The word “bubble” cannot be applied to Bitcoin.

Bitcoin’s rise is no bubble.

It's more of a currency devaluation.

The word “bubble” cannot be applied to Bitcoin.

Bitcoin is not a fiat currency.

It costs over $1000 in electricity and computing costs to make a bitcoin.The value of Bitcoin is not speculative.

It is linked to the number of users, and the number of transactions.

As the Bitcoin network grows, the value of Bitcoin grows.Bitcoin’s rise in value is amplified by the devaluation of national currencies.

As people move into Bitcoin for payments and receipts, they stop using US dollars, Euros, Chinese Yuan, which in the long term devalues these currencies.

What you're seeing is more of a currency devaluation than a bubble in Bitcoin.Bitcoin is not something that we're pulling out of thin air.

Bitcoin is something that is created with massive amounts of electricity and computing power.Temporary fluctuations are meaningless.

Temporary fluctuations are created by speculators, people who do not understand the fundamental technology of the Blockchain.

Those who do, know that in the long term these fluctuations will make no difference.Blockchain will take over all aspects of the financial system.

Blockchain does everything from fixing supply chain problems in corporations to verifying the authenticity of the sender and receiver in a financial transaction.Bitcoin and the Blockchain are not owned by any person, company, or consortium.

They are strictly mathematical formulas that nobody owns which we are all participating in.The advantage to using Bitcoin? It’s instantaneous.

A Bitcoin transfer it takes 30 seconds.

A wire transfer, however, takes 24 hours.

Most of this information is sourced from an interview with John McAfee on RT.

I have transcribed the interview below.

Transcription below

John McAfee "Bitcoin is Not a Bubble" August 2017

Interview on RT, 2017

Video available at:

Stop me if you've heard this before:

Bitcoin broke another record.

Thursday the digital currency topped $4,500 in trading, which means it's doubled in price in the past month alone.

That's huge.

And since the concept of

cryptocurrency is still so new, many

people see growth like this and want to

compare it to a fiat currency, wondering

when the bubble might burst.

Cybersecurity expert John McAfee says

this type of thinking is a mistake.

He joins [RT] now .

RT: “John why do you think the

word bubble cannot be applied to Bitcoin?”

JM: “Well first and foremost, bitcoin is not a

fiat currency. It costs over a thousand

dollars to create a Bitcoin today, in

electricity and computing costs.

Second, the value of Bitcoin is is linked to the

number of users, and the number of

transactions. It is not a speculative investment even

though it is being used as such by many

people.

As the Bitcoin network grows, the

value of Bitcoin grows.

As people move into Bitcoin for payments and receipts,

they stop using US dollars, Euros, Chinese

Yuan, which in the long term devalues

these currencies.

So what you're seeing

is more of a currency devaluation than a

bubble in Bitcoin. As more people use it,

it has more intrinsic value. And again,

the cost of producing a Bitcoin

increases with the value of the Bitcoin.

So this is not something that we're

pulling out of thin air. This is

something that's created with massive

amounts of electricity and computing

power.”

RT: “Someone who disagrees with

you on the term of bubble, when it comes

to Bitcoin, is Mark Cuban.

Back in June he tweeted:

“I think it's a

bubble. I just don't know when or how

much it corrects. When everyone is

bragging about how easy they are making $=bubble”

... When he tweeted that, Bitcoin

dipped in price.

How can one person's random Twitter

thread have that effect on the price, and

what does it say about Bitcoin’s stability?”

JM: “It says nothing about the Bitcoin’s stability.

After it dropped five hundred

dollars, it's now at [$4400] so these

temporary fluctuations are meaningless.

[They] are created by speculators, people who do

not understand the fundamental

technology of the Blockchain.

Those who do, know that

in the long term these

fluctuations will make no difference.

The more people who use Bitcoin the more

valuable it will become. This is the only

metric we can use.”

RT: “Now Bitcoin and Blockchain go hand in hand, but

Blockchain [has the] ability to

track financial transactions in a way that is incorruptible.

[This] gives it infinite amount of uses outside of

the original purpose of using it for Bitcoin.

Do you see Blockchains

overtaking certain aspects of the

financial system as we know it now?”

JM: “It will take over all aspects.

People think that Bitcoin or the blockchain is owned

by someone, by a company, or by a

consortium.

No.

This is strictly a

mathematical formula that nobody owns

that we are all participating in. We

use the Blockchain for everything from

fixing supply chain problems in corporations to verifying the

authenticity of the sender and receiver

in a financial transaction. It is the

most powerful technology that the world

has seen, I believe, since the invention

of agriculture.”

RT: “Now John, we've showed our

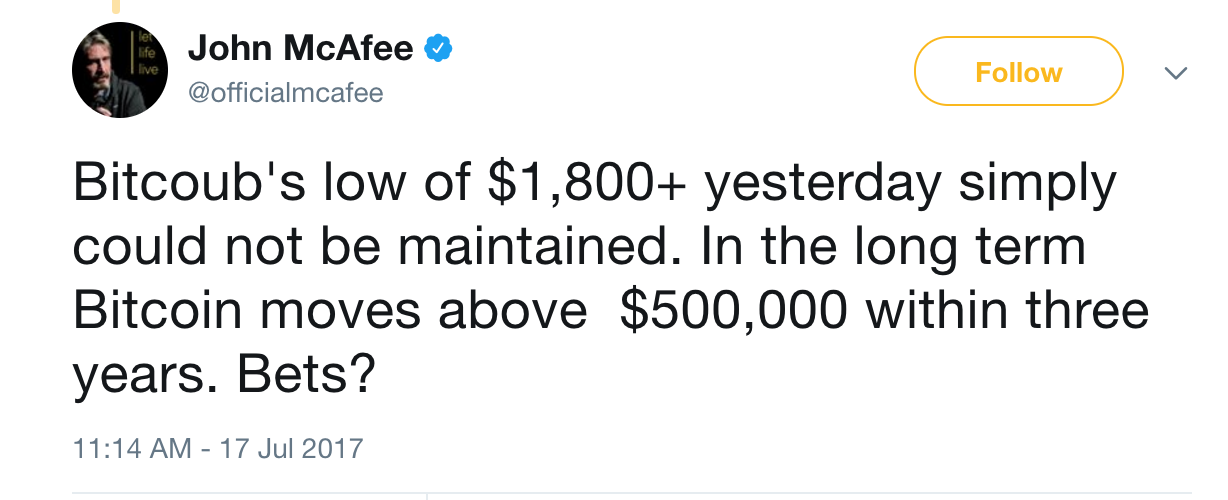

viewers Bitcoin’s rise just in the past month… , on July 17th, one

month ago, you tweeted that

“Bitcoin’s low

of $1800 yesterday simply

could not be maintained in the long term.

Bitcoin moves above $500,000 within three

Years. bets?” you ask.

So I ask you John, do you stand by your statement?”

JM: “Keep in mind, as Bitcoin grows, and grows in value,

other countries’ national currencies are

going to decline.

The advantage to using Bitcoin?

The advantages are huge.

If I do a wire transfer it'll take me 24

hours, if I do a Bitcoin transfer it

takes me 30 seconds. It is instantaneous.

I know people who do not use any other

currency now, other than Bitcoin. They buy

their houses, their cars, everything, using

Bitcoin, by connecting to other users who

sell the things that they need. As more

and more people use this what will

happen to national currencies? They will

obviously devalue. They have to. So that

500,000 includes a massive devaluation

in the US dollar which absolutely has to

come if Bitcoin continues to grow at its

current rate.”

RT: “Well it's certainly a

community effort [for] the Bitcoin

community, and for other cryptocurrencies

it's only growing. John McAfee, founder of

McAfee incorporated, thank you so much

for your thoughts today.”

Video available at:

John makes great points on BTC.

He sure does. I felt the urge to compile his points into a document. I thought they could help people understand the world a little better today.

Yea I actually like him but I am not sure how to feel about him after that documentary, if you saw it...