Buy Bitcoin with Credit Card - Coinmama Review

Coinmama is a cryptocurrency exchange that was formed in 2013. Coinmama is registered in Slovakia but is owned by New Bit Ventures Limited that is headquartered in Israel. It operates in 217 countries worldwide, and is available in 24 US States. It provides users with a platform to purchase Bitcoin and Ethereum using credit and debit cards, or through Western Union. However, Coinmama does not provide a platform for trading in cryptocurrencies nor does it allow users to sell cryptocurrency. Instead, all purchases of cryptocurrency by customers are transferred directly from the company’s own holdings, making transactions more secure than some of its competitors.

Coinmama stands out as one of the fastest and easiest ways to buy Bitcoin or Ethereum with a Credit or Debit card, something that not all exchanges offer. Read on for our full review of Coinmama to find out more.

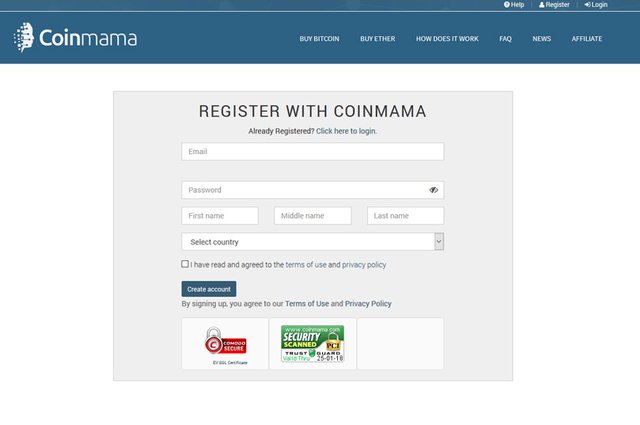

How to Register and Verify Accounts

At present, Coinmama is only currently available as a website, with no mobile app available. In addition, Coinmama has not released an API to enable users to create custom applications that would be compatible with the platform. Aside from its international availability, one of the most appealing features that Coinmama provides that is absent among many of its competitors is that it provides users the opportunity to purchase up to $/€ 150 of cryptocurrency without having to verify their identity.

However, to purchase any further amounts users will need to verify their identity using official government-issued ID for KYC and AML purposes (namely passport, national ID card or driver’s licence) as well as a verification form including their full name, date of birth, gender, address and credit or debit card number. In order to verify accounts, both sides of the documents must be submitted and Coinmama recommends that submitted documents are:

- visible in their entirety;

- high quality images (colour images that are 300dpi or higher);

- valid documents, with the expiry date clearly visible;

- maximum file size of 4MB.

Documents uploaded to Coinmama for verification tend to be processed within a few hours during business hours, with longer processing times to be expected during evenings and weekends. However, Coinmama’s customer service team will try to assist users that require faster verification.

Initial verification usually takes less than 10 minutes. After initial verification users will be able to purchase cryptocurrency immediately, with deliveries of orders taking place within minutes of an order being placed. This allows users to be able to take advantage of advantageous price movements. Once orders are placed, the exchange rate at the time of purchase is locked in, meaning that users receive exactly the amount of cryptocurrency that they ordered, regardless of any fluctuations that may occur between the time or order and the time of receipt of the cryptocurrency. According to the developers, the reason for this is that there was a lot of confusion and misunderstanding when orders were locked to the market rate, especially when customers received less currency than anticipated. If an order aborts, the Coinmama system automatically voids the payment within 48 hours and refunds the money back into the user’s bank account.

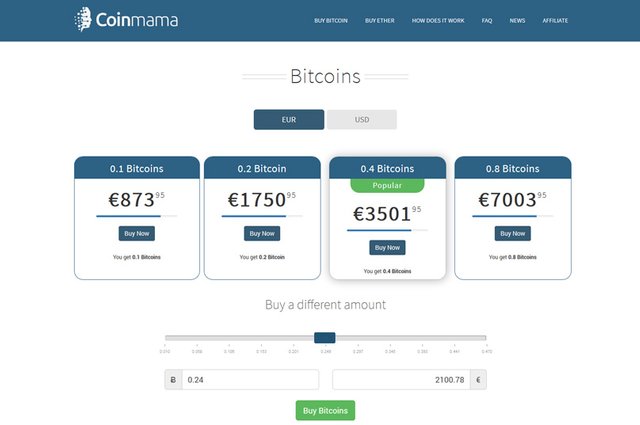

<h2How to PurchaseTo purchase Bitcoin using credit or debit cards, Coinmama doesn’t require users to register their credit or debit card in order to purchase cryptocurrency on the exchange. Instead, the procedure is that once users have registered (and regardless of whether or not they have verified their identity). They proceed to create the order by choosing how much they want to buy, entering their wallet address and then filling out their card details on the checkout page (if users have verified their identity, their credit card address must match their customer account address). Coinmama does not store customer’s credit or debit card details on their servers. After completing the payment, the transaction will then be processed by the credit card processor (which could take up to 20 minutes) before being transferable to the customer’s wallet of choice. Once the payment and wallet address are confirmed, the cryptocurrency is sent immediately to the user. The minimum purchase amount on Coinmama is 60 USD (or its equivalent in EUR) at present, although this is based on the price of Bitcoin (the effective minimum purchase is whatever the listed price of 0.1 Bitcoin is.

Unlike many of its competitors, Coinmama does not provide an online wallet for users to store their cryptocurrency on the exchange. Therefore, once purchased, users will need to create an appropriate wallet to which the exchange can send their cryptocurrency once purchased. In order to confirm wallet addresses, users will receive an email link from Coinmana to allow them to confirm that the address is valid. Because of this validation procedure, customers are unable to purchase cryptocurrency for, or on behalf of, others. Users that wish to transfer currency to another person’s wallet should check the procedure for doing so through their own wallet provider.

<h2FeesIn comparison to its rivals, Coinmama’s transaction fees are quite high, with a 5.50% fee paid to Coinmama per transaction. This fee is included in the Bitcoin or Ethereum rate that is shown on Coinmama’s website. In addition, Coinmama charges an additional 5% fee on each credit and debit card transaction. This fee is added after customers choose their method of payment. In addition, customers may be charged a Cash Advance fee by their bank or card issuer depending on whether the financial institution views the transaction as a ‘cash’ transaction. Case studies carried out by commentators have suggested that it users should add an additional 10% in fees when transacting through Coinmama.

<h2Purchase LimitsCoinmama offers high buying limits, especially in respect of credit card transactions. Verified users can purchase up to $5,000 per day, with a maximum limit of $20,000 per month. Daily limits last for 24 hours from the moment that the limit is reached, while monthly limits is a moving sum of the previous 30 days. It currently displays pricing in USD and EUR with additional currencies to be added soon. However, it accepts orders in all currencies, while noting that exchange fees may be applicable to customers that are purchasing in fiat currencies other than USD or EUR.

The amount of cryptocurrency that a user may purchase is dependent on the level of verification that they have reached with the platform. The more documentation that the user provides, the more currency that they are entitled to purchase. However, it should be noted that daily and monthly limits are applicable regardless of what level users have reached in terms of their verification. The breakdown of the limits and requirements are as follows:

- Level 1: This level allows users to purchase up to 10,000 USD through the service. This level only requires users to provide valid government issued ID (as set out above);

- Level 2: This level allows users to purchase up to 50,000 USD worth of cryptocurrency. In order to access this level users will need to provide two valid government issued IDs, as well as either a utility bill or a selfie of the user holding their ID.

- Level 3: This is the highest level of authorisation on Coinmama and allows users to purchase up to 1 million USD in cryptocurrency. In order to obtain this level of authorisation, users are required to fill out a short form and return it to Coinmama.

Supported Countries / States

As stated above, Coinmama supports a wide range of countries, probably the widest amongst cryptocurrency exchanges and significantly more than most of its rivals, including Coinbase and BitStamp. The only countries that Coinmama is not operational in are obviously sanctioned countries. In order to purchase from Coinmama, users in non-sanctioned countries need a VISA or MasterCard issued in such countries. In addition, Coinmama is available in the following US states: Arizona, California, Colorado, Florida, Illinois, Indiana, Kansas, Kentucky, Louisiana, Massachusetts, Maryland, Michigan, Missouri, Montana, Nevada, New Jersey, New Mexico, North Carolina, Pennsylvania, South Carolina, Tennessee, Texas, Virginia and Wisconsin. In addition, by offering transactions through Western Union, Coinmama is one of the only sites that allow customers to purchase cryptocurrency through ‘cash’ deposits.

Security Customer Support

Although Coinmama remains a relatively small exchange in the cryptocurrency ecosystem, they have yet to experience any known security breaches and are slowly but steadily building up their market share. However, they remain somewhat behind their competitors, with an average of 600,000 visitors per month (in comparison, Coinbase registers 34 million visits a months while Poloniex receives a whopping 44 million visitors in the same time period). Coinmama is registered with FINCEN in the US as a money service business. Although the fact that Coinmama does not hold any cryptocurrency on users’ behalf makes it less susceptible to attacks than other exchanges, it still does hold records of users’ credit card information, although Coinmama states on its website that credit and debit card information is not stored on the exchange server.

Customer support is available via email, as well as an extensive list of FAQ’s. As with most cryptocurrency exchanges, online reviews of their customer service response has been mixed. However, it doesn’t appear that there are any major issues with response times, with most queries consistently replied within 24 hours (with longer waits expected over the weekend or public holidays). Its stated business hours are Sunday to Thursday, from 11 pm to 7 am Pacific Time.

Conclusion

Although Coinmama does offer users a number of advantages, including worldwide accessibility, options to purchase with cash through Western Union, credit and debit card purchases for instant access to Ethereum and Bitcoin and high daily buying limits, it also has a number of disadvantages. For example:

- The platform is limited to Buy Orders only. Most exchanges allow users to trade coins and therefore Coinmama’s utility is quite basic. In addition, Coinmana will not buy back your currency. Therefore, if at any time you wish to sell your crypto, you will have to sign up with another exchange in order to do so.

- Although Coinmama accepts credit and debit card payments from almost every country in the world, it does not offer many other choices, with the inability to make wire or SEPA payments differentiating them from many of their competitors.

- Thus far, Coinmama only supports Bitcoin and Ether, and although the developers have stated that they wish to add more cryptocurrencies in the future, there is little to suggest that there are any immediate plans from Coinmama to support other currencies. This is among the smallest in terms of assets offered. Poloniex, for example, supports over 70 different cryptocurrencies.

- The lack of a mobile app is a negative for users that wish to purchase cryptocurrency while on the go, or even to check their balance.

One of the other advantages of Coinmama is that it effectively forces users to set up a secure digital wallet. This website is a strong advocate of promoting that individuals do not leave their cryptocurrency on an exchange, due to the fact that such exchanges are prominent targets of hackers. By not holding any cryptocurrency on user’s behalf, Coinmama is effectively given users an extra nudge to set up their digital wallet (or even better, purchase a hardware wallet).

Ultimately, Coinmama has a strong reputation within the cryptocurrency community as a safe, honest and trustworthy broker. It may not have some of the additional features that some of its competitors do, and it may not be the cheapest, but it does what it does very efficiently and securely.

FREE Binance Exchange Account - Register NOW -->

Secure HARDWARE CryptoCurrency Wallet - Guide | About | Get It NOW -->

CryptoCurrency ATM Debit MasterCard - Review | Get It NOW -->

BTC | BCH | BTG | ETH | LTC - Accepted!

Congratulations, you were selected for a random upvote! Follow @resteemy and upvote this post to increase your chance of being upvoted again!

Read more about @resteemy here.

hmz, most big banks are banning that way of purchasing Bitcoin or Cryptos: buying on credit card.