Steem Internal Market: How to trade profitably (part2)

If you have followed my post, I have shared about the Internal Market of Steem. Today, I will share about how to set up your trades for a profitable trades on the Internal Market.

Disclaimer: Trading involves high-risk activities that may lead to the loss of your capital. I do not recommend to risk your capital. Please trade wisely and only use the money you can loose.

In this article, I will share 3 points:

- How to identify "opportunity."

- Setup your order and trades

- Pros and Cons

Identify the "opportunity."

When it comes to trading in the Internal Market, bear in mind that our goal is to increase the number of coins we have, which are SBD and Steem. Indeed, the Internal Maret only has two currencies and only offer to trade between those two. Therefore, you cannot trade with other altcoins rather than just SBD and Steem.

Setup your coins monitor

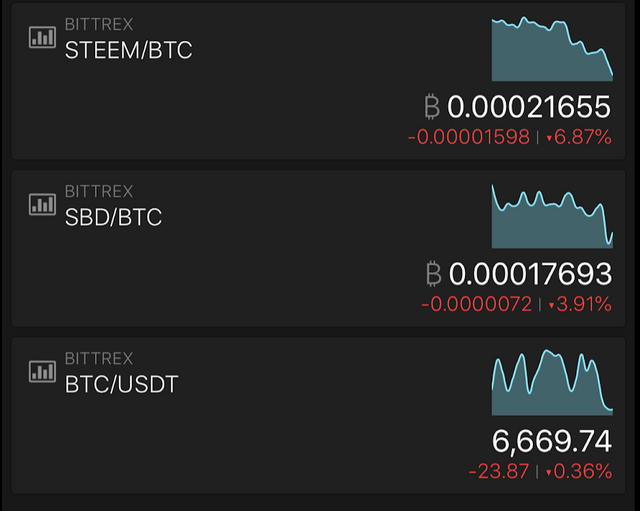

When it comes to checking prices, there are many ways to test. You can use the informative website such as CoinMarketCap or mobile application. I am using TabTrader on both iPhone and my Android to monitor and track the latest prices of the coins.

At your coins to watchlist

At the moment, I only need three pairs: BTC/USDT, Steem/BTC, and SBD/BTC

From that, I have a look at the current market.

Here are some tips and patterns that I have monitored recently:

- SBD has slow price reaction than Steem when prices changes

- Steem has more dependent on Bitcoin movement than SBD

- If BTC moves up actively, Steem tend to react faster than SBD

Based on those patterns, what should you do to utilize the market?

Use SBD to buy STEEM when BTC is down, and then sell STEEM for SBD when Steem price goes up

Quite easy, but need lots of practices.

Set your orders

One good thing about the internal market is that there is no fee to hold your orders and you can open as many as you like. There is also no fee for trading in the market so that you can only buy/ sell many times to earn a profit.

How to setup order

Firstly, let's go to Steem Market

You will see the order book as I shared previously.

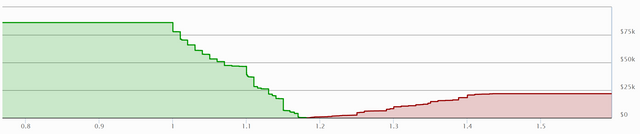

From the current situation, the Steem/SBD rate is around 1.18. Let's say I have 100 Steem for trading; I will set up the order as below:

- Sell 30 Steem at 1.25

- Sell 30 Steem at 1.29

- Sell 40 Steem at 1.39

So when the rate rises to those levels, my order will be executed, and I will have more Steem in my wallet.

For this case, I have sold 100 Steem for (30 x 1.25) + (30 x 1.29) + (40 x 1.39) = 131.8 SBD

Now, I will set the Buy order as below:

- Buy 30 Steem at 1.22

- Buy 20 Steem at 1.2

- Buy 50 Steem at 1.16

If all of my orders are executed, I will get 100 Steem (my capital) and 13.2 SBD as profit.

It's 11.11% ROI in about one-week. It's not too much, but it's something to get in case you have Steem in your account.

Pros and Cons

With my explanation and sample case above, there are some Pros and Cons to consider

Pros

- Easy to execute, using native Steem system

- Can place many orders

- Steem/SBD bounces within specified ranges around 1.15 -> 1.35, easy to manage

Cons

- Low price volatility, not much opportunities to trade in a week

- Low liquidity, normally trading volume is around 10.000 SBD daily

- No API to check on your phone, need to check balance to see if orders executed

Hope you like my post, I will share more about how to monitor your trade efficiently later.

Chúc mừng @attoan.cmt, bạn đã nhận được một upvote 30%. Tôi là con bot của cộng đồng Việt Nam trên Steemit. Tôi được tạo ra bởi nhân chứng @quochuy và được uỷ quyền, tín nhiệm bởi các thành viên Việt Nam, hôm nay tôi vote cho bài của bạn để ủng hộ bạn. Tôi hi vọng sẽ được thấy nhiều bài viết hay từ bạn.

Chúc bạn vui vẻ, và hẹn gặp lại một ngày gần đây.

@attoan.cmt nice analysis

Keep it up

I resteemed your post

Wow. This looks interesting. Thanks for idea.