Bitcoin ETF Net Flow Pushes Price Up

The Bitcoin market soars with historic ETF inflows and a new capitalization record, as the dollar falters.

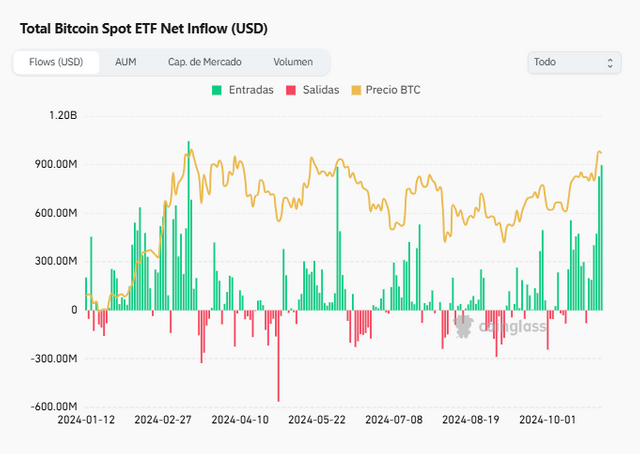

The net flow of Bitcoin through Spot ETFs reached historic figures this week. Market capitalization was also boosted to new highs, in a context of economic and political uncertainty in the United States.

Bitcoin breaks records with ETF flows and market cap booming, as the dollar falters. Discover the latest market trends / Coinglass

Bitcoin ETF Flow: An Unprecedented Boost

On Wednesday, Bitcoin Spot ETFs recorded a positive net flow of $896.30 million. That figure marks the second-largest capital inflow in a single day since the start of these products. The previous record was set on March 12 with $1.02 billion. This phenomenon has continued for six consecutive days, with Tuesday reaching $827 million, according to data from Coinglass. IBIT leads these inflows, reflecting a growing interest in Bitcoin through these financial instruments.

However, after the last two spikes in the net flow of Spot Bitcoin ETFs, two major corrections or profit-taking occurred.

Market capitalization and trading volume on the rise

The increase in assets under management (AUM) through Bitcoin ETFs reached $52.58 billion. It continues an upward trend since August, when it stood at $47.40 billion. This Tuesday, the market capitalization of Bitcoin ETFs reached a new record of $72.57 billion, surpassing previous records since October 15. In addition, the trading volume of these ETFs experienced a significant rebound, reaching $5.11 billion, the highest since August 5.

Bitcoin Price: Challenges and Opportunities

Bitcoin closed this Wednesday above $72,000, despite a slight decline of 0.54%, standing at $72,344.74. The cryptocurrency is facing critical resistance in this zone, which coincides with an active sell-off area since March. Although trading volume has declined, the relative strength index (RSI) indicates overbought, maintaining bullish momentum. The 25-, 50-, and 200-day exponential moving averages (EMA) are aligned upwards, suggesting a positive trend in the short, medium, and long term. Bitcoin established a new support at $68,500.

Macroeconomic Factors: Impact on the Crypto Market

Mixed economic data in the United States, with higher-than-expected ADP payrolls and lower GDP, generated volatility in the dollar. Election uncertainty also adds pressure to the market. A possible interest rate cut by the Federal Reserve could weaken the dollar, which is generally positive for cryptocurrencies. However, Bitcoin continues to post gains, defying macroeconomic trends.

Disclaimer: Cryptoasset investing is not regulated and may not be suitable for all investors. It is possible to lose the entire amount invested.