What a CRYPTO TAX AUDIT Will Look Like (Screen Shots) .. [And Software to AUDIT YOURSELF]

Wondering how all these new proposed and pending regulations will affect your TAX status? Not sure if you would owe taxes based on your crypto "currency" transactions. While different states will have their own State Tax rules, the IRS (Federal) will have it's own opinions about what taxes should be paid, why and when.

See my blog on how Nevada is setting itself up to be a blockchain haven due to their TAX rules.

Let's look at what is currently and publicly stated about how the IRS is attempting to handle the tax liabilities on crypto which is still not viewed as currency BUT which they would like to TAX as currency.

Sounds a little janky, right? Well, we know there's a lot of that double talk when it comes to getting money from you, no matter whom is making the request.

What is pretty much global, is that buying Bitcoin or any other crypto-currency is NOT in itself taxable.

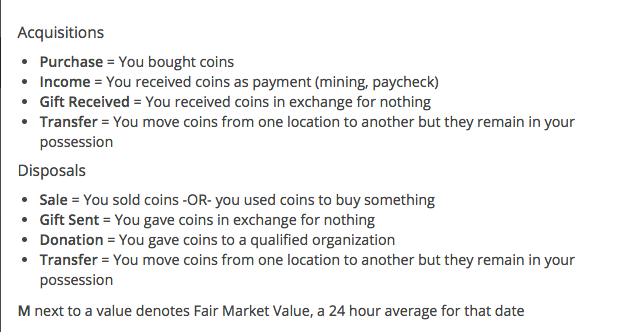

However, you are likely to be taxed when you:

sell or even spend those coins and make a profit.

How much depends on the amount of gains, how long you owned the coins and if and how your country taxes capital gains.

Capital Gains Taxes

Most countries consider Bitcoin and crypto-currencies as capital assets, and so any gains made are taxed like capital gains.

So if you make profits from selling your coins, those profits are taxed.

If you make losses, you may be able to deduct the losses and reduce your taxes.

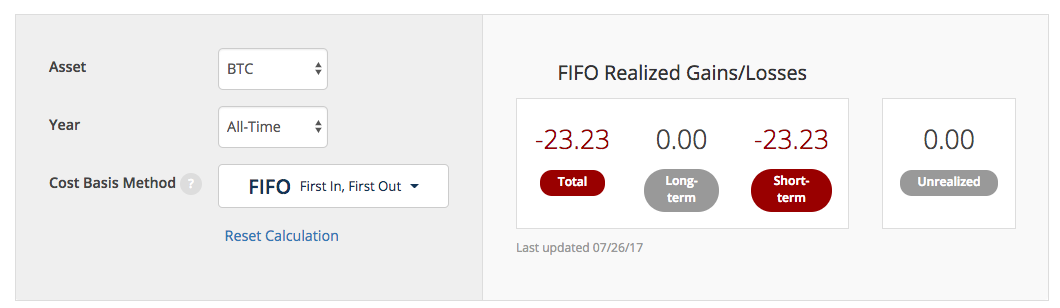

I'm just saying, YOU CAN get ahead of any potential tax issue and control the narrative by knowing or PLANNING your outcome ahead of time (with the help of a professional) and make it work for you.

That sweet sweet LOSSSSSS.. I've taken -- messin' with Bitcoin ;-) (that will offset taxes I might owe for other income or revenue). If they want to treat Bitcoin as an asset/property then you treat it like an asset/property and use it to your tax advantage.

Most countries will also consider earning of crypto-currencies as a barter transaction or payment-in-kind. You are taxed as if you had been given the equivalent amount of your country's own currency.

So, for example, say your salary was paid in part cash and part Bitcoin, and each month you received $1000 worth of Bitcoins, you are taxed like you had just received $1000.

If you are paid WHOLLY in Bitcoins, say 5 BTC, then you would use the fair value.

This would be the value that "would be paid" if your normal currency was used, if known (e.g. $1000), otherwise you would use the price of Bitcoin at the time to establish your taxable income.

"would be paid" ?? -- See how this is getting trickier by the minute..

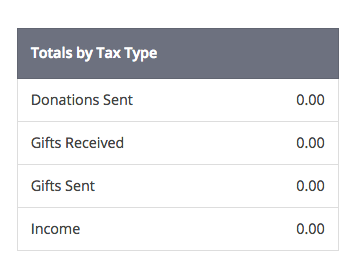

Receiving Tips or Gifts

Laws on receiving tips are likely already established in your country and should be used if you are gifted or tipped any crypto-currency. You will similarly convert the coins into their equivalent currency value in order to report as income, if required.

Do I need to file or pay taxes if I own Bitcoins?

Not if you just bought Bitcoins (or any crypto-currencies) with your own money.

However, if you traded, sold, or used any to purchase something, then you might.

If you were given Bitcoins as payment, as a salary, or as a gift/donation, this is income and should be reported as any other income you earn.

I didn't move any money out of the exchange, I just bought back in. What about then?

Yes. A tax event occurred and you gained money, even though it isn't in your bank account. For tax purposes it is treated no differently.

**The exchange doesn't have my details and so can't report me, should I still pay taxes?

If you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud.

**I bought some things with Bitcoins directly, do I owe taxes?

PROBABLY, but depends on your country. If it's considered as a tax event, then you are essentially exchanging Bitcoins for goods or services. You may have gained in doing so, and therefore it has to be reported. Say you bought 1 BTC for $10. Now say that Bitcoin is worth $100 and you buy a $100 gift card. You got a $100 gift card for only $10. That $90 is gains and taxable.

So are you saying I have to report every thing I buy with Bitcoin?

Yes, if your country's tax authority has determined that gains are made when disposing of Bitcoins, like in the US for example.

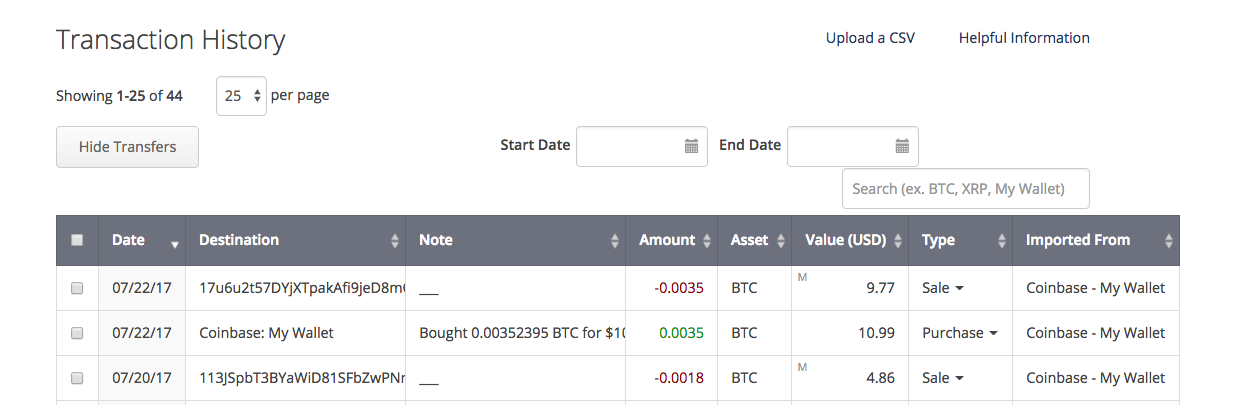

So, in summary in the United States.. It's not just IF you're getting paid as INCOME that you owe taxes and that's all taxes you would owe.. but literally every single thing you do with crypto is potentially a taxable event.

NOW, I will say this..

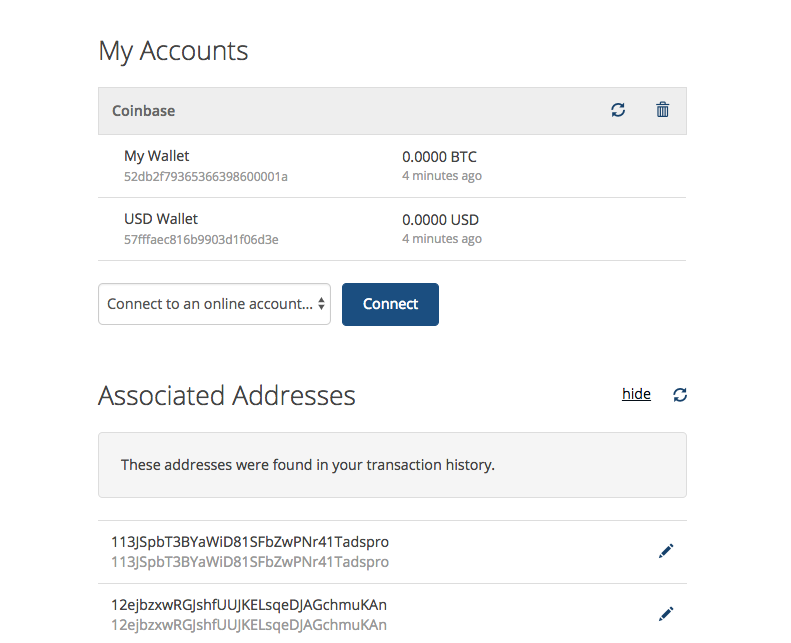

It is pretty easy to get your estimates from centralized purchase exchanges like CoinBase. We already know they are under attack from the IRS. It is best to accept that EVERY Bitcoin Address that you associated with CoinBase is already "known" and will be audited EVENTUALLY. [And of course, every address they can find connected to you that is publicly listed on your social media, video channel, Steemit post, etc.]

I'm just asking you to THINK ahead and do some TAX PLANNING. It will save you from any possible headache in the future.

Due to the nature of Bitcoin, you also know that EVERY address is connected somewhere in the blockchain and if there is a serious issue where the IRS thinks it can justify the man power to investigate every Address associated with every centralized exchange that is some how attached to you, it will be done.

I recommend that if you are one of the lucky people that have had the pleasure of massive crypto gains, that you contact a professional and get AHEAD of any issue. My first choice would be an attorney, followed closely by a CPA (like the one below). Professional are generally insured for their error and omissions, so you are not fully liable for any mistakes or misinterpretations on their part.

And remember, retain (pay) any professional before speaking with them. **No free consultations as they may not be able to stand the challenge to confidentiality should it be made an issue in the future.

Now, TIP me, so I may owe TAX on it :-) If you want a recommendation for a great software you can use for yourself, let me know in the comments below.

Great article...

So, far below are the articles I suggest will help improve / develop you:

5 Ways To Get Free Bitcoins

https://steemit.com/bitcoin/@oliyide-jfem/5-ways-to-get-free-bitcoins

Read This Before You Decide: What Do You Need To Know To Create A Business Model? https://steemit.com/business/@oliyide-jfem/read-this-before-you-decide-what-do-you-need-to-know-to-create-a-business-model

Best Business Model For Your Business

https://steemit.com/business/@oliyide-jfem/best-business-model-for-your-business

Awesome article... Thank you for the insight and the heads up. I don't think the IRS will be able to tackle Crypto for a while but it doesn't hurt to stay on top of things as much as you can. Can you recommend software we can use to calculate your taxes based on our crypto profits and losses?