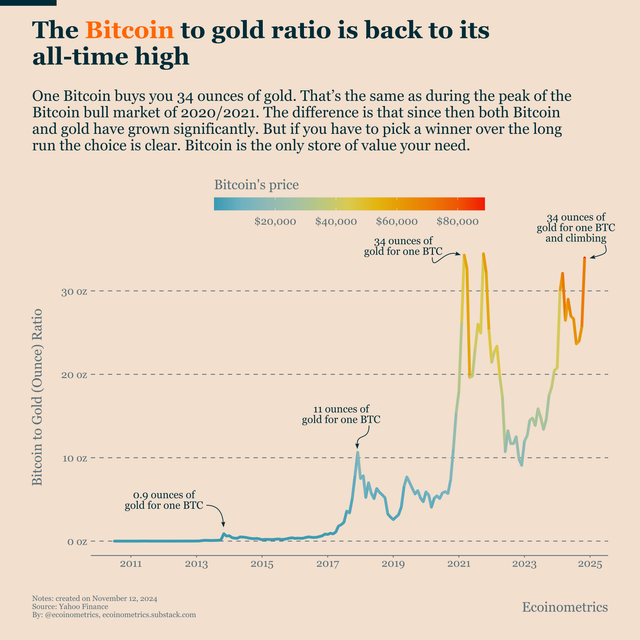

The competition between bitcoin and gold as store of value assets has intensified in recent months. Bitcoin has managed to outperform gold in terms of total returns, with a growth of 152.53% in the past year, while gold has seen a rise of 29.53%. Moreover, one bitcoin is now equivalent to approximately 34 ounces of gold, reflecting a significant shift in the value perception of both assets.

The Federal Reserve and its implications for Bitcoin

The report also analyzes the impact of the Federal Reserve's monetary policies on the cryptocurrency market. According to Ecoinometrics, the Fed's more hawkish tone, evidenced by an increase in the Federal Reserve Communications Index (FCI), suggests that interest rates will remain elevated for longer. But this scenario could hold back bitcoin by reducing the demand for safe haven assets.

The Ecoinometrics report paints an optimistic picture for bitcoin. The leading cryptocurrency is following the historical pattern of post-halving growth, has surpassed gold as a store of value and is benefiting from a favorable macroeconomic environment for now. However, it is important to remember that the cryptocurrency market is highly volatile and investors should conduct thorough research before making any decisions.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves high risk and investors should conduct their own research before making any decisions.

Upvoted! Thank you for supporting witness @jswit.