"The Bubble Has Burst" Bitcoin Tumbles below $8,000 As cryptocarnage continues

Similarly as we saw at yesterday's US securities exchange close, plunge purchasers just ventured in to Bitcoin essentially, lifting the cryptographic money over $1000 off the lows and back above $8000...

But the carnage remains... for now...

It appeared like just yesterday that each digital money bloodbath would be quickly purchased, regularly sending the cost of bitcoin and its associates to new record highs. Those days have all the earmarks of being finished, in any event until further notice.

So far this year, digital forms of money have been plagued with awful news: Bitfinex, by a few records the world's biggest trade, was as of late subpoenaed by the CFTC, alongside Tie, a different corporate substance that includes a large number of similar individuals from Bitfinex, as inquiries mount about the credibility of its tie token. Ties, which are broadly utilized by crypto dealers to rapidly move all through various crypto sets, should be supported by dollars, with one tie = one dollar. Be that as it may, Tie's choice to flame its inspector seems to approve the worries of the trade's faultfinders.

Raising feelings of trepidation about another huge, Mt. Gox-like hack, Coincheck, an average sized Japanese trade, detailed for this present month that it endured "the greatest crypto robbery in its history" when programmers grabbed $400 million worth of NEM tokens. On Friday, Bloomberg detailed that Japan's Budgetary Administrations Office assaulted Coincheck's workplaces seven days after the hack, pulling out reports and PCs as proof.

The examination was led to guarantee security for clients, Back Priest Taro Aso said. On Friday morning, 10 FSA authorities entered Coincheck's premises to pick up a superior comprehension of how the trade is working in light of the controller's business change arrange forced not long ago, an organization official told columnists in Tokyo. The trade has until Feb. 13 to deliver a report itemizing the reasons for the occurrence.

Furthermore, as though the danger of cybertheft wasn't sufficient to drive away the peripheral purchaser, the risk of controllers attempting to boycott crypto - much like China did - has turned into a noteworthy concern. Controllers in India said expressly announced yesterday that bitcoin isn't lawful delicate and said it would take "all measures to take out their utilization," anticipating a coming crackdown in a market that numerous trusted would one day develop to one of bitcoin's biggest. After a weekslong will-they-won't-they forward and backward, South Korea's Service of Equity reported uncovered that it had surrendered a proposition to boycott crypto out and out, yet rather look to direct it, expecting trades to acquire insights about client characters.

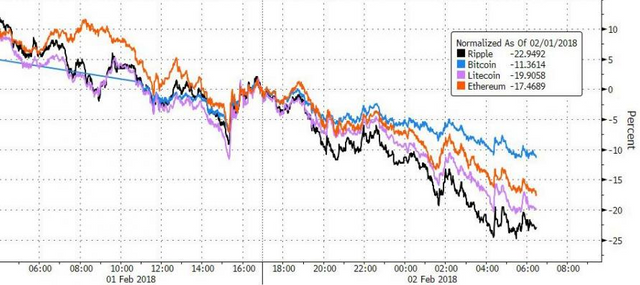

After bitcoin's most exceedingly terrible month in years, it dunked beneath $8,000 Friday morning in the US to levels it hasn't seen since November while Ethereum, Swell and Litecoin all took twofold digit beatings.