Christmas Crash Or Just Another Correction? Price Forecast for 2018

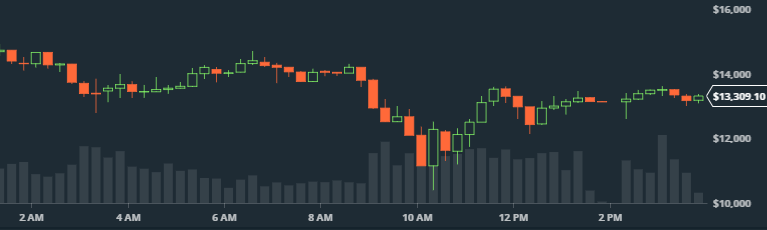

The past 24 hours have seen Bitcoin and other top cryptocurrencies to drop between 10 - 40%. After hitting nearly $20,000 earlier this week, Bitcoin hit a low point of almost $11,000 just hours ago. A surge of optimistic buyers have now enabled a slight recovery with BTC hovering around $13,000.

What follows now is purely speculation, so take it (as you should with all things crypto) with a grain of salt.

Bitcoin Will Take Another Sharp Decline (But Will Recover)

I believe we hit the peak of irrational exuberance a few days ago when it nearly hit $20,000. Most people who hopped on in the past month were driven by greed and FOMO, and have little interest in understanding the tech behind it. High transaction fees with BTC likely spurred these new speculators to trade their BTC for other altcoins in hopes of hitting it big. After Bitcoin peaked and saw a few dips, other coins followed similar trends (with some exceptions). FUD likely began to take hold and a downward trend developed. It all came to a tipping point last night as the price began to plunge and people rushed to sell in a frenzy.

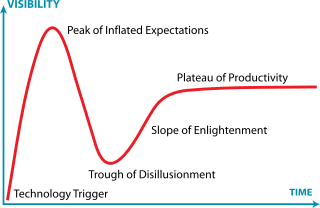

But remain calm, my friends, and hodl. All this has happened before. It follows what's known as a Gartner Hype Cycle:

I discovered this concept earlier this morning, and it's amazing how the history of Bitcoin has followed these cycles. In essence, the concept follows Amara's Law:

"We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.”

You don't have to look far to find this in the crypto world. Every new currency, coin, token, or however it's labeled, has a team behind it with bold visions of how they want to change the world. When we discover these new ideas, and especially when we invest in them, we get excited and share that vision ourselves. New tech is disruptive. And it often does change the world. But it takes time.

Once we realize this, and that many of the promised applications don't work, we begin a downward trend of lowering our expectations. This steep drop is basically as steep as the rise, but it always levels off higher than our initial expectation.

Time passes, the tech is developed, and things are actually starting to look good. It gets to a point of progress which is rational and managed since we've learned from our initial assumptions.

Each time Bitcoin attracts attention a new wave of speculators floods in, and the cycle repeats itself:

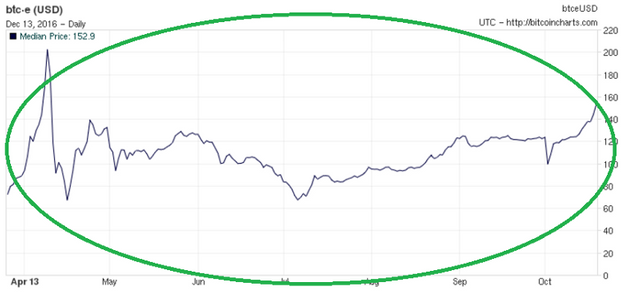

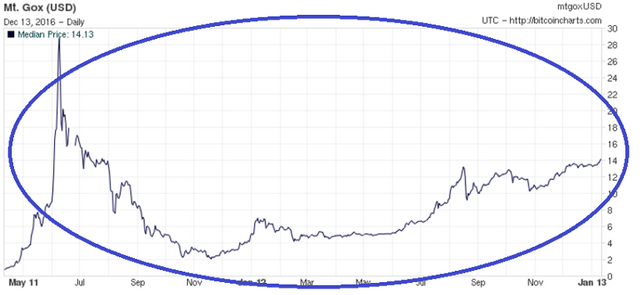

Here's Nov 2013 Bubble, followed by the earlier Feb 2013 Bubble (zoomed in):

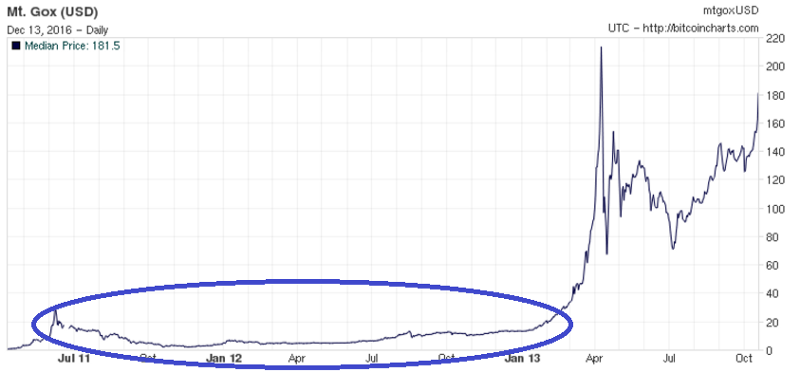

And the Feb 2013 Bubble (above image), with the earlier June 2011 Bubble:

These patterns go all the way back to the early days of Bitcoin when it's price was less than a dollar. And I believe it will continue to happen until cryptocurrencies as a whole reach a majority of mainstream adoption.

Until then, it basically follows this pattern:

- New Speculators Flood the Market; Prices Soar ~1000%

- Prices Peak, FUD Sets In, & People Begin to Sell

- Price Plummets to 20% of it's Peak Value

- Slow Upward Trend Back to 80% of Peak Value

- Cycle Begins Again

Forecast for 2018

Unfortunately for those of us who bought in while prices were soaring (myself included), we may see some losses early in 2018. If we go by this speculative model, we could see prices drop as low as $4000 around Jan - Feb. After it bottoms out and stabilizes, we should see slow growth through Mar - Jun. Once it reaches a stable $16,000 again at some point in the summer this will signal the repeating of the cycle. The bull run will catapult the prices to $160,000 within a few weeks, new people hop on board, and another sharp decline will follow. However it will likely stabilize around $32,000 and see a tentative $40,000 into 2019.

All this is based on the model I've described, and I could be wrong about it all. But human nature doesn't change and history has a way of repeating itself.

Cryptocurrencies are beginning to see mainstream adoption, so these cycles may well be coming to an end. But they will continue until adoption reaches a critical point and settles at a stable level. All this is for another article though ;)

Let me know what you think in the comments below!

If you're interested in a more in depth analysis about Gartner Hype Cycles and a great history of tech adoption. Read this article:

https://medium.com/@mcasey0827/speculative-bitcoin-adoption-price-theory-2eed48ecf7da

All images were taken from this article and used in my predictive forecast for the next year.

Happy Holidays everyone. And don't forget:

HODL!

-J

@originalworks

The @OriginalWorks bot has determined this post by @beanstalk to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

Resteemed by @resteembot! Good Luck!

The resteem was payed by @greetbot

Curious?

The @resteembot's introduction post

Get more from @resteembot with the #resteembotsentme initiative

Check out the great posts I already resteemed.

Hi. I am @greetbot - a bot that uses AI to look for newbies who write good content.

I found your post and decided to help you get noticed.

I will pay a resteeming service to resteem your post,

and I'll give you my stamp of automatic approval!