Bitcoin: Get started for Noobs

Bitcoin is digital money that you can transfer to another person without the need of a third party, like a bank. It can be thought of as a digital equivalent of cash - it's just one person transferring value to another person, no bank involved. In fact, Bitcoins are not issued by a bank or government, so an even more apt analogy than cash might therefore be gold.

Ok, digital gold, got it. Weird. Why are people excited?

- Get rid of transaction costs

Because no third party is needed, there is nobody charging a transaction cost. Banks, card issuers and payment processors places a 1-5% transaction fee on that coffee you bought this morning, and everything else you buy. This is not very visible in everyday life, because it's almost always baked into the price of things, but if you start transferring money internationally with companies like Western Union, you realize that there is quite a bit of money in the business of transferring money.

- Take currency power away from banks and government

Banks and government have the legal and physical ability to create money. I won't get into the details (http://en.wikipedia.org/wiki/Mon...) of how that works, but the main problem is that whenever money is created, it dilutes the value of everyone's money, which makes it a super-fast, completely silent, taxation.

Sometimes, governments and banks use this power responsibly, but sometimes, they do not. Lately, there has been a lot of the latter, with the Financial crisis of 2007–08 caused by irresponsible lending, so a lot of people are starting to think that we probably are more reliant on banks and government that we want to be. An even more current example is Argentina, which has a 11% inflation (!) on its currency. Bitcoin is getting a strong hold there: BitPagos Uses Merchant Processing To Bring Bitcoin To Argentina

How does it work?

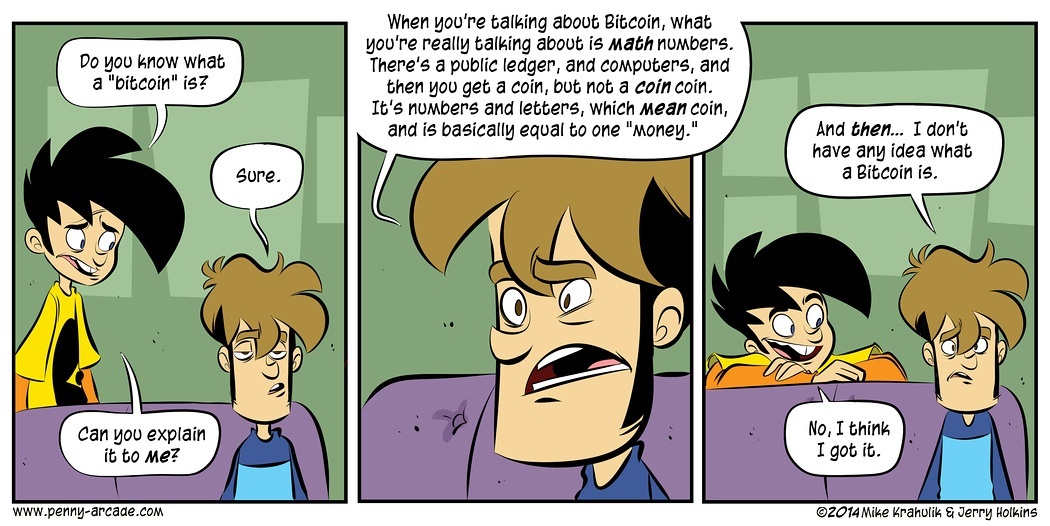

Before I go on, I'd like to point out that you probably don't know how your normal money works. Most people have no idea how money is transferred from one bank to another, or how it's created in the first place.

With that said, all Bitcoin transactions, from the beginning of time, are written down in an enourmous, public ledger. When you transfer money from your Bitcoin wallet to another person, you do that by writing this transaction down in the public ledger. Everyone is watching this ledger and has their own copies of it, and so they now know that there is less money in your wallet, and more money in a friend's wallet. So everyone knows how much money each wallet contains. This is where your money is stored, in this public ledger with millions of copies that everyone maintains together. They do, however, not know who owns that wallet - Bitcoin has no notion of identity.

So what's preventing another person from transferring money from my wallet to their own?

This is where cryptography comes in. When your Bitcoin wallet is generated, it's given to you in two parts. One public part, an address, that you give to other people so that they know where to send you money, and a secret part, a key.

The key is used to "sign" transactions. It takes the amount, the sender address, receiver address, and the key, jumbles it together with math, and out comes a signature, that you put in the ledger along with the transactions. Due to how cryptography works, other people can mathematically verify that the person that generated this signature for this transaction must indeed have the key for this wallet. They can, however, not work backwards to what the key actually is - that would take a supercomputer thousands of years to do.

Nice info.. Everyone just get the hype!

Done!!! upvote and follow me back

https://steemit.com/joke/@xaqib/joke-no-4

☺️

cool

Intresting